Investing in Airtime: How an unlikely financial innovation is promoting economic security for girls in South Africa

“An investment in knowledge pays the best interest.”

– Ben Franklin

At Stellar, our core mission is to leverage education and local knowledge to extend financial access to the 2.5 billion unbanked people worldwide. We do this through a technology that enables money to move directly between people, companies and financial institutions as easily as email, increasing interoperability between diverse financial systems and currencies. Mobile economic tools that can span wide geographic areas at a low cost are a critical component of our efforts. And as we explore powerful ways to alleviate poverty through digital financial services, we need to think in particular about how those tools can reach women and girls.

Why girls?

In many cultures, it’s hard to separate a woman’s identity from her economic relationships with others – so lack of access to financial services serves to perpetuate gender inequality.

In the developing world, only 37 percent of women have bank accounts. Research from Women’s World Banking has shown that poor women are inherent savers, putting away 10-15 percent of their earnings for emergencies. Due to a lack of financial services, however, they’re forced to save in unreliable and sometimes expensive ways — women often hide cash in their homes, where it isn’t secure, or buy livestock, which can become ill or die.

Starting early in a woman’s life, there’s a long list of factors that hinder financial inclusion, including minimum age requirements, lack of formal identification, distance to banks, and difficulty securing permission from familial authorities or other cultural gatekeepers. On top of that, when they do have bank accounts, girls in particular are less likely to maintain hefty balances. Commercial financial institutions are reluctant to design services for small savers, whose accounts they’ve traditionally viewed as prohibitively costly to administer.

We believe that low-cost and reliable methods for saving could have an enormous impact on girls, as well as on their families and communities. Saving not only improves the financial well-being of girls but also nurtures positive attitudes and expectations, building self-esteem and driving productive behavioral changes.

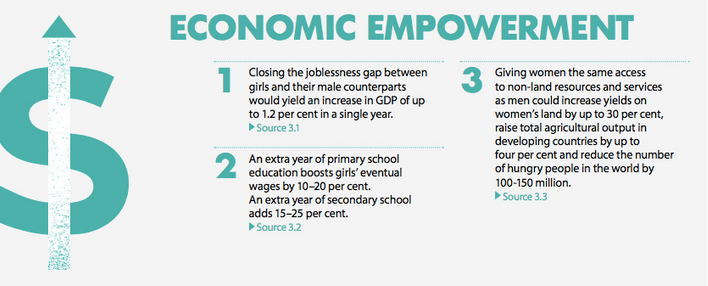

(Above graphic from girlseffect.org)

How Vumi reaches women

When Stellar began digging into this issue, we met the team at the Praekelt Foundation, an amazing nonprofit based in South Africa that has been using open-source technologies to deliver essential information and inclusive services to millions of people living in poverty. Since its founding, Praekelt’s programs have reached over 50 million people across 15 countries in sub-Saharan Africa.

Using Stellar’s open-source protocol, Praekelt is working on a mobile wallet that allows people to save money using Vumi, its messaging platform—think WhatsApp, but open source and designed for the developing world, with a focus on improving the economic security of girls in South Africa. Vumi already powers South Africa’s national maternal health care program, MomConnect, which sends expectant mothers prenatal health information over the course of their pregnancies. After a successful launch in South Africa last year, Praekelt is introducing the service in Nigeria, Africa’s most populous country.

Personal savings accounts for girls

Vumi’s savings program, a pilot program launching soon in South Africa with plans to expand to Kenya and Nigeria, encourages early financial literacy. With a particular focus on formal savings for girls, Vumi’s financial infrastructure allows anyone to open a personal savings account. For many in the program, especially girls, Vumi may be their first formal savings account.

Deposit cash…and airtime?

But cash isn’t the only thing that users can save in Vumi’s program: they can also deposit airtime, and withdraw it later as cash. Why use airtime? Because the few examples of mobile-based banking solutions for youth that focus on traditional mobile wallets have had limited success. In many emerging markets, opening a mobile-money account requires waiting for days after showing ID.

Vumi, on the other hand, fits easily into girls’ lives by utilizing a payment tool that’s part of their daily interactions. With the rapid spread of mobile technology, girls are already familiar with the use of airtime minutes as an alternative currency. Because many telecoms firms in Africa and elsewhere transfer minutes nationwide free of charge, airtime is especially useful for sending and receiving small amounts.

Savings accounts that focus on airtime can be a game-changer for two more reasons:

- They are not limited to smartphones; they are also available to anyone with a feature phone

- They are convenient because they utilize ubiquitous cash-in/cash-out systems such as agents and local stores

Vumi’s pilot program and its focus on girls closely aligns with our core mission at Stellar — financial access for all. Through careful research and measurement, Vumi aims to demonstrate that accepting airtime while also offering incentives and education will result in increased savings and improved financial security for girls.

Girls who are saving small amounts for school fees today could be contributing monetarily in their homes and communities in a few years. We want to start investing in that future now.

Joyce Kim is the Executive Director of Stellar.org

Editor’s note: A version of this post was published on Stellar’s website. It was adapted and republished with permission, in collaboration with the author.

- Categories

- Technology