Why Low-Income Families Don’t Send Their Children to College. Hint: It’s Not Always About Money.

Laura just graduated from high school in Colombia. She hopes to pursue a career in engineering. Her parents work in factories and live “paycheck to paycheck.” Her family cannot afford to send her to university. Instead, Laura is currently searching for a job to contribute to the household income. As a high school graduate entering the workforce, she has limited prospects for a good-paying job.

Each year, thousands of low-income students like Laura face many obstacles in accessing a college education. For most people, finding room in the family budget to pay for college tuition is an impossible task. Many families have enough trouble coping with the day-to-day living expenses and bills, much less doing long-term financial planning, which is what saving for higher education would require.

Household income is not the only limiting factor as to why children of low to upper-low income families do not attend or save for university. There are significant behavioral reasons that discourage parents from saving toward their children’s higher education in Colombia.

ESCALA helps families save for higher education by enabling parents to set aside small monthly payments from their salaries. As an investee of Catalyst Fund, an initiative at the forefront of inclusive fintech that supports early-stage fintech companies, ESCALA was able to work with BFA’s customer insights team to gather revealing insights about ESCALA’s clients, who are mostly families in the low to upper-low income households and make up 70 percent of the Colombian population. (Note: The author is an associate at BFA). Through individual interviews and focus groups with clients, employers, HR staff at the companies and other key stakeholders, we determined that some of the non-financial reasons that keep these families’ children out of college include:

- A mindset that “a higher education is for someone else’s children, not mine”

In a context of extreme inequality like that of Colombia, a quality higher education has largely been a privilege of a small portion of the population. In past decades, increased competition in private education and government investment in public education have made higher education more accessible to new sectors of the population. Yet the mindset that university education is an exclusive privilege of the elites persists. Furthermore, this belief still exists in the minds of parents who could help their children become the first generation in their families to attend university.

- Low-income workers feel insufficiently equipped to guide their children in thinking about their academic and professional future

Parents who only have a secondary-school education feel intimidated by the prospect of guiding their children’s career decisions. The existing abundance and easy access to information regarding higher education overwhelm parents and exacerbate their own sense of inadequacy to be a part of this decision-making process. Such fears discourage parents from raising the issue of higher education with their children and from exploring the options available to them.

- Lack of trust is keeping financial institutions and potential savers apart from each other

Colombia experienced several financial crises in recent decades such as the UPAC mortgage loan system crisis from 1999-2001 and the DMG pyramid investment scheme in 2008. These crises eroded consumer trust in financial institutions and their trust in financial services overall. Many were left feeling defenseless by fraudulent transactions and market forces they did not fully understand. As a result, many low-income populations try to stay as far as possible from all kinds of financial offerings and are particularly reluctant to place their savings with any institution.

Starting with User Experience to Surpass Barriers

The above-mentioned “invisible” forces that financial service providers (FSPs) need to overcome to engage low-income working parents require them to rethink how they go to market. Processes need to be seamless and as effortless as possible to promote client adoption and usage of their products. But an agile and simple user experience requires special coordination among actors. In the higher-education financing context of Colombia, coordination of actors is key, from the process of onboarding clients to the collection of savings and payment of tuition fees through savings.

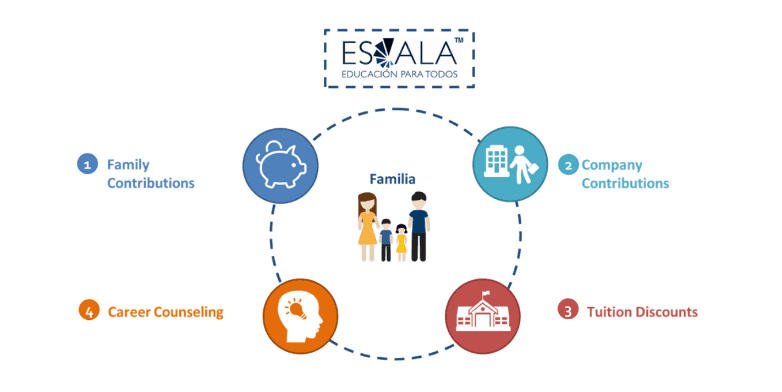

By shaping a saver’s contribution over decades, ESCALA has determined that such savings allow families to fund entire professional programs. ESCALA links employers with FSPs and connects families with FSPs and universities. Through this facilitator role, ESCALA is able to negotiate partnerships with FSPs to further multiply their clients’ savings with valuable economic benefits. For example, clients get tuition discounts from select institutions and may be eligible for room and board scholarships from foundations. ESCALA also offers career counseling for children and counseling on personal finance and higher education for parents.

With the help of the BFA customer insights and fintech specialists, ESCALA evaluated their product design for the Colombian context. We started with mapping the customer journey to identify pain points for customers. The biggest challenge was the signup process for clients. Streamlining processes and coordinating with the different actors is especially difficult in a heavily regulated environment like Colombia. After its repeated financial crises, financial services registration is a complex and lengthy process. Thus, the manual customer onboarding process requires multiple days, with long forms to fill out, discouraging employees from signing up. Not getting the signup process right would make it more challenging for ESCALA to move on to addressing the other invisible hurdles of customer adoption. Informed by the direct work with ESCALA and other early-stage fintech investees at Catalyst Fund, here are three priorities for companies to consider when developing the right product offering for low-income customers.

- Re-engineer processes to put customers at the center

BFA’s customer insights experts worked with ESCALA to streamline its processes to enhance the experience of its customers, such as a simple signup. ESCALA also emphasized the importance of educating customers on the flows of data that made its offering possible. In turn, customers are motivated to continuously use and feed the system with data.

- Use a technology-based backend to support the offering

BFA’s fintech and data experts helped ESCALA redesign its internal information systems with more efficient processes and scalable design. It is now easier to manage relationships with customers, retrieve specific users’ information, monitor savings balances, integrate with banks and automate dashboards and reports.

- Be clear about the distinct value-add for target stakeholders

With a more robust architecture in place, the Catalyst Fund team helped prepare ESCALA to develop larger-scale partnerships and better offerings to partnering employers. In turn, ESCALA can mediate increased and more stable benefits to its customers. As a result, more of the low-income population can access a richer gamut of financial services tailored to promoting and enabling savings toward higher education by low-income families.

With a faster, more reliable service, ESCALA can now turn to the next phase of engaging and educating customers. By addressing user experience and designing to counter behavioral barriers, ESCALA can continue to refine its product offering and position itself for growth.

Natalia Gomez is an associate at BFA who specializes in business case analysis and strategy for financial institutions focused on increasing financial inclusion.

Photo courtesy of World Bank, Flickr