Decentralizing Data Management Across ESG and Impact Investing: How Blockchain Innovation Can Address the Data Gap – And the Ratings Controversy

As long-standing global crises accelerate and new crises continue to emerge, a new, more conscious generation of investors increasingly expects their capital to create positive environmental and social impact.

These investors now represent a sizable segment of the market: As of 2020, around US $2.3 trillion in capital had been deployed to impact investments, while by 2025, a projected US $53 trillion, representing one-third of global assets under management, will be classified as ESG (environment, social and governance) investments.

Today’s generation of investors is motivated not only by the opportunity to make an impact, but by a growing amount of data showing that companies that focus on sustainability also tend to perform well financially. For instance, a 2021 BlackRock report revealed a close linkage between company indicators focused on advancing the SDGs (Sustainable Development Goals) and those that are associated with positive long-term financial performance, finding an overlap of as much as 70% between these indicators. On the opposite side of the ledger, the report found that for many of the issues addressed by the SDGs – in particular gender equality, biodiversity loss, and violence and armed conflict – the cost of not achieving the goals is far greater than the cost of action.

The Trouble with ESG Ratings

However, this new generation of sustainable investors can’t direct their capital toward businesses that are truly making a positive impact on people and our planet without reliable data. That’s where ratings and regulations are falling short.

In December 2021, Bloomberg released a podcast and article, both titled “The ESG Mirage,” which argued that “MSCI, the largest ESG rating company, doesn’t even try to measure the impact of a corporation on the world.” Instead, Bloomberg’s analysts argued, the company’s ESG ratings are more focused on assessing the impact of the world on a corporation’s profits and shareholders, resulting in a system in which superficial efforts toward sustainability (and even rudimentary business practices) can produce a positive rating – even if the company’s negative impacts far outweigh them. As the article put it, “almost 90% of the stocks in the S&P 500 have wound up in ESG funds built with MSCI’s ratings. What does sustainable mean if it applies to almost every company in a representative sample of the U.S. economy?”

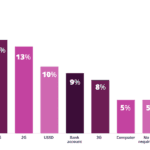

That question is essential to answer, since MSCI dominates the ESG ratings market, with Bloomberg Intelligence estimating that 60% of all the money global retail investors have directed towards sustainability and ESG has gone to funds whose status is based entirely on MSCI’s ratings. But the problem isn’t limited to MSCI: Each ESG ratings provider uses its own proprietary system and data sources to determine its ratings, most of which lack transparency and rely on self-reported data from the companies they rate. So it’s difficult to have much confidence that their ratings reflect real impact.

The ESG Data Gap

Although regulations are emerging that mandate greater transparency, such as the E.U.’s Sustainable Finance Disclosure Regulation (SFDR), and the U.S. SEC’s climate disclosure rules, expecting companies to self-report the impact of their operations just isn’t enough anymore – and the lack of reliable impact data is complicating these regulatory efforts.

As Capital Monitor reported in February, around eight in 10 funds designated by the SFDR as “sustainable” are invested in fossil fuel companies, and “a major issue is that much of the data to support SFDR classifications isn’t available yet.” Meanwhile, according to Kristian Håkansson, head of product and marketing at Swedish fund house SPP, “The articles [of the SFDR] are so wide in their definitions that managers can take any social or environmental characteristics, no matter how minimal, and market their fund as sustainable.”

Similarly, in July 2021, the International Finance Law Review published an article that highlighted the challenges facing asset managers when it comes to the SFDR and its accompanying regulatory technical standards (RTS). A significant takeaway is that “…the SFDR RTS require that the principal adverse impact datasets must be sourced at the investee company level and therein lies the next challenge for asset managers. Most companies are not prepared for this and will not be in a position to provide asset managers with the data needed … Compounding this is also a lack of comparable, reliable and publicly available data.”

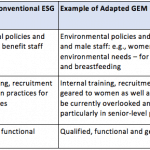

The problem with impact reporting is that data usually comes from companies’ ESG analysts, and is prepared by teams of individuals who were not actually engaged in creating the outcomes they are documenting. For investors to gain an accurate picture of whether a company is achieving positive outcomes for people and the planet, those who are involved with delivering on its impact strategy – including on-the-ground employees, customers, suppliers and community members – need to provide data on the actions the company is taking.

To ensure that ESG and impact data reflects real-world progress, an integrated mechanism is necessary that simultaneously tracks commitments, capital allocation and data origin, while incentivizing stakeholders to participate. For ESG to evolve in this direction, incentive structures must be designed to lead people to make unbiased, accurate assessments about the positive outcomes they’re involved in creating.

Data, Digital Assets and Decentralized Impact

Emerging applications of blockchain (distributed ledger) technology in the ESG and impact finance space can play a key role in this evolution in data reporting, transforming the way the sector makes decisions and mobilizes investment. Blockchain technology is well-suited to tracking the origin, transparency, authenticity and credibility of ESG data. At its core, a distributed ledger is a system for recording the transaction of assets on nodes – i.e., multiple servers in a network that follow certain rules. Those servers are connected to each other, and continuously exchange the newest information across the chain. In contrast to traditional databases, blockchains do not require a single data storage or administration functionality: In the absence of a central authority, every node on the network is involved in agreeing that transactions are valid, in a process known as “achieving consensus.”

Tokens are one application of blockchain technology that can be leveraged for transparent impact reporting. Tokens are digital assets built on top of a specific, pre-existing blockchain, which can be designed to perform a wide range of functions, and traded between holders or on exchanges. Token utility features – essentially software that can be used to exchange value – can be designed to incentivize the collection of data related to ESG and impact projects. Plastic Bank, a for-profit social enterprise that incentivizes plastic collection to address ocean pollution in developing countries, provides a good example of how tokenization can work in the context of impact data reporting. The company created a tokenized system to establish secure digital identities, savings and wallet accounts for the local community members it engages in plastic collection efforts, while providing access to internet connections and allowing collectors to earn their way to mobile phones. This enables people to manage the two forms of tokens they are awarded for their plastic collection work: one tied to the U.S. dollar that can be exchanged for fiat currency, and one that can be exchanged, through the company’s mobile application, for goods and services such as food, water and tuition. This type of approach ensures that people can establish transparent and private digital identities, while also demonstrating and benefiting from the positive impact they are creating on the ground.

A similar approach can be applied to ESG reporting. Individuals who contribute to (or are otherwise knowledgeable about) projects led by organizations, enterprises, investment firms or even independent groups of people can associate their data, performance and community reputations with “trust tokens” that can be leveraged to generate reliable impact data across the ESG landscape. In parallel, blockchain-based reputation mechanisms can also be implemented to prevent individuals from intentionally causing harm to a company or project by providing inaccurate impact data. For example, the Commons Stack, a Swiss nonprofit, is employing these technologies to support the development of Commons – i.e., groups of people who come together to accomplish public benefits, and who collectively own and manage the technological resources that are employed to achieve those goals. To that end, it has created the CSTK trust token, a non-transferable digital asset that is awarded to members in exchange for contributions of funds or labor to the organization’s mission of creating sustainable funding for public goods. Their community utilizes a graduated sanctions mechanism to manage any member behavior that’s contrary to their values, which provides a pathway to reducing someone’s CSTK score (i.e., the reputation they’ve earned over time), or revoking their CSTK if absolutely necessary. CSTK is a badge of honor that establishes which individuals the community can trust, and automates their access to future Commons and Field Tests.

How Blockchain Innovation is Democratizing ESG and Impact Data

The emergence of decentralized autonomous organizations (DAOs) focused on merging technology with ESG and impact investing offers one way to maximize the potential of these new technologies. A DAO is essentially a group of people who agree to follow certain rules for a common purpose, which are encoded as smart contracts – i.e., programs on a blockchain that run when specific conditions are met, or when decisions are made through voting processes that expand on the previously established rules. Individual holders of a specific blockchain project’s token can vote to encode new processes as smart contracts, while managing technical development decisions, as well as participating in decisions involving the group’s collective assets. These assets can include deployable grant funding made available as cryptocurrencies managed by the DAO’s treasury, including stablecoins (a class of cryptocurrencies that attempt to offer price stability and are backed by a reserve asset). Impact-driven DAOs can design their own incentive structures to ensure the transparency, authenticity and credibility of data that treasury asset deployment decisions are based on.

If we utilize blockchain technology to track who is involved in realizing positive impact, while recording data on when, with whom and what they are contributing to this impact, we can facilitate an entirely different approach to ESG data management. But how can we accomplish this while simultaneously leaving the choice of how much personal data to contribute to a project up to the individual? What happens if a company’s ESG data, or impact claims, contradict what is observed by employees, customers, suppliers and other stakeholders? And how can those affected by the decisions and practices of a company, organization or group of individuals share their observations and feedback without concern for the personal and professional repercussions of such disclosures?

One blockchain initiative attempting to answer these questions is RAZ, launched by Roshem Impact, Serbia’s first Certified B Corporation (which I lead as a co-founder). RAZ is developing blockchain-driven software and tools that facilitate contributions of data and feedback on impact-focused projects from their employees, advisors, customers and other stakeholders, alongside external advisors, verifiers and support providers. The data origin trail, and an unalterable timeline of work being conducted, is tracked by recording document hashes (calculated by a cryptographic algorithm that establishes the uniqueness of a file) on Tezos – an energy-efficient blockchain we’ve chosen to create smart contracts and build decentralized applications that cannot be censored or shut down by third parties.

As part of our long-term development plans, the RAZ Protocol will create a buffer between a person’s identifying information and the company, project or organization they are providing feedback on, so as to protect potential whistleblowers. Individuals can engage anonymously – without disclosing their identifying information – while projects and their investors receive assurances of a data contributor’s reputation, credibility and access rights. The RAZ approach is intended to ease concerns about digital “social credit scores” being irrevocably tied to a person’s online identity. The existence of certain credentials can be confirmed, and the individual remains in control of when to share identifying information, while also being able to erase, transfer and revoke data permissions in alignment with the European Union’s General Data Protection Regulation. We’re implementing these privacy-preserving functionalities through cryptographic validation that allows one party to prove it possesses certain information without revealing that information. The RAZ DAO is developing mechanisms that will incentivize contributions to the Protocol’s governance and funding models, as well as impact data and capacity building support from project employees and other key stakeholders across the network. These processes will utilize tokens and smart contracts to make the realization of integrated impact and financial outcomes more efficient.

ESG and Impact Data that Benefits All Stakeholders

Due to the speed and scope of developments across blockchain innovation, it is clear that ratings providers and consultancies will not have a monopoly over ESG data for much longer. As more and more open-source applications and tools are being developed on blockchain networks, this technology is poised to facilitate trust and accountability across the ESG reporting landscape.

If individuals working to realize specific positive outcomes for our planet and its people form their own DAOs, we could see a future of collaborative impact measurement and management emerge. Leaders and employees of impact-driven companies and organizations could engage with suppliers, community members, and independent data verifiers and auditors to track impact in real-time, while it’s happening, by engineering blockchain tokens to support innovative processes. For example, reputation tokens across this ecosystem could facilitate data providers’ access to various groups, projects, companies and organizations based on their history of data contributions tracked on blockchain ledgers. Custom rules could be set across DAOs that require the verification of specific digital assets, such as trust and reputation tokens, that reward people for their expertise, not just for the monetary value of their assets. Rather than ESG, sustainable development and reporting standards being managed by a select few institutions, outcome reporting could be driven by groups of value-aligned people who utilize DAO structures to make impact data management more efficient, reliable and reflective of real on-the-ground conditions.

If we want to gain an accurate picture of whether an investment, company or project is making a positive impact, we need to create new systems that empower the individuals contributing to, and benefitting from, that impact to confirm it actually happened. The blockchain applications discussed above can provide a foundation for these new systems, enabling and incentivizing people to provide trustworthy, transparent, anonymous impact data – without the conflicts of interest inherent to data from ratings agencies or self-reported data from companies themselves.

This is a call to action for investors, donors, leaders and entrepreneurs seeking reliable impact reporting to support the design of decentralized, blockchain-based impact data systems. Together, we can leverage the power of decentralization to ensure that the global community’s collective knowledge and experiences lead to lasting, positive economic, environmental and social impact.

Miriam Davidovic is the Co-Founder of RAZ Finance.

Photo credit: geralt / Pixabay.

- Categories

- Investing, Technology