The Future of Microfinance is Mobile: FinTech Resolves Three Key Obstacles of Lending to the Unbanked

The arrival of the credit score, or FICO, in the late 20th century initiated a cultural shift that democratized credit and made borrowing commonplace across middle-class households. Without it, would U.S. car sales have reached 17.5 million in 2016? Or would that country’s college enrollment have increased 240 percent from 1965 to 2014? Global retail e-commerce sales certainly would not be on track to reach $4.48 trillion in revenue by 2021 without the credit card.

But while credit is today a part of the fabric of everyday middle-class life, 2.5 billion of the world’s adults do not have access to traditional banking services or efficient microfinance alternatives. And with the number of people “just about managing” having risen by 4 million to 19 million since 2011 in the U.K. alone, more and more consumers are at risk of falling off the grid.

The good news for these consumers is that their “FICO moment” is here.

The catalyst? Rapid smartphone penetration across the world’s low-income communities is enabling alternative ways to “know your customer”; cheaper methods of capturing alternative data; and a high-touch, low-cost distribution channel. Ultimately, what this technology promises is a way to bring the many “credit invisibles” onto the grid by resolving three key obstacles of lending to the unbanked and underbanked: delivery, risk and design.

Outreach and delivery

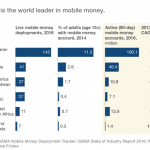

“Off-the-grid” is the natural state in the vibrant cash economies of the developing world, where informal community-based ecosystems replace traditional banking services that are inaccessible to the poor. Emerging-market innovators are leapfrogging traditional banking infrastructure with mobile technology, offering ways for the unbanked to prove their identity and make or receive micropayments.

Ultimately, this technology gives these new entrants a foothold into the distribution of more complex financial products like savings, insurance and loans. Yet their potential to access the global capital markets and expand with consistency into new geographies has been curbed by the tight-knit community networks they serve.

This failure of these emerging market players to pass the test of mass-decentralisation has been to the advantage of traditional microlenders in more mature economies reliant on the availability of partial infrastructure – bank payments, regulation and methods of identification – to entrench their position as market leaders. An example is the U.K.’s doorstep lending sector, in which the largest players have monopolised close to 80 percent of the market.

These low-tech operators rely on expansive physical workforces to manage their book. And while their low level of credit losses has impressed the investment community, what they choose to overlook is that the excess cost of maintaining analogue operations is borne by the borrower. Research from Bristol University found that the poverty premium costs low-income households in the U.K. on average £490 a year, or about $638. A significant portion of this stands to be eliminated by modernising operations.

Traditional microlenders justify their high prices by pointing to the added risk of lending to people without credit history. What they don’t understand is that high-touch models no longer need to be expensive. Great advances have been made in the design of engaging user experiences that integrate gamification and other concepts from behavioural science to nudge behaviour.

Smartphones provide the optimal platform to deploy a high-touch experience that is far cheaper and more easily replicable in new markets than analogue models.

Risk

Traditional microlending businesses are conveniently opaque when it comes to risk. Without the support of powerful data analytics and artificial intelligence to continuously evaluate the actions of an individual borrower, it’s easier, and more profitable, to keep interest rates static. Lenders effectively farm the surplus profit from good borrowers, reinforcing the inertia of those at the bottom of the credit ladder.

The smartphone, however, offers a path up that ladder. The rich media options offered by the smartphone create a high flow of information from lender to consumer and vice versa, providing a near real-time view of customer behaviour. Armed with clearer insights into the various customer profiles, lenders can tailor rates according to level of risk. Good payers are rewarded with lower rates while bad actors are weeded out more swiftly.

Product design

The issue of product design represents one of the next frontiers in retail financial services: How to deliver access to a set of critical services such as payments, savings and credit, in smaller units than what traditional financial markets were built to handle.

Because retail financial products and the supporting infrastructure were designed for the middle class, poor people pay proportionately more on every single transaction they make through traditional banking channels.

Providers like M-Pesa in Kenya have already brought down cost of processing smaller payments through mobile. And as smartphone technology becomes more accessible to consumers at the Base of the Pyramid, we’ll continue seeing the introduction of alternative methods of transacting that create a system that is fairer for all.

Frederic Nze is the CEO and founder of U.K.-based digital microlender Oakam.

Photos courtesy of Oakam

- Categories

- Finance, Technology