The Power of Social Underwriting: Kiva Zip, on why it pays for lenders to tap the wisdom of the crowd

Part of Muhammad Yunus’ genius in creating Grameen Bank was his development of group-based guarantees among the women he was lending to in rural Bangladeshi villages. Whereas conventional loans look at financial data to measure credit risk (collateral, cashflows, credit scores, etc.), Grameen loans sought to assess borrowers’ characters, by tapping into the trust networks that already existed in their communities. It was social underwriting.

Of course, social underwriting is not new. This is how banking used to operate – watch George Bailey, the “good” banker in the film ‘It’s a Wonderful Life’, for a great example. But today, these time-honored principles of banking based on character, community and trust can be combined with digital tools, expanding access to capital for borrowers that conventional lenders might reject as too risky, or too unprofitable. That’s what we’re doing at Kiva Zip, in a process we call Social Underwriting 2.0.

Best known for our international microlending initiatives, Kiva has more recently gained recognition for our efforts to crowdfund loans for U.S.-based small business owners through Kiva Zip, our new crowdfunding engine. The platform is currently operating in Kenya and the United States, where it offers 0 percent interest, no-fee loans averaging $300 (in Kenya) and $5,000 (in the U.S.). As on the main Kiva microlending platform, visitors to Kiva Zip can browse through the profiles of entrepreneurs looking to start or expand their business and choose one that they want to support with a loan of $5 or more. As the borrower successfully repays, lenders can relend their money or withdraw it from the system.

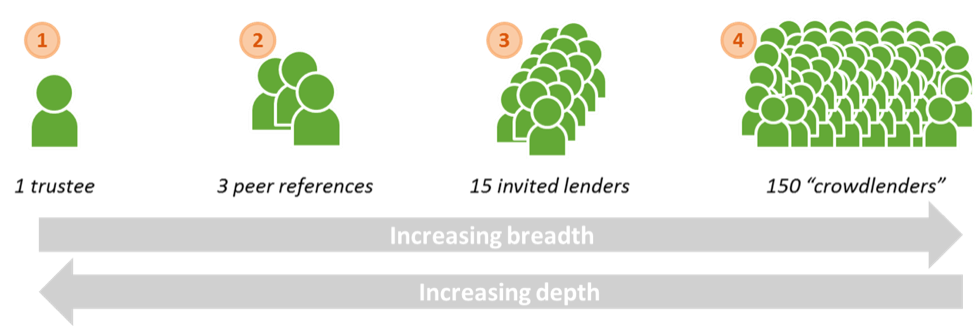

Here are four ways in which Kiva Zip is implementing social underwriting, and four reasons we’re excited by its potential to revolutionize the way that small business owners in America, and the wider world, are able to access microcredit. I am going to focus this blog on the U.S. part of Kiva Zip, because that’s the team I am honored to lead.

What does Social Underwriting look like on Kiva Zip?

1.) Trustees. Most Kiva Zip borrowers are “vouched for” by a trustee – usually an organization, or a trusted individual in the borrower’s community. Trustees have no money at stake in the event of borrower default, but their reputation and credibility on our KivaZip.org website are publicly tied to the repayment performance of the loans they’ve vouched for. Over the last three years, almost 600 trustees have endorsed loans on Kiva Zip. Many are technical assistance providers like La Cocina in San Francisco, or the Entrepreneurship Bootcamp for Veterans with Disabilities in Syracuse. But we have also had networks of farmers, city governments, and even the new Mayor of Oakland, Libby Schaaf, endorse their clients or community members for our 0 percent interest microloans. An interesting data point, which reinforces the power of social underwriting, is that borrowers who have known their trustee for more than a year have a 4 percent higher repayment rate than borrowers who have known their trustee for less than a year.

2.) Peer references. We are experimenting with asking our borrowers to provide three peer references (suppliers, customers, neighboring small businesses, etc.) for their Kiva Zip loan application – just as you would provide character references for a job application.

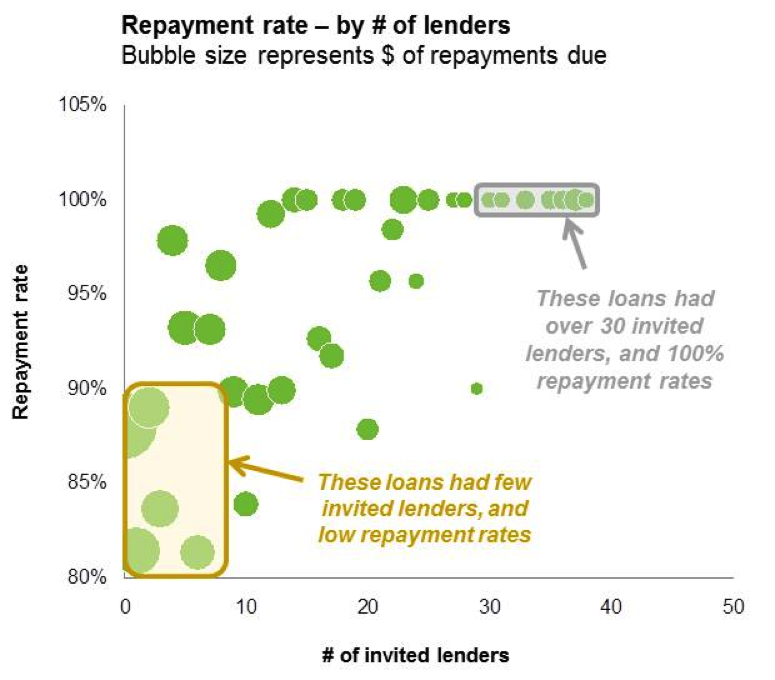

3.) The “Private Fundraising Period”. This is the most innovative and powerful element of our social underwriting approach. In early 2014, we started requiring Kiva Zip borrowers to recruit a member of their own network to lend to them in private, before we posted their loan publicly on our website. By going through this process, borrowers demonstrate their entrepreneurial spirit and ability to market their business, showing they have a “trust network” willing to lend them money (albeit in tiny increments of as little as $5). Because their own friends and family are putting their trust and dollars in them, we believe the Private Fundraising Period also increases borrowers’ commitment to repaying their loans, especially when the going gets tough. And the data backs this up: Borrowers with more than 20 invited lenders on their loan have a 98 percent repayment rate, compared to 88 percent for borrowers with no invited lenders.

3.) The “Private Fundraising Period”. This is the most innovative and powerful element of our social underwriting approach. In early 2014, we started requiring Kiva Zip borrowers to recruit a member of their own network to lend to them in private, before we posted their loan publicly on our website. By going through this process, borrowers demonstrate their entrepreneurial spirit and ability to market their business, showing they have a “trust network” willing to lend them money (albeit in tiny increments of as little as $5). Because their own friends and family are putting their trust and dollars in them, we believe the Private Fundraising Period also increases borrowers’ commitment to repaying their loans, especially when the going gets tough. And the data backs this up: Borrowers with more than 20 invited lenders on their loan have a 98 percent repayment rate, compared to 88 percent for borrowers with no invited lenders.

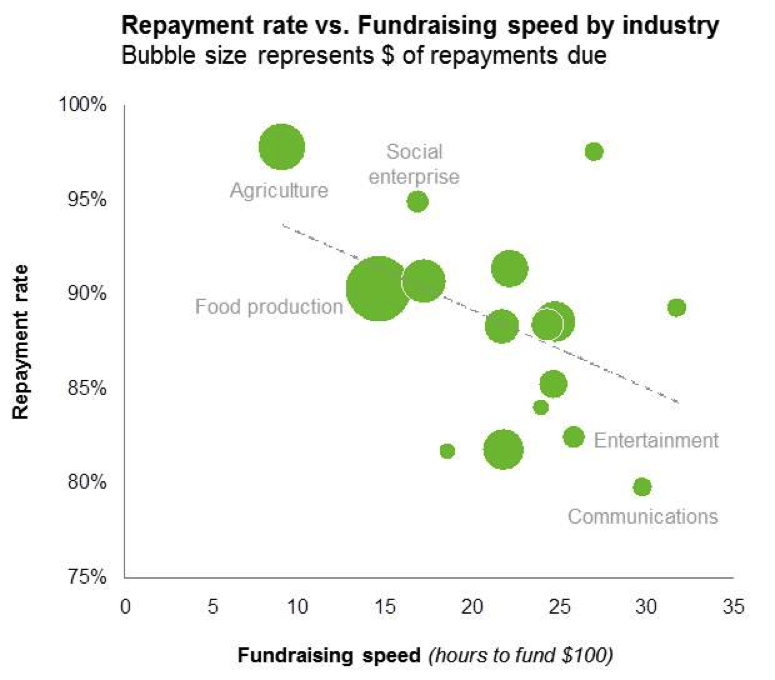

4.) The crowd in crowdfunding. Every Kiva Zip loan needs to be funded by Kiva’s growing community of over a million lenders. And we believe there is collective wisdom in that community. Thousands of pairs of eyes on a loan might spot an inconsistency or a red flag, which a single underwriter might miss – even if his eyes are better-trained. And once the loan is disbursed, if a small business owner has 200 crowdlenders on her loan, that also means she has 200 potential new Twitter followers for her business, 200 potential business advisers, 200 potential customers, and 200 reasons to repay her loan. One of our borrowers told us in an interview that “a Kiva Zip loan isn’t like other loans. You actually have to pay back a Kiva Zip loan!” – in other words, since hundreds of strangers had put their trust in her, she was determined not to let them down. Again, the data supports this. Loans with more than 300 crowdlenders have a repayment rate of 98 percent, compared to only 80 percent for loans with less than 30 crowdlenders. And see the bubble chart below, which shows the correlation between industries’ fundraising speed on Kiva Zip, and their repayment rate – agriculture loans are the most popular among our lenders, and they also have the highest repayment rate of any industry.

4.) The crowd in crowdfunding. Every Kiva Zip loan needs to be funded by Kiva’s growing community of over a million lenders. And we believe there is collective wisdom in that community. Thousands of pairs of eyes on a loan might spot an inconsistency or a red flag, which a single underwriter might miss – even if his eyes are better-trained. And once the loan is disbursed, if a small business owner has 200 crowdlenders on her loan, that also means she has 200 potential new Twitter followers for her business, 200 potential business advisers, 200 potential customers, and 200 reasons to repay her loan. One of our borrowers told us in an interview that “a Kiva Zip loan isn’t like other loans. You actually have to pay back a Kiva Zip loan!” – in other words, since hundreds of strangers had put their trust in her, she was determined not to let them down. Again, the data supports this. Loans with more than 300 crowdlenders have a repayment rate of 98 percent, compared to only 80 percent for loans with less than 30 crowdlenders. And see the bubble chart below, which shows the correlation between industries’ fundraising speed on Kiva Zip, and their repayment rate – agriculture loans are the most popular among our lenders, and they also have the highest repayment rate of any industry.

Why is social underwriting so powerful?

1.) It’s cheap! It’s very expensive for a conventional underwriter to trawl through a small business owner’s financial history – not least because most small business owners don’t keep meticulous financial records – when they keep them at all. From the Kiva Zip team’s perspective, having a borrower recruit some people from her network to lend to her is completely free. And it usually saves the borrower many hours of painstaking work combing through shoeboxes full of receipts as well.

2.) It works. See the data above for some good examples. The number of invited lenders is particularly powerful as a predictor of repayment performance.

3.) It expands access. The problem with averages and algorithms is that they rule out a lot of “good” would-be borrowers. To take a simplistic example, a conventional lender might say, “Loan applicants with a FICO score of 580 will on average have a 95 percent repayment rate. We are looking for a 98 percent repayment rate. So we won’t lend to loan applicants with a FICO score of 580 or less.” But that rules out 19 of 20 loan applicants that would repay their loans! Social underwriting allows you to dig beneath the averages, and expand economic opportunities for those 19 to launch or grow their businesses. Social underwriters (e.g. the Kiva Zip community) might also have a lower repayment rate target than one centralized underwriter (e.g. a bank), because they might be more motivated by social connection, and the desire to have a positive impact in their community, than the maximization of financial returns.

4.) It contributes to growth, rather than stifling it. Stricter conventional underwriting is normally in stark conflict with growth. A higher repayment rate target means more loan applications are rejected. Perhaps the most exciting aspect of social underwriting for the Kiva Zip team is that the Private Fundraising Period actually accelerates our growth! Because borrowers are required to invite some people from their own networks to demonstrate their credibility before they can leverage our network, they are helping us grow our community at the same time. For instance, we hope that when a Kiva Zip borrower repays her mom, her mom might then relend some of that money to help the next entrepreneur, whether he lives in Kentucky or Kenya – or in any of the 83 countries in which Kiva operates, as credit is fungible between a lender’s Kiva.org and Kiva Zip accounts.

Now, don’t get me wrong. There is value in traditional financial underwriting. And it’s a good way to assess credit risk – that’s why the financial industry employs it. But if financial underwriting is complemented by innovative and creative approaches to social underwriting, we believe that more efficient and equitable economic outcomes will result.

Jonny Price is Senior Director of Kiva Zip.

- Categories

- Uncategorized