NexThought Monday – Making Social, Environment Standards – Standard: The days of pure financial reporting for public companies are numbered

The 13,500 publicly listed companies in the U.S. comprise $18.6 trillion in assets under management. Have you ever thought about the magnitude of the associated environmental and social impacts of these companies? No one set of metrics yet quantifies these impacts, but clearly they are material.

Here’s a quick financial history lesson. In response to the U.S. Great Depression, the Securities and Exchange Commission (SEC) was formed shortly after the passing of The Securities Act and the Securities Exchange Act passed in 1933 and ’34. At this point, the SEC instituted the regular review of financial statements, beginning a long trend of government regulation over both the practices of accounting and investing.

The responsibility of actually developing accounting standards fell to a suite of actors until it finally landed on the Financial Accounting Standards Board (FASB) in 1973. Although a big deal at the time, most of us probably don’t remember a time before it was commonplace, and legally binding, to require U.S. public companies to disclose important financial information.

Now, what about reporting environmental and social impacts? Given that many corporations have deeper pockets than some countries, it seems necessary to understand the impacts these public companies are having on people and ecosystems from not only a broad societal standpoint, but also from a fiduciary responsibility and a risk/return perspective.

As it turns out, environmental and social reporting doesn’t even require a change in legislation. Since 1982 public companies have been required to disclose “material” information in their 10-k filing requirements with the Securities and Exchange Commission (SEC) under a legal framework called the S-K. The problem is, no one has defined what that means, until now.

The Sustainability Accounting Standards Board (SASB), a 501(c) 3 based out of San Francisco, CA was formed in 2011 to do just this. “It’s not that any disclosure on material sustainability issues hasn’t been happening until now,” says Jean Rogers, founder and executive director of SASB, “the problem is reporting hasn’t been necessarily comparable or decision-useful.”

In terms of linking financial performance with various environmental and social metrics, “that’s not really our role, but we are hoping the analyst community and information aggregators take this on and test information that’s relevant for investors,” says Rogers.

A number of other players are working on metrics for company reporting, including the Global Reporting Initiative (GRI) and the International Integrated Reporting Committee (IIRC). SASB is closely collaborating with these other entities.

What really differentiates SASB from other players in the space is the focus on metrics that are really useful for investors and their activities, not on a broader range of stakeholders (although they do collaborate with other stakeholders to get input on the metrics).

SASB’s sole purpose is to create accounting standards focused on helping companies comply with “material” 10-k reporting requirements. One example of these material standards that relate directly to poverty alleviation is whether the Health Care Delivery Industry focuses on health care access for low-income patients.

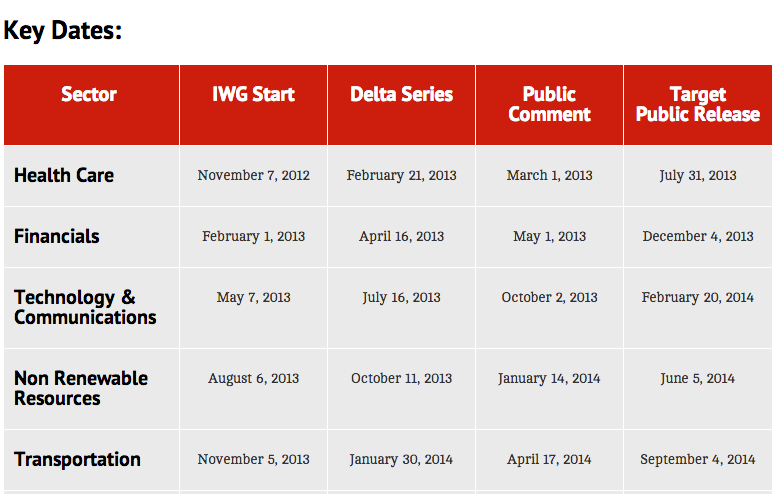

Over the next two and a half years, SASB is working to develop more than 80 industry level standards (industries are grouped according to similarities in sustainability impacts). The process involves gathering background research on each major industry, convening various industry-working groups to understand key issues and presenting the draft standards for public comment before finalizing.

So far, the health care industry standards are the only ones available. Other industries will follow, one quarter at a time. (See the above schedule). One example of these particular standards that relate directly to poverty alleviation is whether the health care delivery industry focuses on access for low-income patients.

More than 700 people (companies, investors and intermediaries) have downloaded the standards since their release on July 31.

Of particular note is the level of stakeholder participation in the SASB Industry Working Groups so far: 850 individuals in four sectors to date, out of ten total. These stakeholders include investors representing $12 trillion in assets under management and corporations with market capitalization in excess of $5 trillion.

After all the standards are finalized, there’s still more work to be done. SASB will continue help companies comply and incorporate SASB metrics into their SEC filings, and understand the costs and benefits of doing so. They will also continue to obtain feedback and iterate the standards as appropriate.

SASB, and others working on ESG accounting for public and private companies, will be attending the Sustainable Brands (R) New Metrics for Sustainable Business conference in Philadelphia on Tuesday and Wednesday (Sept. 24-25). This event will bring representatives from dozens of public companies, as well as other stakeholders, to discuss these and other issues related to double and triple bottom line accounting.

I’ll be tweeting directly from the conference, and posting an additional blog post, so stay tuned.

- Categories

- Environment, Impact Assessment

- Tags

- impact investing