Mobile Money in Tanzania: Understanding consumers’ perspectives

Using mobile money as a tool for financial inclusion is growing worldwide, but in many countries demand-side data on users and potential users is still quite limited. Mobile network operators (MNOs) have vast quantities of supply-side data such as the number of mobile connections and the number and size of mobile money transactions. But understanding the demand-side of the equation, the perspectives of those mobile money is meant to be helping, requires a different kind of data, research, and analysis.

My organization, InterMedia, recently completed a year-long tracking study of mobile money in Tanzania for the Gates Foundation. The goal was to understand the market from individual Tanzanians’ perspectives, and provide insight into the drivers and barriers to mobile money awareness and use.

We conducted four waves of research, each including a nationally representative survey and a series of qualitative research elements, so that we could analyze how the market was changing over time. We recently published a report summarizing the year’s research.

Who is Using Mobile Money?

![]() After stagnating during the first two waves of research, mobile money use among Tanzanian adults nearly doubled over the course of the study. Poor, rural women were consistently the least likely to use mobile money, while urban men above the poverty line were the most likely. However, we found that gender does not play as large a role in mobile money use as might be expected. Poverty and living in an urban versus a rural location are much stronger determinants of use. In urban areas, for example, men and women above the poverty line are almost equally likely to use mobile money.

After stagnating during the first two waves of research, mobile money use among Tanzanian adults nearly doubled over the course of the study. Poor, rural women were consistently the least likely to use mobile money, while urban men above the poverty line were the most likely. However, we found that gender does not play as large a role in mobile money use as might be expected. Poverty and living in an urban versus a rural location are much stronger determinants of use. In urban areas, for example, men and women above the poverty line are almost equally likely to use mobile money.

How Tanzanians Use Mobile Money

Most Tanzanians who use mobile money do so to receive money transfers, while sending transfers is the second most common use. Money transfers are not the only way Tanzanians are using the service, however. Almost half of mobile money users use it as a savings mechanism, even though savings is not a formal mobile money product offering in Tanzania.

How Tanzanians Choose a Provider

How Tanzanians Choose a Provider

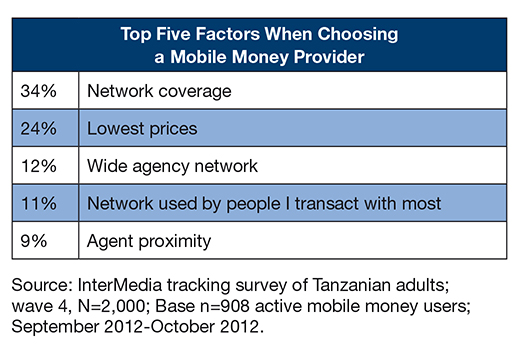

Network coverage is the top factor Tanzanians consider when choosing a mobile money provider, even more important as a determinant than price. Mobile money users also complained about network outages, with more than half experiencing network problems in every wave of the study. Expanding and improving network coverage will clearly be important for providers to grow their customer base.

What Limits Mobile Money Growth?

With awareness at 99 percent of the population, practically all Tanzanians can name or recognize at least one mobile money provider. However, many still do not understand the different ways mobile money can be used or how to operate the services. Consumers said they would like mobile money providers to educate them on the services. Agents also recommended providers increase their education efforts because agents do not have the time or the ability to provide customers with all the information they need about the services. Some agents said answering customer questions was taking so much of their time that it was detracting from their ability to run their businesses.

In addition to a lack of understanding, Tanzanians cite lack of access to an agent as a barrier to use, as well as not having a need for mobile money services. As mobile money providers try to expand into rural areas in particular, these factors will need to be addressed. Cost is also a barrier for some, although when asked, many Tanzanians had a poor understanding of the fee structure. Even those who had used mobile money were often unclear about how much they had paid for the transaction.

In addition to a lack of understanding, Tanzanians cite lack of access to an agent as a barrier to use, as well as not having a need for mobile money services. As mobile money providers try to expand into rural areas in particular, these factors will need to be addressed. Cost is also a barrier for some, although when asked, many Tanzanians had a poor understanding of the fee structure. Even those who had used mobile money were often unclear about how much they had paid for the transaction.

Additional findings can be found in our year-end summary report, as well as in the more detailed reports covering each wave of research.

What’s Next in Mobile Money Research?

Even as this study wraps up, InterMedia is engaged in other demand-side mobile money research, and is in the planning stages for a continuation of the Tanzania study as well as an expansion into other countries. This research will help mobile money providers better tailor products, services, marketing and education campaigns to consumer needs and demands. By providing continuing research and market tracking from the consumers’ perspectives, our hope is that the research will help shape, develop, and grow mobile money markets to better serve those in Tanzania and elsewhere, and increase financial inclusion.

If you’re interested in exploring demand-side data yourself, check out our Mobile Money Data Center, where you can conduct your own analysis and request access to our publically-available datasets.

Michelle Kaffenberger is research manager at InterMedia and is experienced in quantitative research, data analysis, project evaluation, and project management.

- Categories

- Technology, Telecommunications