Small Farmers Meet Big Data: How the data revolution could transform smallholder finance

The enormous gap between the supply and demand of formal credit for smallholder farmers has been well documented. Among the varied causes of this mismatch is the extreme lack of information on potential borrowers that’s available to lenders. This lack of information with which to accurately assess creditworthiness creates risks for financial institutions and limits their willingness to lend. In rural and smallholder environments, data on potential borrowers is even thinner and the risk aversion of financial institutions in these contexts is even higher, resulting in low levels of financial inclusion.

Two recent innovations, however, have the potential to dramatically reduce these information challenges and the associated lending risks, which could in turn help to open up pools of capital for previously underserved populations:

- The ability to collect and collate new data sources (“alternative data”), both digital and non-digital

- The ability to analyze and apply this data through new methodologies (“data science”)

As we at the Initiative for Smallholder Finance explore in our latest briefing note, “The Rise of the Data Scientist: How big data and data science are changing smallholder finance,” innovative lenders are starting to use these new data sources and analytics to assess the creditworthiness of borrowers.

The data opportunity in the developing world

The rapid growth of credit assessment models that use alternative data has been impressive. As recently as five years ago, lenders relied primarily on credit history, income information and relationship-driven assessments to determine the creditworthiness of borrowers. However, new actors that generate and analyze data about the habits and behaviors of borrowers are redefining this landscape; mobile network operators, telecommunication companies, data analytics firms, and service and utility providers are increasingly active in efforts to build predictive risk algorithms and expand lending.

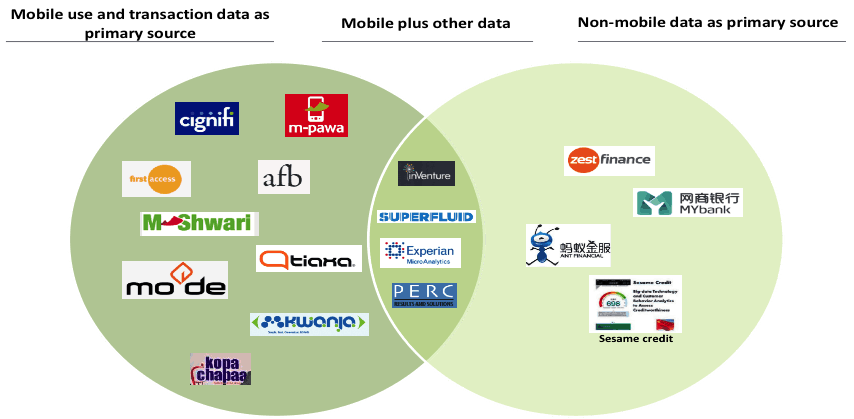

Currently, however, alternative data-driven lending models are heavily concentrated in urban environments, among a predominantly young, tech-savvy and educated demographic – the “early adopters.” As illustrated in the figure below, the majority of models use mobile utilization data and e-wallet or mobile money data as their primary data sources, a feature that makes them well suited for urban environments where the depth and breadth of mobile use creates strong digital footprints.

This market and data-source bias is reflected in the products offered. Borrowers in these contexts tend to need relatively small (low value) loans with relatively fast turnover that can be used to finance trade inventory, attend to unplanned expenses, and purchase small consumer goods. This particular use case has resulted in the label “big data small credit” being used in other studies.

Broadening and deepening to serve rural and smallholder borrowers

Despite the large number of models being tested in developing countries, few actively target agricultural borrowers. Gro Ventures, Farm Drive, and the Grameen Foundation have built models explicitly for the agriculture sector, and a few others, such as EFL and Arifu, are piloting programs to adapt their models for farmers. While these examples are currently the exception, the broadening of mobile money services into rural areas suggests that alternative credit assessment models should also be able to penetrate these markets. However, the different financing needs and data contexts in rural areas mean urban models cannot simply be transposed.

In particular, three features of the agricultural market pose challenges for the development of data-driven credit assessment models:

- The need for larger loans of longer tenor to accommodate large pre-season purchases and long lags in production, harvest and marketing cycles. The micro-loans available on mobile platforms smooth cash flows but are too small to finance the purchase of assets and inputs.

- Lower levels of mobile phone penetration and utilization in rural areas result in less reliable digital footprints.

- Smallholders’ risk of default is affected by multiple drivers, including production and sales risks that are often beyond their control.

The larger size of loans required in agricultural contexts, combined with the lower predictive power of mobile utilization data, point to the need for lenders to incorporate different data that provide a more individualized client profile in rural markets. Innovators are experimenting with data that could provide a deeper understanding of the character of a potential borrower. In particular, psychometric data and a combination of social media and social network data may provide lenders with insight into both the willingness and predisposition of a borrower to repay his loan in an environment where portfolio-based risk assessment is insufficient.

That said, for agricultural loans, a farmer’s ability to pay may be a greater driver of default risk than her willingness to pay. Factors such as weather, soil health and input quality can affect production and yields, while market prices, warehousing and buyer linkages can affect sales, all of which in turn could limit the ability to pay. Innovators must understand the relative importance of these drivers, and incorporate data that can assess them. While not prevalent yet, some models have started to test the utility of various geographic and climatic data, as well as value chain and market data, for this purpose.

Future trends and what is needed from here

While credit scoring models that use alternative data are still new in the agriculture sector, several trends suggests that this market will soon be better served. The increasing penetration of smartphones and improved rural connectivity will increase the availability of digital data there. This is enhanced by the increasing digitization of informal data such as from saving and lending circles common in rural areas. Finally, data scientists are also conducting inductive analysis, along with deductive, to test the value of previously unused data for risk scoring.

Going forward, our research suggests that a focus on three key areas will facilitate the adaptation of models to the particular needs of the agricultural sector:

- More collaboration with non-traditional actors that may have data on agricultural borrowers, such as technical assistance providers, agricultural and climate research institutes, and value chain aggregators.

- More digitization of data from, for example, subsidy programs, censuses and extension worker programs could be useful for borrower verification and credit algorithms in the agriculture sector.

- More context-appropriate investment that is aligned to the longer product development and testing cycles in the agriculture sector. Agricultural loans must be made in line with harvest cycles, meaning that each step of the innovation process could take up to a year, compared to a few weeks or months in other lending contexts.

Photo credit: lirneasia, via Flickr.

- Categories

- Agriculture