Empowering Female Entrepreneurs: Solutions to Five Key Barriers to Women’s Financial Inclusion

Every three years, the World Bank’s Global Findex Database offers a glimpse of how access to financial services is developing around the world. The 2017 edition shows that financial inclusion is on the rise globally. However, there is a significant gender gap, with women still less likely to have a bank account than men: In developing economies, only 59% of women have a bank account, compared to 67% of men.

To help boost women’s access to financial services, VisionFund International, the microfinance arm of World Vision, launched the Women’s Empowerment Fund (WEF) in 2016. The fund’s aim is to build women’s resilience by expanding financial access and delivering high quality credit, savings and insurance products developed with women, especially mothers, in mind.

In its first year of existence, WEF supported many female-led businesses, providing over $1.5 million in loans to 5,062 women who support 13,037 children in the Dominican Republic, Mexico, Myanmar, Peru, Rwanda and Senegal. In 2019, VisionFund pledged a further $1.2 million in funding to support over 32,000 women in Armenia, Myanmar, Sri Lanka, Uganda, Kosovo and Vietnam.

Progress has been encouraging, but not without challenges – the majority of which have been related to adapting our product and service offerings to the specific needs of female clients. We need to make sure they understand the financial options available and are also able to access VisionFund’s financial services in the first place.

Serving Women in Difficult Contexts

In Uganda, for instance, we have faced the challenging task of bringing financial inclusion to women living in some of the world’s largest refugee communities. We do this by first providing them with financial literacy training, then offering small loans through savings groups run by World Vision.

We quickly realised that in order to better serve women, we had to understand their needs and their daily challenges. We found that women were more comfortable sharing their difficulties with other women and, in particular, with those with similar life experiences. That is how we came to the decision to hire women from the local community as loan officers. But “normal” hiring practices do not necessarily apply in refugee camps. Instead of traditional advertising channels, we used announcement boards and word of mouth to attract and hire women, including a number of women refugees.

Responding to Climate Change

Understanding the context of the regions where we work is paramount to the success of the programme. In some of these regions, poverty often co-exists with the challenges of fighting the negative effects of climate change. That’s why we are developing financial products that increase households’ preparedness to withstand climate shocks, such as extreme temperatures and natural disasters. These products include affordable solar panels, greener and cheaper fuels, as well as other measures to mitigate climate-related risks. In Armenia, for example, loans and training are being complemented with services aimed specifically at building resilience to climate change.

Making Finance Convenient

Finding convenient ways for women to access branches, gain approval for loans and make repayments has also been a challenge. It is not always easy for women to take time away from their businesses, while also looking after the family and taking responsibility for most of the (unpaid) care work.

In some cases, technology is providing a solution. In the Dominican Republic, for instance, we have digitised credit applications, resulting in faster disbursement times. In addition, mobile money allows repayments to be made remotely and conveniently through mobile phones.

Dealing with Geographical Challenges

On occasions, the major hurdle to reaching clients is simply the local topography. In Rwanda, accessing villages in hilly areas presents a big challenge. In response, we have explored solutions such as providing motorbikes to loan officers and increasing online banking. We are also investigating how we can expand our operations by partnering with another bank, so that clients may use their branches as well as our own.

However, face-to-face interaction between clients and VisionFund field staff is still crucial for providing solutions that change lives. And as convenient as mobile money is, there are times when clients need to visit our branches. This can involve travelling long distances, with women often carrying one or more children. With this in mind, Rwanda’s Kigali branch built a designated play area. Children can play in a safe and secure environment while their mothers can take time to talk to staff, to learn about managing their finances, and to select the best financial services available to them.

Ensuring Lenders’ Sustainability

Another operational challenge has been to guarantee the long-term viability of the local microfinance institutions. It is our aim to provide communities with consistent and dependable financial support. This means our branches must be financially sustainable. In some regions, however, the very small size of the loans taken by women makes sustainability difficult. In Senegal, for example, 85% of VisionFund’s borrowers are women, but they represent only 15% of the value of the institution’s loan portfolio.

While we want to ensure that the more vulnerable women in rural areas – who tend to take smaller loans – have access to high quality financial products, there is a cost associated with providing this service. Therefore, we have to balance this primary focus on rural women living in poverty by also working with women who can benefit from larger loans, which are relatively less costly for VisionFund to manage. To achieve this, we simultaneously target women living in peri-urban areas who have access to larger markets, own bigger businesses, and need different loan sizes and features.

The most important lesson we have learned over the last three years of the Women’s Empowerment Fund is that most hurdles can be overcome with hard work and creativity. We remain convinced that the economic empowerment of women has the potential to create a transformational, lasting impact on families and entire communities. This drives us to continue developing financial products and services that can solve the unique challenges faced by women running small businesses in remote areas.

Johanna Ryan is Global Director of Impact at VisionFund International.

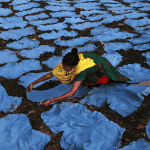

Photo courtesy of Perry Grone.