A Milestone in Innovative Finance: Exploring the First-Ever Outcome-Based DIB for Poverty Alleviation in Africa

More than 767 million people worldwide still live in extreme poverty, with just over half in sub-Saharan Africa. As Africa’s population has grown, so has the number of people living on less than $1.90 a day. We believe that achieving the United Nation’s Sustainable Development Goal 1 of ending extreme poverty by 2030 is possible, but not without economic growth, major innovation and additional funding.

GRADUATION PROGRAMS SHOW PROMISE

Entrepreneurship is a key driver of economic growth, especially in Africa. But income-generating opportunities for the extreme poor are limited, and tools like microloans have not proven effective in sustainably increasing the income and savings of the world’s poorest. From Village Enterprise’s 30 years of experience, we know that the ultra-poor don’t just lack money – they also lack other basic skills and resources needed to become self-sufficient. They also often live in rural areas with very limited access to markets and financial institutions.

To address these challenges, NGOs and governments must adopt and scale holistic and effective solutions. The graduation approach, which provides a cash or asset transfer (not a loan), training, mentoring and access to formal financial institutions, is one such solution. There is now strong evidence that graduation programs bring about lasting improvements in income levels for the very poor, as reported in a multi-country study published by Banerjee, et al. in Science in 2015. However, the same study showed that outcomes varied across geographies and implementation teams, indicating that contextual factors, scale and the quality of implementation are significant success factors.

New developments are needed to improve program impact and efficiency at scale. Unfortunately, traditional funding models provide neither the flexibility nor the performance incentives to drive this impact, since funding is typically tied to activities rather than outcomes. This also presents a missed opportunity to improve the livelihoods of the extreme poor.

TYING FUNDING TO IMPACT

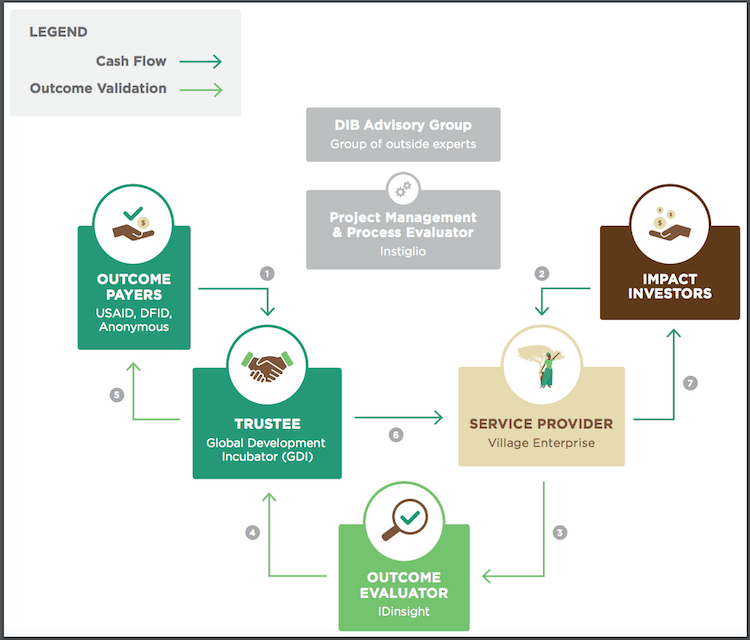

To address this challenge, Village Enterprise, an NGO working to end extreme poverty in rural Africa, and Instiglio, a pioneer in results-based financing, have partnered with the world’s two largest development agencies, U.S. Agency for International Development (USAID) Development Innovation Ventures (DIV) and the U.K. Department for International Development (DFID) to launch the Village Enterprise Development Impact Bond (DIB). The Village Enterprise DIB is the first-ever outcome-based development impact bond (DIB) for poverty alleviation in Africa.

Village Enterprise implements a cost-effective and evidence-based graduation program that is recognized by industry leaders, including Innovations for Poverty Action, ImpactMatters and The Life You Can Save. The Village Enterprise program is scalable and adaptable. This US $5.26 million DIB will allow us to further scale our graduation program by launching a minimum of 4,200+ sustainable microenterprises over the next two years and positively impacting 13,800+ households in rural Kenya and Uganda.

The Village Enterprise DIB is an innovative and performance-based financing tool that is designed to demonstrate how to scale a graduation out of extreme poverty program in a way that is both cost-effective and results-based. Performance outcomes are based on recent positive results from our 6,300 household randomized controlled trial (RCT) conducted by Innovations for Poverty Action.

In this payment-for-results model, USAID DIV and DFID, along with an anonymous funder, agree to pay back Village Enterprise and our investors the original investment plus a return if we achieve the agreed upon outcomes. Outcomes to be measured are increases in consumption (as a proxy for income) and net assets. Impact will be assessed through an RCT conducted by IDinsight over the course of the DIB. Instiglio will act as the project manager and process evaluator. And the Global Development Incubator (GDI) will serve as the trustee of the outcome fund.

BENEFITS OF THE RESULTS-BASED APPROACH

We believe that the Village Enterprise DIB (and potentially, future DIBs) will demonstrate several distinct advantages over traditional funding mechanisms, including:

- Making money more effective. By tying funding to measurable results, the Village Enterprise DIB ensures that funding creates a real impact, providing a significantly greater guarantee of value-for-money compared with pay-for-inputs funding.

- Allowing Village Enterprise to adapt to change. By shifting focus from activity to impact – that is, by reimbursing results rather than receipts – impact bonds give service providers more flexibility to innovate and iterate to get results.

- Incentivizing better programs. By tying funding to results, impact bonds make it attractive and profitable for service providers to improve their programs.

- Attracting new forms of capital. By creating an investment opportunity that includes a financial return, impact bonds invite the private sector to participate in ending poverty.

Critics of impact bonds have noted that their set-up costs are high and their scale is limited. We believe this has mainly been because previous approaches have insufficiently leveraged true market forces, and instead have relied on a central and over-engineered approach. We believe that if donors come together to commit significant outcome funds and specify clear and realistic conditions for a provider to earn payments, capable service providers will have the incentive to build capabilities to mobilize the necessary working capital and negotiate terms with investors.

A MODEL FOR FUTURE FUNDING?

In this DIB, we set out to test this hypothesis, fully recognizing that raising capital and structuring investments will be a challenge for Village Enterprise. If our hypothesis proves correct and we are successful, it could make future DIB structuring less costly and more scalable.

This process provides us with maximum flexibility regarding the timing and nature of capital injections and repayment terms. By taking responsibility for raising capital, Village Enterprise is incentivized to raise and structure capital in the most cost-efficient manner. This could lead to new and diverse investment structures that vary depending on the contexts and preferences of service providers and their investors, rather than structures centrally planned by outcome payers or intermediaries.

Our longer-term goal is to scale this demonstration DIB by setting up an outcomes fund that can grow to serve more donors, investors and service providers that wish to achieve results in poverty alleviation. Village Enterprise has been working for three decades to end extreme poverty in rural Africa through entrepreneurship. We are now poised to scale through new and innovative partnerships with other NGOs and governments. If successful, the Village Enterprise DIB could impact millions more lives, and contribute substantially to the goal of ending extreme poverty in Africa.

Editor’s Note: This article was voted by readers as one of NextBillion’s Most Influential Articles of 2017.

Dianne Calvi is president and CEO of Village Enterprise.

Photo courtesy of Village Enterprise.

- Categories

- Investing, Social Enterprise