Paying for School: Six Insights for Better Financial Services

This blog first appeared on CGAP’s website and is reprinted here with permission. It’s part of NextBillion’s focus on education for the month of February.

The inability to pay fees and other education expenses keeps many children out of school. What is the extent of these challenges, who is affected and what kinds of financial services could help? These questions are further explored below, and in a new CGAP publication, “Digital Finance and Innovations in Financing for Education.”

Recent data collected in eight countries as part of the nationally representative Financial Inclusion Insights (FII) surveys provide new insights. Equipped with a better understanding of the challenges, financial service providers, educators and governments will be better placed to develop innovative financial solutions that help families enroll and keep their children in school.

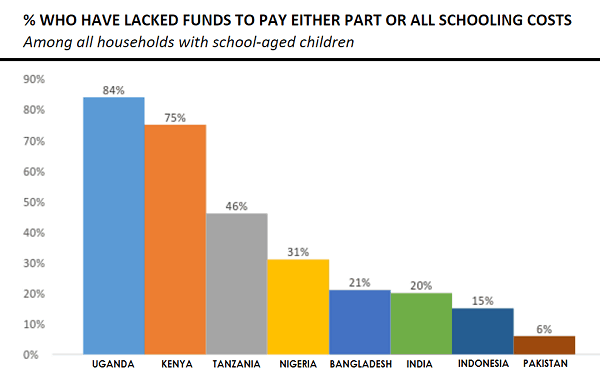

1. Paying for school presents a huge and widespread challenge to keeping children in school. In Uganda, a whopping 84 percent of households with school-age children have, at some point, lacked the funds to pay either part or all of schooling costs. In Kenya, 75 percent have. Even in Bangladesh and India, where the percentages are smaller, 20 percent of households with school-age children have struggled to pay for school.

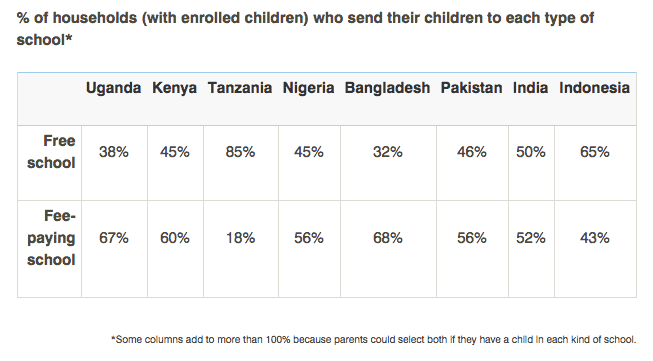

2. A large portion of families send their children to schools that require tuition payments. More than half of households with enrolled children pay fees to send their children to school in six of the eight countries included in the survey (see table below). This category includes both private schools, an increasingly popular choice among low-income families, and public schools that charge fees – even many countries that have instituted free primary school still have fees for secondary school, and in some countries public primary schools still have fees, too.

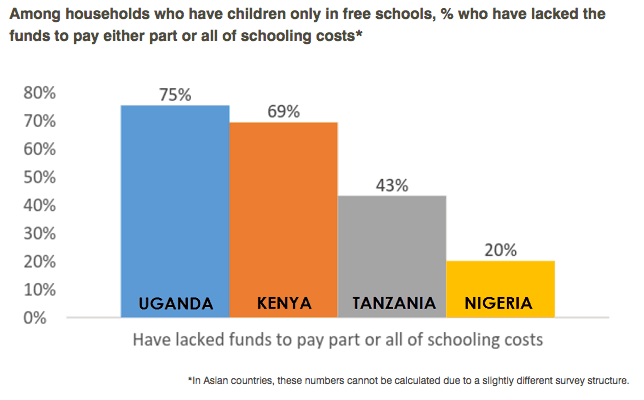

3. Even at “free” schools, however, families face many other costs to keep their children in school. In Kenya, for example, students in “free” public schools may be required to buy uniforms, pay examination fees and in some cases even provide their own desk and chair. In Uganda, government capitation grants (the funding given to public schools to cover each enrolled student) are insufficient to cover all students and are dispersed inconsistently, leading schools to charge parents extra fees (sometimes unpredictably) to bridge the gap. The FII data show the burden these kinds of expenses put on families: Among Kenyan families who have children only in “free” schools, fully 69 percent report difficulties paying for school. In Uganda, 75 percent of families using only free schools have had difficulties.

4. The problems are common across demographic groups, as well. In Uganda, for example, where difficulties are most common, 84 percent of those below the poverty line and 80 percent of those above the poverty line have struggled to pay for school. Among urban and rural residents, the same 84 percent have had difficulties. In Kenya, the poor and rural residents are slightly more likely to struggle with paying for school, at about 77 percent of each group, but still nearly 70 percent of urban residents and those not categorized as poor, also have had difficulties.

5. For the minority of children not enrolled in school, an inability to pay school fees is a common reason, though answers vary. In Uganda nearly 40 percent of families say school fees prevent them from enrolling their children. In Kenya and Nigeria, a fifth say this. There are many other reasons why the remaining children are not enrolled, most of which do not relate to finances. In Asia, for example, one of the top reasons a child is not enrolled is that the child lost interest or does not want to attend, which can be an indication of poor quality education or teacher absenteeism resulting in limited learning taking place. Financial services will of course not solve all these problems, but for the portion of households struggling with fees, they could provide some solutions.

6. Paying for school also weighs heavily on many families’ aspirations. When respondents were asked to name their single “most important financial goal,” 24 percent of those in Kenya, and about 20 percent of those in Uganda and Nigeria said “paying school fees.” In India, Indonesia, Tanzania and Pakistan, it was near or above 10 percent. For these respondents, paying school fees is a higher priority than saving, investing in a business, buying goods or property or any number of other financial goals a person might have.

With such widespread challenges paying for school, the potential market for solutions is large. For many low-income families with irregular patterns of income, using digital financial services to smooth payments into smaller amounts over a longer period of time might help families who are not able to come up with the full term fee at one time. In Bangladesh, for example, 90 percent of the struggles were to pay a portion of schooling costs, indicating families had some of the money they needed, but not all. A digital platform also lowers the transaction and accounting costs for the schools, so receiving and tracking many small payments is more feasible (see Bridge International Academies as an example). (Read more about Bridge here and here as part of NextBillion’s February focus on education.)

Digital savings accounts, which allow families to put away small amounts of money at a time, could also help families manage lumpy expenses, as could responsibly delivered digital credit, such as top-up loans for tuition. Some current models link financial services directly to schools, but other models will need to be developed for education expenses, such as uniforms or notebooks purchased outside the school. As discussed in CGAP’s new publication, digital financial services have the potential to act as a catalyst for keeping more children in school through these types of models.

Michelle Kaffenberger is an applied research consultant and Lauren Braniff is a consultant working with CGAP on the Digital Finance + Initiative.

Photo by Pete Bellis via Flickr

- Categories

- Education