Achieving ‘Resilience’: Financial services beyond the scramble to survive

“[F]inancial services, like clean water, sanitation, and electricity, are essential components of the prosperous life. Though an unlikely end to poverty, microfinance provides those services to the poor and it can be considered a success in the aid community. In what other sector has public and private aid helped build such businesses and business-like nonprofits at the bottom of the pyramid, which grow by meeting the market test every day?”

When the Microcredit Summit Campaign began in 1997, it was, as the name implies, focused on microcredit. Since then, the world of financial services for the poor has undergone a shift from microcredit to microfinance—a broader range of formal and informal products and services.

Resilience: The State of the Microcredit Summit Campaign Report, 2014 keeps up with the times by providing an interesting discussion of a number of innovations in the field of microfinance. The report focuses on resilience, and how financial services can promote it among the world’s poorest families. But it also covers a broad range of services that have the potential to help people grow—to lead the prosperous life that Birdsall mentions—much more than credit alone can. As Jake Kendall and Rodger Voorhies of the Bill & Melinda Gates Foundation (quoted in the report) put it: “In many…situations, the most important buffers against crippling setbacks are financial tools, such as personal savings, insurance, credit, or cash transfers from family and friends. Yet these are rarely available because most of the world’s poor lack access to even the most basic banking services.”

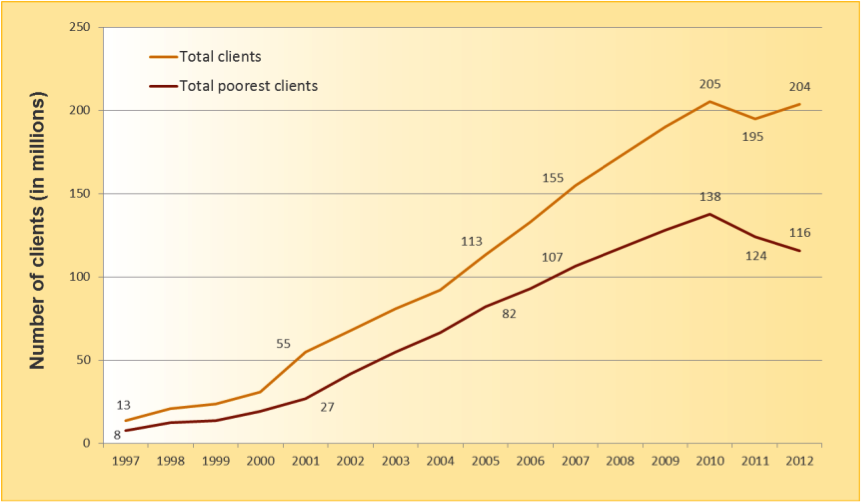

Reflecting this thinking, this year’s report signals a shift in focus from microcredit to microfinance in the Campaign itself. While it is not clear if this is due to a change in the focus of Campaign members from credit to other financial services, it does reflect the trends shown in the Campaign’s data. The 2013 report (which compiled data from 2011) showed a decline in borrowers for the first time; this year’s report continues to show a decline in borrowers among the poorest.

Figure 1: Growth of Total and Poorest Clients (December 31, 1997 to December 31, 2012)

Which Financial Services Promote Resilience?

Given that the impact of credit on poverty alleviation may be exaggerated, and that it may even cause more harm than good, the Microcredit Summit Campaign’s broader focus is a welcome adjustment. Last year’s focus on vulnerability—and this year’s on resilience—remind us of the core reasons that we do this work: to provide a useful and beneficial service to people who have historically been excluded. We don’t need to throw the baby out with the bathwater, but we do need to take a critical look at our work and revise our objectives accordingly. As the report’s author, Larry R. Reed, points out, we need to ask, “How often—and how well—do MFIs reach those living in extreme poverty and supply them the type of financial services that help build resilience to withstand economic, medical, and weather-related shocks?”

While noting that it is less common for credit services to reach those in extreme poverty, Reed highlights actions from different regions of the world in which appropriate and affordable financial services can help people to prosper instead of scrambling to survive, such as:

-

Responding quickly and flexibly to emergencies: CARD MFI in the Philippines opened its doors in Tacloban just 24 days after typhoon Yolanda hit. Natural disasters like Yolanda often destroy families financially. CARD responded quickly to their clients’ needs by developing a “calamity loan” with terms and conditions like partial repayments, a grace period and lower interest rates.

-

Knowing exactly who you are reaching: For institutions with a social mission to serve the underserved, understanding whether or not they are truly achieving that mission is important. Poverty is about more than just income level, and the wider development and adoption of simple tools like the Progress out of Poverty Index (PPI) is a success of the Campaign. Julie Peachey, Grameen Foundation’s director of social performance, has noted that the first response of organizations to their results from the PPI is often defensiveness and disbelief to find that their clients are not quite as poor as assumed. However, those that take the data to heart can use it to more accurately target poorer clients. (You can watch an interview with Peachey on the PPI here.)

-

Offering products that integrate health and microfinance: Those living in poverty seldom have a buffer against vulnerability, and must often deal with economic shocks in a reactive rather than proactive way. Lack of access to basic health services is a major gap for poorer clients: As the report puts it, “Health is one of the key constraints on everyday life and a primary cause of microfinance clients’ inability to repay loans and the catastrophic failure of their business.” That’s why institutions like Equitas Microfinance provide free health screenings for clients. (You can watch an interview with John Alex, Equitas’ vice president and head of social initiatives here.)

-

Creating partnerships between the public and private sector: In the report, Roger Voorhies, director of the Financial Services for the Poor initiative, states, “I cannot think of a more transformative thing microfinance could do than to figure out how to offer financial services to smallholder farmers.” Providing these services requires creative public-private partnerships and the use of technology, like the approach CARE, Equity Bank and Orange Money took in Kenya. Such initiatives have the potential to cost-effectively connect low-income people with formal financial services (see the below interview with WSBI’s Ian Radcliffe) thereby reducing the risks inherent in informal services.

The future of financial services that promote resilience and reduce vulnerability depends on institutions that not only innovate, but also practice self-reflection to ensure that they meet their social missions in a cost-effective way. While microfinance has seen its share of well-deserved controversy, the report offers a measured and realistic view of microfinance as an industry. No matter where you find yourself on the spectrum of ideology surrounding microfinance, Resilience is an interesting and informative read.

The 17th Microcredit Summit will be held from Sept. 3-5 in Mérida, Mexico. NextBillion Financial Innovation will be a media partner of the event.

Jessica Massie is a Senior Technical Advisor with Reach Global and lives in Kigali, Rwanda. You can reach her at jmassie@reach-global.org.

- Categories

- Education