The AgTech Pedestal Problem: How to Bring Innovation Down to Earth

Projections of huge food needs and massive financial investment have increased the hype around agricultural technology – or “AgTech.” Monsanto’s nearly $1 billion acquisition of Climate Corp, a big data weather company, in 2013 pushed AgTech into the line of sight of Silicon Valley investors. Meanwhile, a seminal report from the UN’s Food and Agriculture Organization called for a 70 percent increase in food production by 2050, galvanizing interest in AgTech from the development community. Since then, AgTech has seen rapid growth – investment increased 166 percent in 2014 and another 92 percent in 2015. [1]

This growth has brought about exciting innovations: drones capturing digital images that allow farmers to precisely manage each patch of soil, and new seeds that require half the fertilizer and yield twice the produce, to name just two. These innovations hold enormous appeal, particularly in regions like sub-Saharan Africa and Central Asia, where the agricultural productivity gap is a well-established problem.

AgTech for Whom?

While the investment, growth and innovations are welcome advancements, development practitioners must be careful not to put AgTech on a pedestal. The AgTech funded by Silicon Valley caters to the California farm belt with technologies designed for large, commercial operations, typically found in developed world agriculture. The majority of developing world farms do not fit the profile of Silicon Valley AgTech customers. More than 500 million of all 570 million farmers today are smallholder farmers and 475 million of these farmers own less than 2 hectares of land. Most of these smallholdings are concentrated in Asia and Africa.

These smallholdings, along with medium-sized agribusinesses (20-300 hectares), cannot use the innovations coming out of Silicon Valley, which are geared toward large farm operations and are prohibitively expensive. They need context-relevant and appropriately priced technology.

Medium-sized agribusinesses often operate via outgrower schemes – they have a network of smallholders feeding into the central agribusiness. These agribusinesses have expressed demand for fundamental solutions for their central farms and their networks of smallholders, including:

- Simple post-harvest loss technologies that would allow their smallholder networks to reduce waste and bypass the post-harvest market glut when prices are lowest.

- On-farm processing technology such as solar drying to preserve goods for storage.

- Irrigation technology – both solar-powered irrigation for smallholder farmers and larger irrigation systems for the central farms.

- Soil management techniques to help invigorate nutrient-depleted soil.

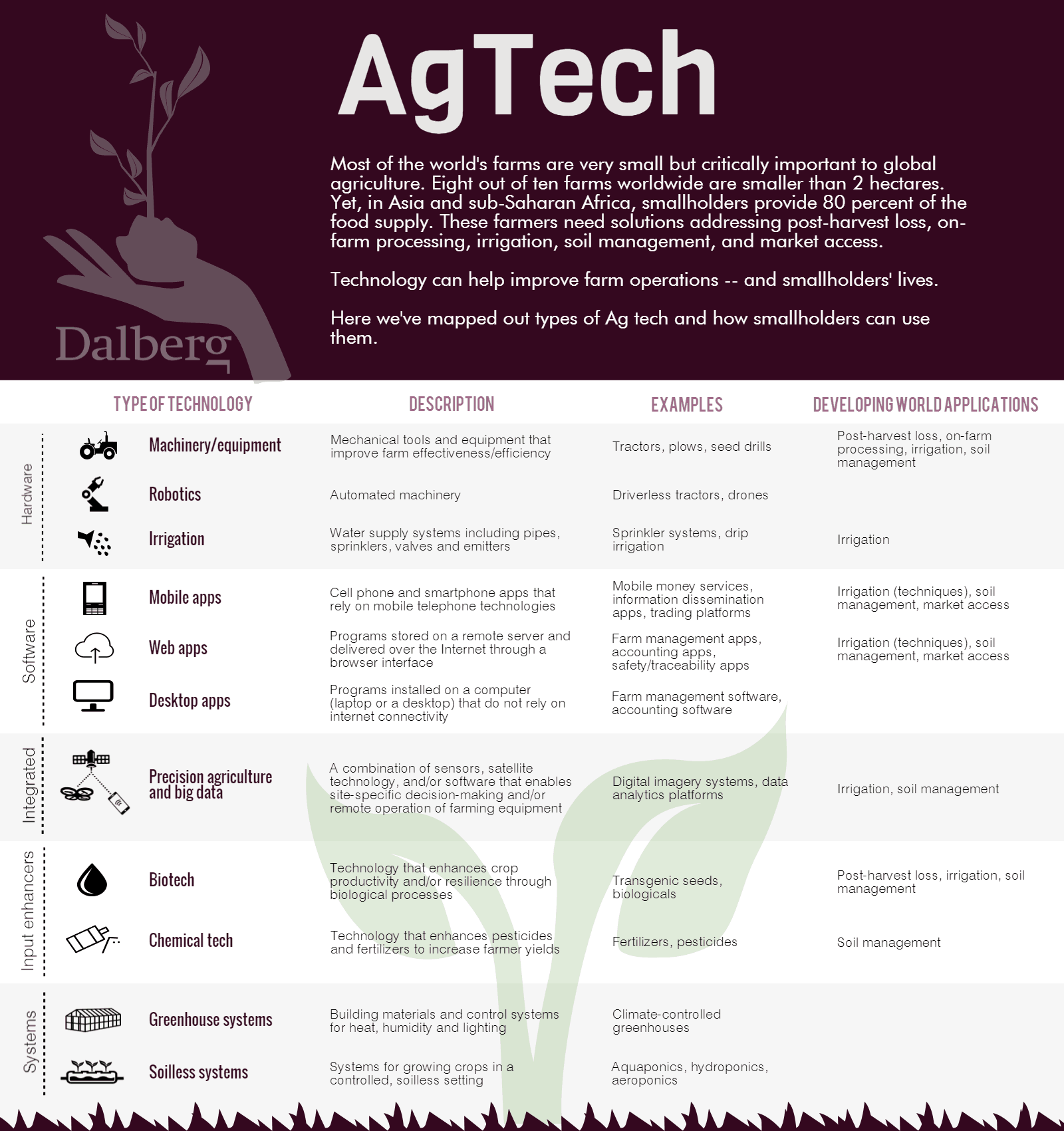

(Information graphic by Minahil Amin, Dalberg Global Development Advisors)

Enter the Silicon Plateau

This is where the second variety of AgTech – “Silicon Plateau”-style AgTech – comes in. Silicon Plateau refers to Bangalore, the tech hub of India, which hosts numerous AgTech enterprises – not as many as Silicon Valley, but enough to comprise a significant trend. India was second only to the U.S. in number of AgTech deals made in 2015, but these deals accounted for 12 percent of total deals compared to the U.S.’s share of 58 percent.

Silicon Plateau has focused on redesigning developed world AgTech to meet the unique challenges and financing capabilities of developing world farmers. Such innovations range from more affordable milking machines to soil nutrient analyzers to weather insurance.

A few highly innovative technologies emerging from Silicon Plateau include: Ecozen Solutions, solar-powered cold storage units and water-pumping solutions; Stellapps, precision data technology simple enough to be used by the average small dairy farmer in India; and EM3 AgriServices, an end-to-end farm services provider that is also scaling an “Uber-like” model for tractor use.

These innovations are exciting. Unfortunately, they are also few and far between. The AgTech sector in the developing world is in its infancy, largely because agriculture there faces different and more fundamental challenges than in Western countries.

More than new technology, developing world smallholders and agribusinesses need access to existing technology, inputs and land, as well as access to financing and markets. The last, especially, is crucial. Much of AgTech is focused on increasing productivity, but if farmers are not able to sell their goods, they have no use for increased yields. Furthermore, the infrastructure crucial for a thriving agricultural sector – namely, a reliable supply of electricity and water and efficient distribution systems – is also critical for many agricultural technologies to be successful.

Without the knowledge to operate it and systems to maintain it, technology is a liability rather than an asset to a farmer. It cannot work in isolation. We must be careful not to place AgTech on a pedestal; AgTech can only be successful if it is grounded in the realities of the developing world farmer.

[1] Source: AgFunder – “AgTech Investing Report – 2015;” CleanTech Group – Innovation Monitor: Agriculture & Food;” Dalberg analysis.

Minahil Amin is a consultant at Dalberg Global Development Advisors with deep interests in global labor supply chains, experience in the agriculture and microfinance sectors in Africa and South Asia, along with a background in social entrepreneurship.

- Categories

- Agriculture, Social Enterprise, Technology