India Needs Over $900 Billion in Climate Finance by 2030: This Roadmap Can Mobilize Private Sector Investment

India is committed to tackling greenhouse gas (GHG) emissions under the Paris Agreement. But even if the country meets the commitments it made in 2015, the targets themselves are not ambitious enough.

India aims to reduce GHG emission intensity in relation to its gross domestic product (GDP) — but given its GDP growth, gross GHG emissions will go up even if this target is met. The country is also only focused on renewable electricity generation as key to its climate action, with little attention being paid to the electricity grid and storage, energy efficiency, and non-energy GHG emissions from agriculture and manufacturing processes. Another area missing from its climate action plan is adaptation — i.e., the investments in food security, safe water, healthcare and insurance, and infrastructure that are necessary for India’s people to thrive in a more hostile climate.

To be effective, India needs climate action that lowers GHG emissions beyond what has been committed and that does more to adapt to new weather phenomena. This will only be possible if a whole host of innovations are developed, become commercially viable, and are ultimately scaled for mainstream adoption.

This calls for an enabling environment for climate innovation and finance in India, something that cannot be done by the government alone. The country needs private investment to also play a leading role.

That is where the Climate Finance Initiative (CFI) comes in. CFI is looking to collaboratively build the private climate innovation and finance ecosystem needed in India. We focus on the climate investment goals India should have, identify areas where private investment and financing can make a significant impact, and aim to promote commercially viable innovations as they launch, grow and scale.

What India’s Climate Investment Goals Should Look Like

We believe that India’s climate action approach should be driven by three priorities:

Priority 1: Aim for 100% Renewable Energy, Efficiently Consumed

According to our estimates, India’s renewable energy target (under the Paris Agreement) of 450 GW by 2030 would cost up to INR 11 trillion (US $151 billion) to achieve. Attaining this goal would also require the storage and related infrastructure to manage and balance grids efficiently, along with the adoption of energy efficiency measures — this would increase the investment to around US $300 billion, at a minimum.

But the Paris goals would not mark the end of India’s shift to renewable energy: A post-2030 vision is likely to see countries like India advancing toward a 100% renewable energy grid over time. Achieving this goal will require India to build a platform for renewable energy generation and the necessary supporting infrastructure over the next 10 years.

The country will also need to focus on energy efficiency — an often-neglected element of this process. If it prioritizes efficiency, the energy requirements for India’s buildings, factories, equipment and other areas will be reduced without affecting growth outputs. If India can achieve 100% renewable energy by 2050, while also maximizing energy efficiency measures in power consumption, the country’s renewable energy system will face 59% less demand as compared to the business-as-usual scenario in 2050. That means creating a robust and clean energy system can be achieved with less investment.

Priority 2: Invest in Sustainable Agriculture and Food Security

Agriculture and food production have two critical implications from a climate action perspective: reducing GHG emissions associated with livestock rearing, rice cultivation and food processing; and creating a sustainable food supply and the accompanying infrastructure (including things like cold chains, logistics, etc.). We estimate that implementing these climate adaptation and mitigation measures in agriculture would require US $340 billion in investment by 2030.

Priority 3: Build Resilient Cities

Urbanization is on the rise in India, straining cities that already have poor infrastructure and increasing their need for greater resilience. By 2030, India will require at least US $270 billion of investment in climate adaptation in cities. Climate adaptation measures typically fall into the government’s purview, but there are three areas where private sector involvement and private financing could make a difference in densely populated urban areas: developing stronger supply chains and infrastructure for safe drinking water, essential sanitation and healthcare, and food.

Driving Private Finance Towards Climate Action

Addressing these priorities will require private investment of around US $100 billion a year, every year until 2030. And tackling these differentiated areas of climate action will require new financing structures.

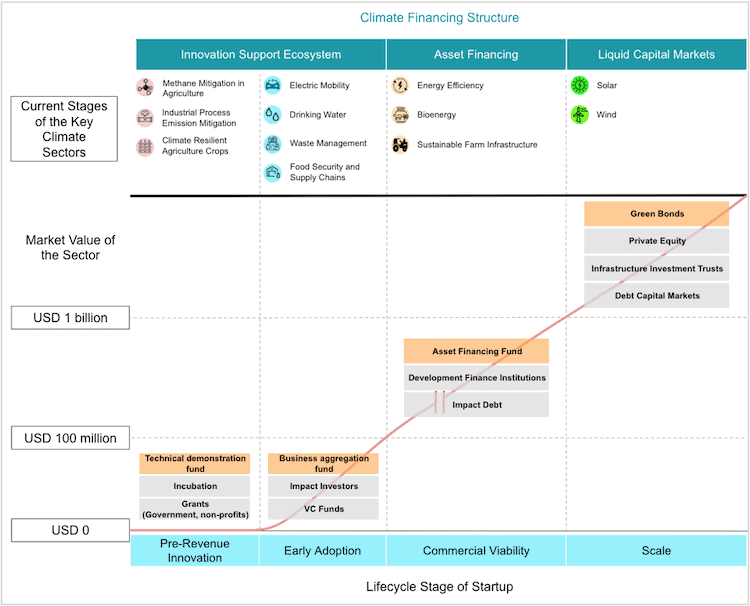

India’s current private climate finance structures are inadequate and too narrow in scope. They are either focused exclusively on industrial-scale projects in wind and solar at one end or on one-time grant and incubation support for small and early-stage ventures and innovations at the other. There is almost nothing for the Missing Middle, the wide area where financing and investments are needed to create and de-risk fully scalable, commercially viable businesses.

The country needs financing structures that offer timely and relevant finance, delivered when the company is at a stage when investment will make a significant difference for its growth and success. Private investors can influence climate action for the better by transforming the way finance finds its way to climate innovation and growth, an untapped opportunity area today.

We believe providing this finance is a three-stage process:

In the first stage, since innovation support is essential for new technologies to progress into actual businesses, a two-pronged innovation support ecosystem needs to be built. This ecosystem would provide risk capital and much-needed support to innovators and entrepreneurs via:

- A technical demonstration fund that evaluates the innovations and helps them develop into an actual working product. If innovations have to fail, let them fail fast and fail often so the focus can shift to other, better-working solutions.

- A business aggregator fund that assembles a team of finance, marketing, compliance and legal experts, which invests in multiple products that are technologically proven and converts them into fully functioning business ideas.

As innovations start to grow, they often need asset funding to enable end users to purchase them. But large-scale asset financing lenders are currently unwilling to fund new, untested climate assets and technologies without a track record.

That’s why we propose, as the second stage of the process, setting up climate asset financing entities. Each of these entities would work toward a defined area of climate action — energy efficiency, waste management, etc. — providing structures that would bridge the gap between the innovation support ecosystem and the existing large-scale asset financing lenders.

By combining the practices of an asset financing company with the lessons learned from fintech lenders on reducing transaction costs, and deploying capital toward a defined climate area, these asset financing vehicles could have a significant impact and create a new asset class for climate investors.

Once green technologies start to grow to several hundred million dollars in size, as is the case with solar and wind today, liquid capital markets — the third stage of the process — will play a crucial role in moving these businesses toward massive scale.

Figure 2 above shows the various climate financing interventions in India that are currently in place (the grey boxes), and ones that are missing in supporting climate finance (the orange boxes), with the current position of key climate action spaces relative to their financing needs today.

The three new models of financing structures described above, if executed well, are equipped to build climate action investment to the required US $100 billion a year. These are not the only viable paths to that level of investment, but we believe they are the most scalable ones available today to achieve that goal.

Getting to US $100 Billion A Year Needs Systemic Financing Disruption

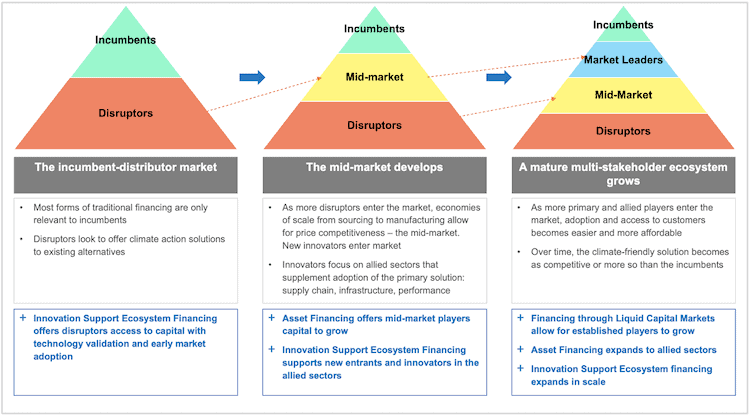

Disruptors face significant challenges when competing in markets dominated by incumbent, emission-creating technologies. Climate financing has to make this challenge easier to overcome, while building the foundation for climate-positive actions to grow. The figure below highlights how this process might play out.

We’ve published an initial position paper and are planning an upcoming series on “Strengthening India’s Climate Financing Structures,” which focuses on researching and proposing blueprints of the climate financing structures the country needs. These aim to provide a starting point for India’s climate finance conversations and a roadmap for the elements that need to come together for positive, impactful climate action. You can read more about the Climate Finance Initiative and download the full report at https://climatefinance.in/.

We aim to make a difference in the speed of adoption for sustainable technologies by focusing on improving access to finance for climate action. We invite stakeholders in the climate finance world to join CFI and to work with us in supporting the shifts we’ve proposed. You can contact us here for more information, or email us at simmi@greenfunder.in and shravan@thebw.in.

Shravan Shankar is the founder of the BIG Green Collaborative and Simmi Sareen is the founder of GreenFunder. The Climate Finance Initiative is a collaboration between the two organizations.

Photo courtesy of Micheile Henderson.

- Categories

- Energy, Environment, Investing