An Underutilized Weapon Against Climate Change Risks: Maximizing the Potential of Micro-insurance

In October 2013, Cyclonic Storm Phailin touched down on the eastern coast of India, resulting in 45 fatalities and almost $700 million in damages. According to estimates by officials from the state of Odisha, over 12 million people in the state have been impacted by the social and economic aftermath of the cyclone. Over the past few decades, changes in climate activity have led to extreme weather events like Phailin that have posed substantial threats to security and financial well-being – not just in India, but globally.

Since India is already plagued by poverty, health issues and political inefficacies, the risks posed by climate change increase the vulnerability of its population. This is particularly true for those at the bottom of the economic pyramid, who bear the brunt of systemic stresses such as inadequate education, health care and other services – in addition to having limited coping mechanisms to withstand the longer-term social and economic ramifications of climate change.

Meteorological data indicate that climate change-driven natural disasters may become the new norm, impelling governments and development sector experts to devise strategies that not only address climate change’s impact as disasters are happening, but also prepare low-income communities to rehabilitate and restore their livelihoods post-disaster.

One approach to building resilience to the impact of climate change is through asset-based micro-insurance. This type of non-life insurance product takes into account calamity-related losses in lives, livelihood, health and property based on the understanding that low-income communities have distinct needs such as product affordability, inclusiveness and simplicity.

To provide micro-insurance, insurance companies have attempted to build partnerships with specific agents such as NGOs, self-help groups, cooperatives and, most prominently, microfinance institutions (MFIs). A robust partnership between the insurance company, which has an expertise in insurance products and underwriting the underlying risk, and the distribution agent, which provides the last-mile delivery support and brings an understanding of the cultural context and community needs, is pivotal to successfully deploying asset-based micro-insurance in markets that are susceptible to climate change.

But currently, the sale of asset-based micro-insurance on its own – especially as a means of resilience-building – has not been successful in scaling up. One reason is that unlike life insurance, agents find it difficult to explain the benefits of such a policy to prospective customers in terms of protection for their livestock or home from an unforeseen circumstance. MFIs and other agents also often lack the financial bandwidth and human resources to effectively distribute and monitor micro-insurance programs. And with the average ticket size ranging from Rs. 2,000 to 4,000 and commissions capped at 15 percent, there is limited incentive for agents to promote these products. Additionally, a lack of government support has limited the growth of the microinsurance model as a tool to build resilience toward climate change. In most emerging economies, governments tend to focus more on post-disaster relief funding instead of providing support for scaling up and creating awareness of suitable microinsurance products. This is very different from the approach taken in most developed countries. For instance, the Turkish government has set up an insurance pool which ensures that all property tax payers have affordable earthquake insurance cover.

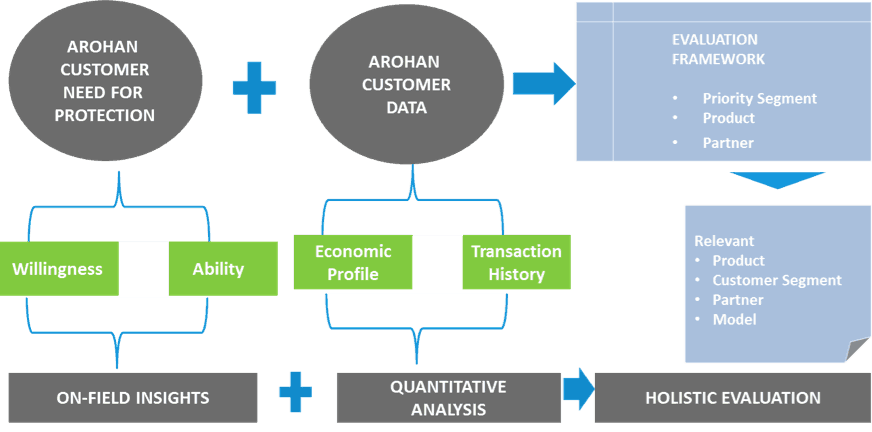

To address some of these challenges, Intellecap conducted a study to understand consumers’ key insurance needs, in partnership with Arohan Financial Services, one of the top MFIs in India serving almost 500,000 customers across four low-income eastern states. The study, conducted with existing Arohan customers, aimed to identify mechanisms to roll out a sustainable micro-insurance program that builds up low-income communities’ capacities to develop and expand their livelihoods and be prepared for natural disasters. The holistic evaluation model consisted of understanding and evaluating customers’ needs for protection, the priority segment, the products which are available and the ideal partners for Arohan. The framework has been indicated below.

Figure 1 : Holistic evaluation framework

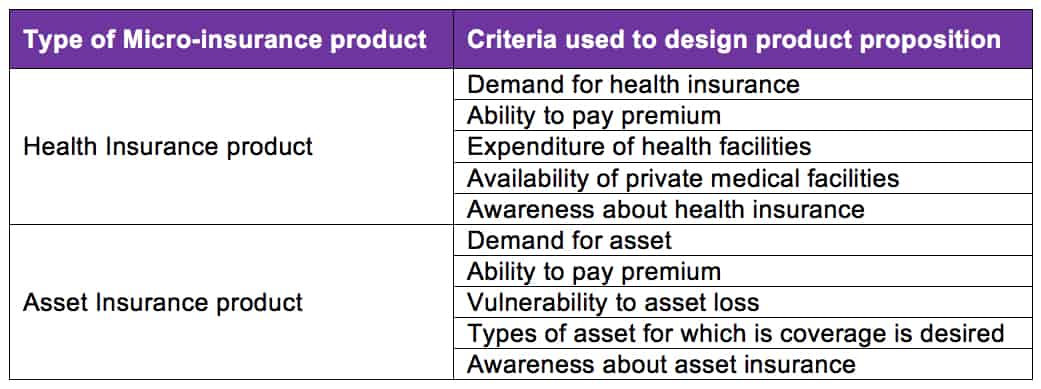

One of the key aspects of the evaluation model was to design a product suiting the gap between customer needs and existing insurance products. The following table shows the set of criteria applied to the various customer segments for developing the health and asset insurance product propositions.

Table 1: Criteria adopted for designing product proposition

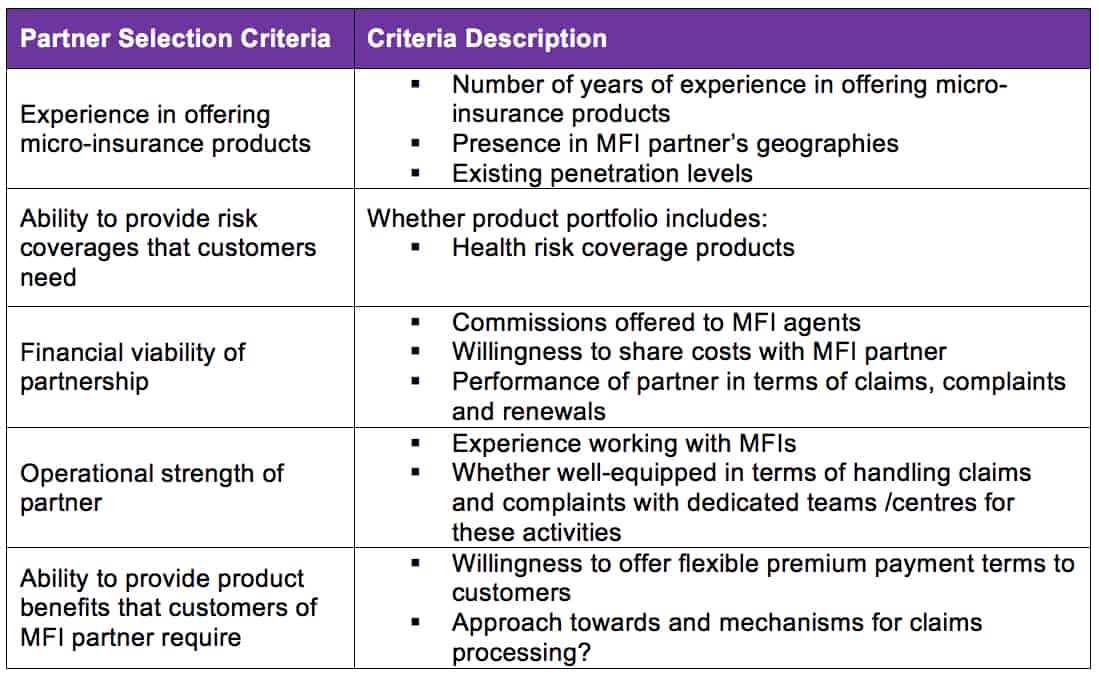

The next key aspect of the evaluation model was to develop a partner selection framework to identify the ideal insurance partner. The framework shown in the following exhibit evaluated micro-insurance providers on a set of five broad parameters.

Table 2: Partner selection framework

A scoring model was built around the partner selection framework mentioned above and a suitable insurance partner was selected. The program was launched in early 2015 across six urban/semi-urban locations that were identified as highly vulnerable to the impact of climate change. The locations identified for the pilot were Baranagar, Shyambazaar, Tribeni, Akra, Maheshtala and Kharagpur.

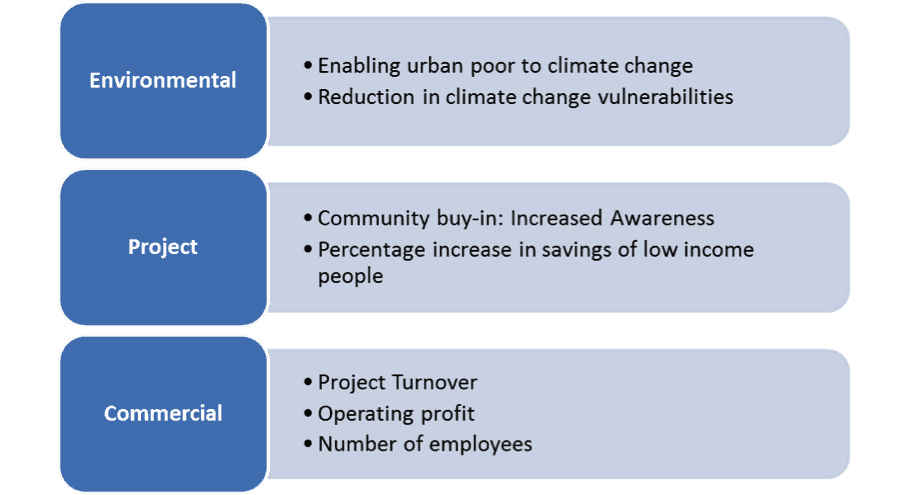

Intellecap also established the parameters for measuring the success of the programme. These parameters can be classified into three broad categories; commercial, environmental and project indicators. The indicators under each of these categories are indicated below.

Figure 2 : Success parameters

The three-month pilot concluded with promising results, as more than 6,400 low-income consumers were made aware of microinsurance and the various associated benefits. As a result, in regions where microinsurance uptake was negligible, the consortia managed to exceed its policy sale target by around 5 percent. Encouraged by the initial successes, Arohan has integrated this program with all 104 of its branches in the last 10 months, and it saw an almost tenfold increase in the number of borrowers insured.

Given these promising results, as Arohan and likeminded organizations around the world look to extend the reach and scale of micro-insurance, three critical factors must be kept in mind. First, efforts should be made to identify the climate change risks that target communities face. Second, improving public-private partnerships will be integral to shift mainstream climate change mitigation practices away from post-disaster relief funds to pre-disaster insurance models to offer micro-insurance more ubiquitously to low-income communities. Finally, efforts to make micro-insurance more affordable for target communities need to continue. As the pilot program evinces, as far as asset micro-insurance is concerned, generating awareness about the adverse effects of climate change results in better product uptake than forced selling. More importantly, it highlights the promise that asset insurance harbors for addressing climate change vulnerabilities.

The Asian Cities Climate Change Resilience Network (ACCCRN), supported by the Rockefeller Foundation now reaches more than 50 cities in Bangladesh, India, Indonesia, the Philippines, Thailand and Vietnam, and has helped to improve the capacity of these cities to prepare for, withstand and recover from the impacts of climate change. Intellecap is supporting these private-sector interventions and mapping pilot project results across various sectors. This blog is the second post in a three-part series, with Part 1 looking at health care solutions.

Photo credit: Photo Unit, via Flickr.

Vipul Singhal is an Associate Vice President and Vineeth Menon is a Manager at Intellecap.

- Categories

- Environment