NexThought Monday: Sprinters vs. Limpers – Three Critical Success Factors for Digital Finance Deployments

According to the GSMA’s State of the Industry Report 2014, there are 271 mobile money services in operation across 93 countries, and digital financial services (DFS) are now available in over 60 percent of developing markets. As of December 2014 there were 134 million active mobile money accounts (up from 73 million in 2013). An increasing number of services are reaching scale: 30 services now have more than one million active accounts. But 241 have failed to do so. So what separates these 30 “sprinters” from those deployments that are merely limping along?

There are, of course, many factors, but at the heart of all the successful deployments has been a serious investment in at least three core pillars:

- Understanding the market;

- Leveraging technology; and

- Building a robust & reliable agent network

Understanding the market

It’s a little known fact that Safaricom took 18 months to research, test and refine its M-PESA mobile money product, user interface and marketing materials. This process completely changed the core focus of the M-PESA value proposition from digitising microfinance transactions to its now much-lauded slogan, “Send money home.” But since that time, too many providers have sought to simply replicate M-PESA’s core person-to-person (P2P) payment proposition as their anchor product without conducting market research of their own to assess the demand.

Another key decision that needs careful research and thought is whether to lead with a go-to-market strategy in which transactions are facilitated by over the counter (OTC) agents. OTC has proven extremely successful in Asia (particularly Pakistan and Bangladesh), and even in the pioneering mobile money market of Kenya 54 percent of registered mobile money users still seek agent assistance to make transactions. While we have some understanding of the drivers of OTC’s popularity, it is less clear how to move people from OTC/agent-assisted transactions onto self-service, user-initiated ones. Wing in Cambodia has interesting strategies to do this (see Anthony Perkins’ comments here). But Pakistan and Bangladesh are having mixed experiences in registering customers into user-initiated services. In Pakistan, according to Intermedia’s latest surveys, 14 million users (11 percent of the adult population) are now registered in self-service systems – but only 10.7 percent of these have been active in the past 30 days. And in Bangladesh, 10 million users (9 percent of adult population) are now registered, with about 78 percent of these active in the past 30 days.

One of the key drivers of OTC remains the lack of credible products to make DFS what Ignacio Mas calls “daily relevant” and thus encourage users to keep digital value on their phones. While transactions typically involve users going to an agent to load e-money in order to remit it or pay a bill, perhaps we should not be surprised that they also ask that agent to assist them with the transaction. It will be interesting to see if agent assistance statistics are different for users of bank-led models, where digital value is typically stored in a mapped savings account. But ultimately, DFS largely remain limited to remittances and bill payments. And clearly, with a few notable exceptions like M-Shwari and KCB-M-PESA, they have not engaged users enough for them to make the services a daily part of their lives. It is, however, important to note that the mass uptake of both M-Shwari and KCB M-PESA was enabled by the fact that the vast majority of customers in Kenya are registered mobile money users – and thus sign-up for these products was very easy through the SMS toolkit drop down menus.

After the initial market research to define anchor products and go-to-market strategy, successful providers will need to continue to monitor the market if they hope to expand the scale and scope of their offerings. In particular, it is essential to monitor and optimise customer journeys – at the macro level (from awareness to regular usage) and the micro level (the processes of registration and conducting different transactions). In addition, particularly in the initial stages, it is necessary to monitor the satisfaction of the agents (who often struggle to sell the service profitably) as well as key drivers of customer satisfaction and trust such as agent liquidity, knowledge, branding and tariff display. Some of this market analysis can, of course, be done based on data from the DFS platform, but the majority of it will require a combination of regular monitoring visits to agents to optimise on-going operations, and special research initiatives to inform strategy, policy and procedures.

Leveraging technology

In their outstanding paper, “Platforms for Successful Mobile Money Services,” Fionan McGrath and Susie Lonie highlight how most providers have under-estimated the investment required to build/buy and integrate IT systems for DFS. This has been a challenge for sprinters and limpers alike – but the sprinters are, almost without exception, busy upgrading their systems to invest in “second generation” platforms to respond to this challenge.

In their outstanding paper, “Platforms for Successful Mobile Money Services,” Fionan McGrath and Susie Lonie highlight how most providers have under-estimated the investment required to build/buy and integrate IT systems for DFS. This has been a challenge for sprinters and limpers alike – but the sprinters are, almost without exception, busy upgrading their systems to invest in “second generation” platforms to respond to this challenge.

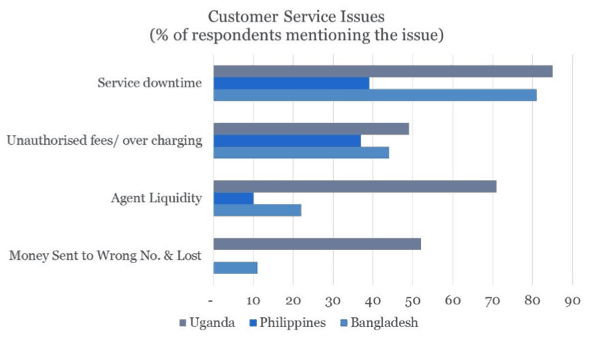

Irrespective of whether the DFS platform is managed in-house or is cloud-based, it must be reliable and flexible, and allow for growth in both the scale and scope of services. MicroSave research in Bangladesh, Uganda and the Philippines (see graph) and most recently in India (forthcoming) has highlighted service downtime as the key customer service issue. These customer service issues undermine trust in DFS, and thus restrict both uptake and usage.

Building a reliable, robust agent network

Agents are the face of the service for its users. Building a reliable and trusted agent network is key to a successful DFS operation. For mobile network operators, the existing network of airtime sellers provides an opportunity for the rapid rollout of an agent network – but this is not without downsides. Understanding the target customers’ beliefs, expectations and perceptions about who would make a good agent is as key as the supply side drivers like location, liquidity etc. Ultimately, many of the questions that customers will ask about DFS and their willingness to trust and use these services hinge on the provider’s choice of agents to represent them in the marketplace. And we know that agents who are more transparent with their pricing and more knowledgeable about mobile money policies experience significantly higher transaction demand, as the Helix Institute of Digital Finance/Harvard Business School have found.

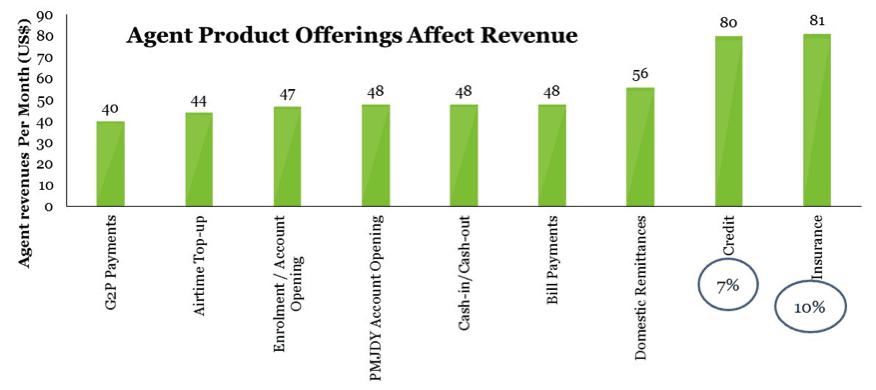

Yet many providers continue to under invest in their agent networks. This leaves customers to rely upon poorly trained agents operating out of poorly branded outlets without displaying tariffs (and thus often levying unauthorised supplementary charges – particularly for OTC transactions), and unsure of how to resolve customer problems. In addition, agents need to make adequate profits to continue offering DFS. Much has been written about growing the agent network in parallel with the customer base to ensure convenience for customers and a viable business for agents. However, there is growing evidence that in some markets (particularly where commission rates are limited, India being the prime example) the range of financial products offered by agents plays a key role in determining their revenue. In the graph below, it is clear that agents offering credit/insurance products on top of more traditional remittance/payments and airtime top-up receive significantly more revenue than those that do not. But, of course, offering these products makes the job of the agents more complex – they need to be able to sell these products responsibly, implying the need for even greater investment in training, monitoring and support by the provider. Perhaps this is why the 2015 ANA survey of Indian agents by MicroSave’s The Helix Institute of Digital Finance revealed that only 7 percent of Indian agents currently offer credit products, and only 10 percent offer insurance (see chart below).

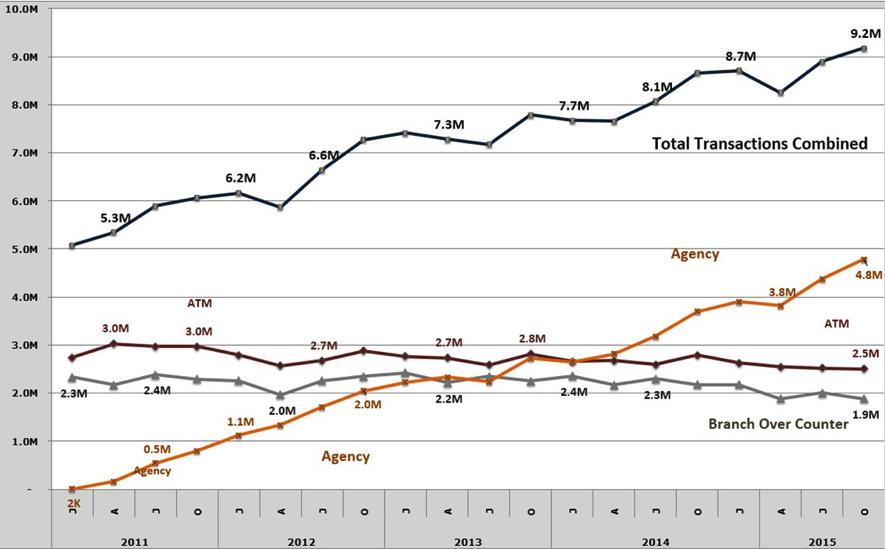

We have all learned, the hard way, that M-PESA’s success is not easy to replicate – and that large-scale, patient investment is essential. But there is growing evidence that it is possible not just for mobile network operators but also for banks to sprint – despite the initial challenges of start-up economics (see Why Do (Some) MNOs Sprint and (Most) Banks Limp?). In Kenya, 52 percent of Equity Bank’s 9.2 million transactions each month now occur with agents. Furthermore, the number of agent transactions continues to increase, clearly displacing transactions in the branches and even at ATMs. This is immensely important, since agent-managed transactions are significantly cheaper for the bank than those conducted at branches, and marginally cheaper than those conducted at ATMs (see chart below).

However, this transition has taken five years of hard-work, learning and patient investment in all three of the critical success factors discussed in this blog. Equity Bank is now set to reap the rewards as it moves to implement its Bank 3.0 strategy. Investing in these three key pillars will allow other institutions to achieve the same results.

However, this transition has taken five years of hard-work, learning and patient investment in all three of the critical success factors discussed in this blog. Equity Bank is now set to reap the rewards as it moves to implement its Bank 3.0 strategy. Investing in these three key pillars will allow other institutions to achieve the same results.

Photo credit: Valentina Powers, via Flickr.

- Categories

- Uncategorized