Weekly Roundup – 5/17/14: How big is the BoP? IFC’s Global Consumption Database offers answers

In 2007, the International Finance Corporation and the World Resources Institute released their seminal report, “The Next 4 Billion: Market Size and Business Strategy at the Base of the Pyramid.”

At the time, the report was one of the most exhaustive looks at consumer purchasing power, supplier potential and overall market size of low-income populations around the world. It should be at the top of the social entrepreneur and indeed corporate canons.

Seven years later, the IFC has updated and significantly expanded the picture of the market first articulated by “The Next 4 Billion,” and this week delivered it in a publicly accessible resource called The Global Consumption Database.

Eriko Ishikawa, global head of Inclusive Business at IFC, says the more than 1 million household surveys that provide the source data for the database were conducted between 2005 and 2010. For consistency and comparability, the data were calibrated to a common 2010 reference year, according to Ishikawa.

The database builds on the work by WRI and IFC for “The Next 4 Billion.” However, Ishikawa explained that the Next 4 Billion and the Global Consumption Database used different methodologies and different surveys. The latter includes 92 countries instead of the 36 in the original study, with breakdowns for 100 products and services in addition to the sector data.

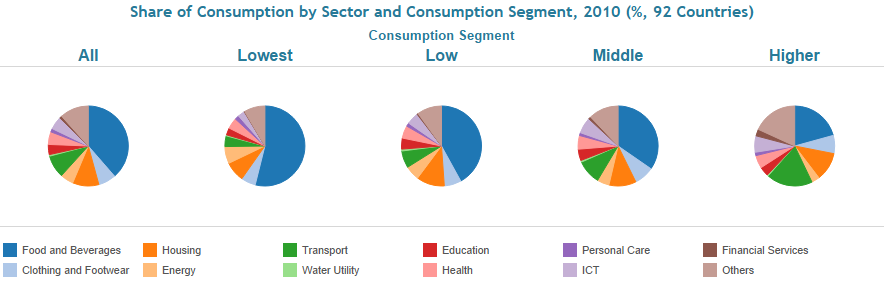

Users can slice the information from multiple angles, including by rural or urban setting; by consumption segment (defined as lowest, low, middle and higher income levels); by sector (12 are included, such as housing, clothing, water and financial services); and by some 25 sub-sector categories. The data also can be compiled into charts and graphs, and downloaded into spreadsheets.

“IFC inclusive business clients tell us that basic data on market size and purchasing patterns for lower income segments are not readily available for developing countries,” Ishikawa told me via email. “The Global Consumption Database is being made available free of charge to help a wide variety of users, including private sector companies, to see investment potential in serving the base of the pyramid – a $5 trillion market. Users of this database can use it to formulate future strategies and identify areas where more in-depth market research needs to be done.”

A couple of key facts and takeaways:

Size

The 4.5 billion people living within the BoP spend, in aggregate, $5 trillion per year, according to the IFC. The majority, $2.3 trillion, is spent on food; $508 billion on housing; $405 billion on clothing and personal care products; $317 billion on energy (including $137 billion on electricity); $243 billion on health care; $206 billion on IT and communications; and $193 billion on education, to select a few of the sectors listed.

Diversity

“The BoP is a diverse group – encompassing 3 billion people spending less than $3 a day and 1.5 billion spending up to 3 times that much; 1.7 billion in crowded urban environments and 2.8 in vast rural areas.”

Takeaway: This requires companies to be ready and nimble enough to offer a variety of products through a host of “marketing strategies, distribution channels, pricing and payment options,” the report says.

Youth

“People at the BoP are younger than those in higher consumption segments – 44 percent are under age 20, and 61 percent are under age 30.”

Takeaway: That youth factor is an advantage, especially when it comes to new products and services that harness technology “to engage them as customers, suppliers, distributors, retailers and employees,” the report notes.

Some interesting infographics and other details can be found in the brochure for the database.

****

I haven’t had a chance to explore this consumption database in depth. Nor am I a statistician. So I’m not exactly the most qualified person to render a judgement on how effective it is, or if it has a particular advantage over other publicly available research resources. (If that’s your field, please give it a spin and let us know what you think in comments).

Still, upon first blush, it looks to be a very powerful mechanism that researchers and companies should add to their research toolbox when considering a new product, service or supplier in developing markets.

In Case You Missed It … This Week on NextBillion

Scott Anderson is the managing editor of the NextBillion network.

- Categories

- Uncategorized