Global Movement of the Vulnerable Class, and What it Means for Financial Inclusion

This post is based on research from the Mapping the Invisible Market project published in a paper entitled “Growing Income, Growing Inclusion,” by Sonja E. Kelly and Elisabeth Rhyne. The paper was released today, and can be downloaded at here.

The World Bank, UN, and The Economist are all talking about it: growing income around the world. The UN’s goal to halve the number of people living in poverty by 2015 has already been achieved, and the media frequently spotlights growth in emerging markets contrasted with reports of malaise in the EU and U.S. economies.

In low and middle income economies, it isn’t just the wealthy or the well-connected who benefit from this growth. Real incomes are rising among the poor, moving hundreds of millions of people from extreme levels of poverty into levels at which they begin to have more income flexibility.

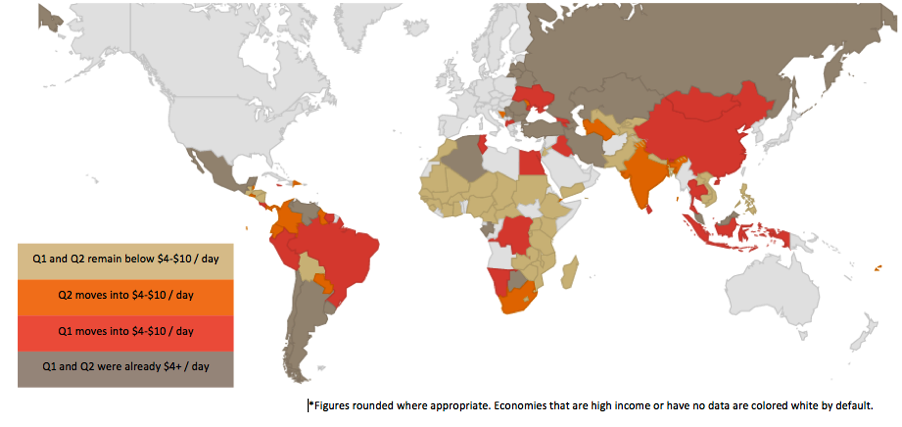

Over the course of this decade, the bottom two quintiles in many of the world’s most populous countries will see movement into and even beyond the “vulnerable class,” defined as having an income of $4 to $10 per day.

Source: Authors’ calculations based on World Economic Outlook and UNU-Wider database on inequality.

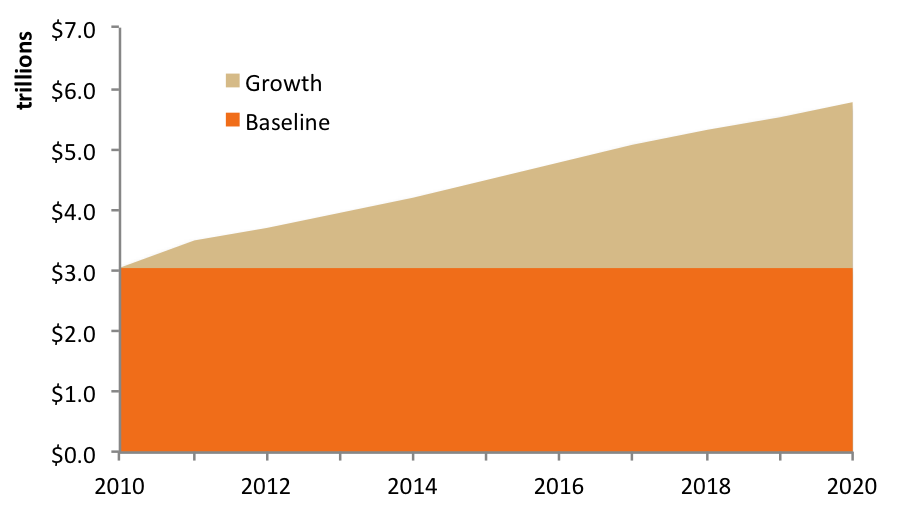

In 2010, the bottom 40 percent of the populations, in low and middle-income economies constituted a market of $3 trillion. By the end of the decade, the real spending power of this market will nearly double, to $5.8 trillion.

Source: Author’s calculations based on World Economic Outlook and UNU-Wider database on inequality.

Last year, the World Bank’s Global Findex reported that the number one reason why people did not have a bank account was that they did not have enough money. We also see a moderately strong statistical connection between income and account use in the bottom 40 percent.

With higher personal income, financial management will likely shift to more formal services as people gradually “outgrow” their informal mechanisms. The time it takes a person to make this shift depends on a number of factors, including the level, source, and volatility of an individual’s income as well as the availability of suitable services.

Understanding this transition is essential as policymakers and providers seek to prepare for it. If providers can offer appropriately tooled products, higher incomes at the base of the pyramid will translate into greater financial inclusion. If policymakers can encourage growth while safeguarding it, they will be able to anticipate challenges to client protection for customers using formal financial services for the first time.

Offering appropriately tooled products and anticipating client protection challenges, of course, are not limited to places that will see high growth over this decade. Much of Africa’s bottom 40 percent, for example, will continue to be under the $4 to $10 per day range, and in these places, creative application of technology and mission-driven organizations will play a key role in increasing financial inclusion.

For more on the connection between income and inclusion, head on over to the Mapping the Invisible Market website at mapping.financialinclusion2020.org.

Elisabeth Rhyne is the managing director of the Center for Financial Inclusion. Sonja E. Kelly is a fellow at CFI.

- Categories

- Uncategorized