‘Ahead of the Curve’ – Three Companies Get Serious About Measuring Customers’ Financial Health

Every organization wants to measure its impact in some way. Certain industries are further ahead than others in doing this effectively. The health care industry has key indicators to measure the effectiveness of medication, hospital care and doctor supervision. The education industry continually challenges itself to identify the most effective ways to measure its impact on students’ short- and long-term futures.

The time has come for America’s financial services industry to get serious about measuring its impact on customers. It is easy to track the number of active checking accounts or the number of dollars lent on credit cards. It is much harder to measure if those checking accounts and credit cards are actually helping customers manage their money better. Do these products and services help customers achieve financial health?

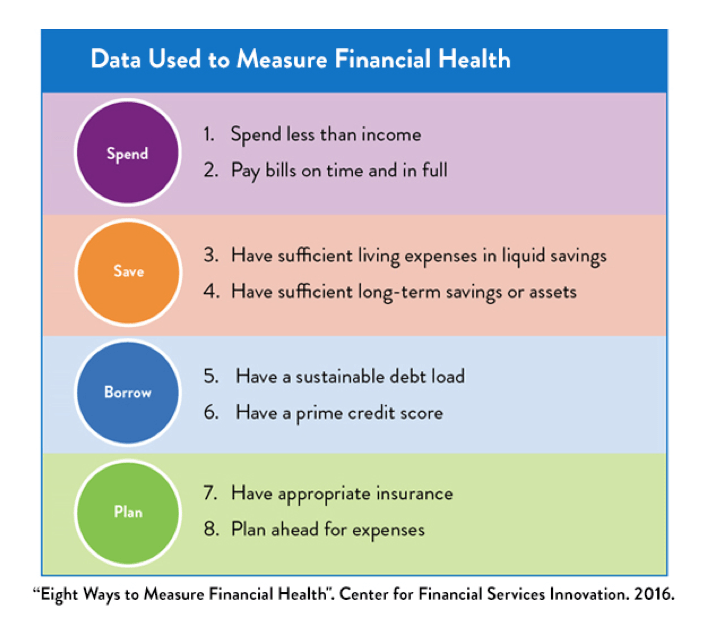

To help financial services providers get serious about measuring their customers’ financial health, we recently released eight key indicators of financial health as a starting point for any institution.

But how feasible is this, really? How can a financial institution take the number of active checking accounts it has and translate that into whether its customers are paying their bills on time? Actually, many providers are already out ahead of the curve measuring these exact customer outcomes. In these recently released case studies, we profile three such companies.

- HelloWallet works with employers to provide independent, personalized financial guidance to employees through web- and mobile-based software applications. The company’s central tool is its Financial Wellness Score, which assesses individuals’ financial health across eight distinct components. HelloWallet’s eight components closely mirror CFSI’s own eight indicators. Because of such a tool, HelloWallet can track improvements in customers’ financial health over time. After just one month of use, the median HelloWallet member increased the total amount of money transferred into savings accounts by 15 percent. After one year of use, this savings deferral increased by 29 percent.

- Wells Fargo has supported a bank-wide initiative for several years to help customers improve their financial health by establishing a set of standards to help customers understand, measure and monitor their financial health. They have launched a financial health website that provides eight rules of thumb for healthy financial behaviors, again very similar to the eight indicators from CFSI. The rules of thumb are designed to encourage, rather than discourage, customers as they embark on their financial health journey. If a customer cannot currently save 10 percent of her income for retirement, she is encouraged to set up an automatic transfer with whatever amount she feels comfortable saving at the moment.

- Offered by the nonprofit Solutions for Progress, MyBudgetCoach is an online platform used in financial coaching programs to measure consumer financial health. Solutions for Progress saw the need to assess a client beyond simply looking at her credit score. MyBudgetCoach uses the Financial Capability Scale, designed to measure client outcomes based on responses to six subjective self-reported questions developed by the Center for Financial Security at the University of Wisconsin-Madison. The questionnaire asks about concepts similar to CFSI’s eight indicators, including behaviors on spending, budgeting, saving for emergency funds and paying bills on time. Early results from the pilot are positive. Participants who completed at least five coaching sessions showed a 41 percent improvement in their Financial Capability Scale score, and with this tool, such progress is more easily tracked.

These three case studies show us that it is possible to measure the financial health outcomes of consumers. And it’s possible for very different types of organizations, whether a business-to-business fintech provider, a top-tier bank or a mission-driven nonprofit.

It certainly is easier to track checking accounts and credit cards. But it’s more important to track the outcomes that these products have in the lives of real people.

Stay tuned as seven additional companies embark on their journey to measure financial health as part of our Financial Health Beta project, an initiative designed to help providers representing a diverse cross-section of the financial services industry to measure and improve their customers’ financial health.

Photo credit: David Wright, via Flickr.

Sarah Parker is a Director working on public thought-leadership at the Center for Financial Services Innovation.

- Categories

- Uncategorized