There is Such a Thing as Too Much, Too Fast: Avoiding ‘Mismatched Expectations’ in Off-Grid Energy Investing

The off-grid energy sector has begun to turn an important corner, moving from what was generally considered impact investing to something much more attractive to commercial financiers. In the past year alone, distributed energy services companies (DESCOs) providing energy services to households and small businesses across sub-Saharan Africa using solar home system (SHS) technologies and a pay-as-you-go business model have raised financing in excess of US $250 million (based on data we collected from clients and industry insights). These companies are demonstrating impressive rates of market penetration, going from selling a few hundred systems each month just a couple of years ago, to reaching thousands of customers a month today.

The purpose of this article is to share insights on three key trends that we have observed in the still nascent DESCO sector related to consumer financing, operational efficiency and growth rates, and to offer thoughts on potential opportunities for fresh thinking on the evolution of the business model.

Firstly, given the nature of the customer base and heavy focus on consumer financing, there are indications that companies in the energy services market are increasingly evolving toward operating as non-banking financial institutions. In addition, for those customers with a good, proven credit history, some DESCOs have recently begun extended their offering to include appliances, insurance and educational loans, using the original SHS as collateral (once fully paid or paid for the most part). In this context, in order to ensure that they have access to the necessary skill set for this type of business – and as a means to increase reach and improve efficiency – DESCOs might consider partnering with financial institutions or, alternatively, evolving from a company focused on product design, delivery and service into a type of financial institution. A similar evolution occurred in the rent-to-own appliance sector in Latin America, as many of the companies created their own banking arm or partnered on financing with commercial banks as their businesses grew.

Secondly, while it may seem to be obvious that operating costs have a significant bearing on financial performance, there appears to be room to rationalize these across the sector. The reality is that off-grid customers are often hard to serve and that most DESCOs are pioneers, originally entering markets that were so early-stage that the company had to play across the value chain in order to make their business work. Moreover, many of the most visible companies are not indigenous to the countries in which they operate. The result is a typically higher cost of goods sold than other start-ups. As such, and as the market matures over time, there appears to be room to rationalize costs and improve operational efficiency through increased focus or specialization, localization and the development of joint ventures.

Finally, as companies push to become market leaders in off-grid energy access, they will need to continue to grow at an accelerated rate to serve part of the 1.2 billion people who lack electricity globally. However, there may be a tension between achieving strong social returns and ensuring a robust return on investment. To sustain such rapid expansion, DESCOs cannot rely on equity. Rather, they will need access to significant amount of commercial, local currency debt financing and, in some cases, concessional financing, in order to serve the latent customer base, particularly in countries where the broader energy access market is less mature and thus requires greater investment.

Consumer financing – There is such a thing as too much

The core business of SHS DESCOs is to provide electrification options to customers in un- or under-electrified rural and peri-urban areas, using a range of technology solutions, from modular solar kits to rooftop solar systems bundled with appliances. Most of these DESCOs transfer the asset to the customer once it has been paid off – as a rent-to-own company would do – generally after two-five years, though a minority offer energy-as-a-service over an indefinite period, much like a traditional electricity utility.

Many of the customers of the SHS DESCOs are not able to pay upfront for the product. That’s why these companies provide customers with financing in order to access their products. Regardless of the specific revenue model, most SHS DESCOs typically require an upfront registration or connection fee, and then collect payments on a regular basis until the balance of the system costs, plus a margin on the product, are recovered from the customer. As in many other industries, where there is a significant time lag between paying the manufacturer and collecting receivables from end users, most DESCOs rely on a combination of short-term debt or working capital facilities to finance product acquisition by their customers. Hence, they essentially act as a financial intermediary.

Notwithstanding potential issues related to non-payment of the amount owed by customers (collection or default risk), the business of directly financing customers is challenging because, unlike banks and other financial intermediaries, solar home system DESCOs do not collect cash deposits to provide loans to their customers. Instead they are dependent on financing from investors, lenders and the cash reserves generated from margins on the sale of their products.

To alleviate the challenges of directly financing customers, some DESCOs have started utilizing asset-based financing and off balance sheet special purpose vehicles, where receivables are categorized based on their collection risks and then sold to investors. This model moves part of the customer credit risks from equity holders to commercial investors, who have the financial resources, reputation and experience in structured debt to provide the proper due diligence and create a secondary market.

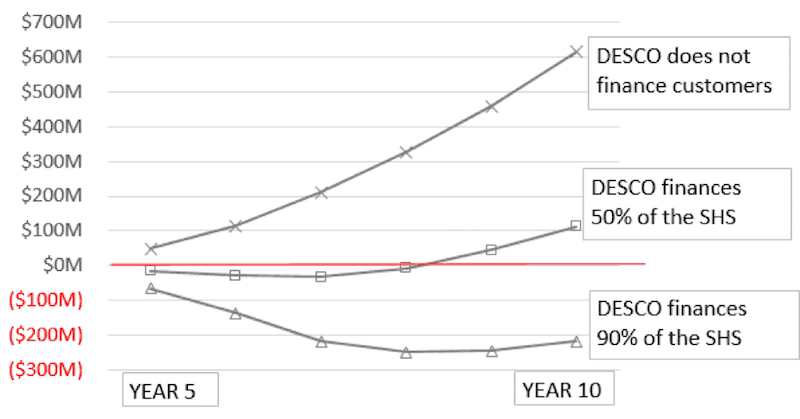

Attracting the interest of the debt market is of crucial importance to those DESCOs that serve the base of the pyramid, trying to provide electrification to customers that cannot afford to pay off the solar home system in less than two-three years. For example, Figure 1 shows an equity-only DESCO that plans to reach 2 million customers in the first 10 years of operations. It is worth noting that, for the purposes of modeling, a business financed 100 percent with equity is used, as it allows for a simpler financial model that clearly shows the effect that increased consumer finance and operational costs have on cash flow. Such a model also illustrates the possible magnitude of debt and other credit facilities that DESCOs would need to grow.

From the model, we see that the lower the level of financing provided to the consumer, the better the cash flows. As an extreme, if no financing is provided – as would be the case with a retail sales model – cash flows are positive from the very beginning of operations. On the other end of the spectrum, in the case of a DESCO financing 90 percent of the SHS purchase price, a robust working capital facility is necessary to fill the gap generated by negative cash flows even after 10 years of operations. While DESCOs vary greatly in terms of the extent to which they provide consumer financing, what is clear is that they cannot grow indefinitely by relying entirely, or even largely, on equity. Indeed, access to debt, including concessional and structured finance, is pivotal for the business model to scale up.

Figure 1: Cash flows for DESCOs providing a three-year consumer financing (with 2 million customers in the first 10 years of operations. Model with cost of goods sold at 33 percent of revenue and operating expenses at 15 percent of revenue)

Growth rates – The issue with moving too fast

With more than a billion people without access to electricity globally, it is indeed ironic that expanding as fast as possible to achieve universal electrification could pose a problem for off-grid energy companies. Yet this may be the case for business models in rural electrification that lack financial stability and the needed discipline to ensure high levels of operational efficiency (see the next section for more details).

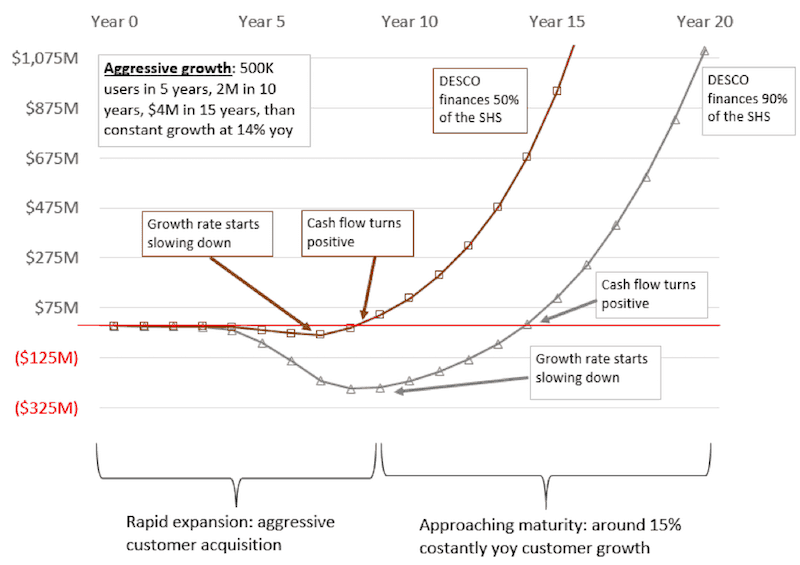

After a certain number of years, successful solar home system DESCOs are able to sustain themselves financially and are thus able to start making amortization payments on any loans taken during their initial expansion phase. However, drawing on data collected from several firms, Figure 2 shows that SHS DESCOs with aggressive growth rates and levels of consumer financing corresponding to 50-90 percent of the SHS purchase price, may need to rely on external sources of funding for 8-15 years, before generating cash. When consumer financing is provided, the more aggressive the company’s growth, the greater the need for external funds for it to remain in business over several years, due to this cash crunch.

The good news is that, at maturity, DESCOs with aggressive early-stage growth are likely to generate more cash than those with lower customer acquisition in the initial phase. But the key is to be able to financially sustain the business for the first eight-15 years before enjoying this much more comfortable cash flow position. It is important that both investors and operators recognize that there may be a tension between achieving social returns (or impact on access rates) and investment returns (or DESCO financial performance). Otherwise, there is a risk of mismatched expectations over time.

Figure 2: Cash flows for DESCOs providing a three-year consumer financing for 90 percent and 50 percent of SHS purchase price (model with cost of goods sold at 33 percent of revenue and operating expenses at 15 percent of revenue)

Operational costs – The value of slimming down

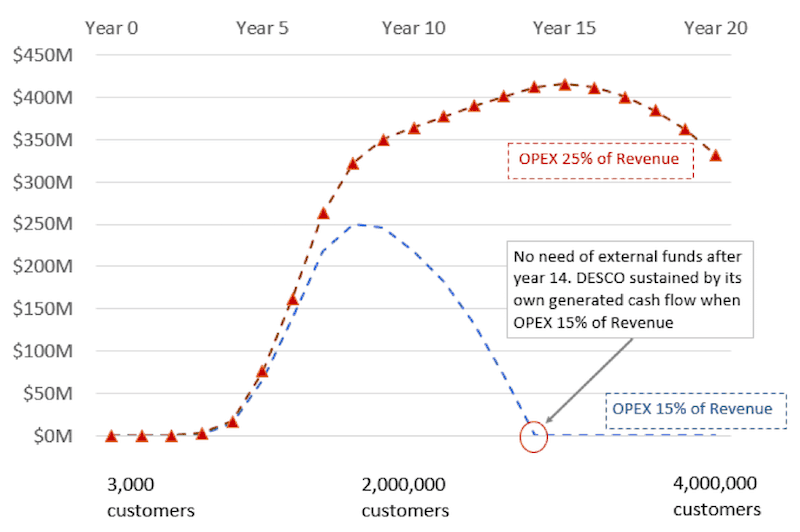

An efficient cost structure in operating the business is a critical factor for reducing the required amount and tenor of external financing for off-grid energy companies. Indeed, in the SHS DESCOs modeled, shrinking the share of operational and administrative expenses over revenue from 25 percent to 15 percent slashes the loans required to a point that, as growth declines, the scenario with 15 percent operating expenses no longer needs a credit facility; the DESCO is sustained by its own generated cash. Conversely, when the DESCO is less operationally efficient – for example, with operational expenses equal to 25 percent of revenue – the need for credit lines remains. Figure 3 illustrates these two scenarios for a DESCO with aggressive growth rates.

To improve their cost structures, some companies have started to specialize in certain portions of the value chain in an effort to achieve economies of scale. Furthermore, whereas only a couple of years ago there was a sense that the market was at such an early stage that DESCOs needed to “do it all,” today vertical integration no longer seems to be the operational approach of choice for many of the emerging market leaders. Indeed, some firms are focusing on product development, and others on distribution and financing. Secondly, many DESCOs are increasingly anchoring their country operations in local expertise, building management teams from the bottom-up and reducing reliance on foreign staff. Finally, as firms expand into new markets, many are increasingly doing so through strategic partnerships and joint ventures to tap the expertise of existing companies. These and other early trends are likely to have a positive impact on operational efficiency over time.

Figure 3: External funding required by DESCOs with different operational costs (model with cost of goods sold at 33 percent of revenue and DESCOs financing users for 90 percent of SHS purchase price over three years)

Conclusion

Based on our observations of the still nascent sector, we believe that developers and investors alike would do well to take a fresh look at the effect of rapid growth rates, high levels of consumer financing and operational efficiency on the liquidity of solar home system DESCOs.

In terms of growth rates, SHS DESCOs pursuing aggressive customer acquisition will generate cash in the long run, but only if growth can be financially sustained to the tipping point where the business has reached a certain scale. The implication is that the DESCO may need to find a way to constantly attract patient commercial capital for the entire aggressive growth phase in order to avoid a significant squeeze on cash. Alternatively, if the DESCO opts for more of a social impact business model – i.e. prioritizing the connection of as many people as quickly as possible – it may need to delink growth from liquidity and eventual profitability, though this approach implies significant operational risks due to tight cash flows.

Secondly, since most solar home system DESCOs set out to deliver high-quality energy services at a rapid pace, they often offer high levels of consumer financing to fuel this customer acquisition phase. But this ultimately turns the business into a financial intermediary. And mastering financial intermediation is fundamentally different from delivering high-quality energy services, as it requires a very different set of competencies. For example, financial intermediation requires a firm to execute strong credit scoring and risk analysis, and the ability to raise significant amounts of capital at least to cover the risk of those customers that default their payment obligations. Meanwhile, many top-tier DESCOs are typically distinguished by their ability to develop or source desirable energy access products and excel at customer service, leveraging a strong maintenance and repair network. At some point, the DESCO could plausibly come to a fork in the road in terms of how to deal with the part of it business that finances customers. It may need to consider whether to partner with experienced financial institutions on the credit side of its value chain, or become a financial institution itself, which is not a trivial process.

From the perspective of investors, no single indicator can predict whether a particular solar home system DESCO will become a commercial success. What much of this points to is the need to have clear metrics to assess companies across the sector, in order to ensure that operational efficiency is kept under control and customer credit is provided based on appropriate due diligence needed to attract the interest of capital markets and other more sophisticated financial structures.

Finally, at this critical point in the sector’s life, we believe that solar home system DESCOs must have access to local currency debt. For that to happen, local financial institutions may need to be supported with concessional finance for credit support and/or risk sharing – at least initially – in order to enter this still relatively fledgling sector. In addition, financing innovation such as securitization products may help to round things out, as is being demonstrated by a handful of companies that have begun innovating in this area.

Pepukaye Bardouille is a Senior Operations Officer with the International Finance Corporation. Daniel Shepherd is the regional lead for IFC’s Energy & Water Advisory unit in the Sub-Saharan Africa region. Gianmaria Vanzulli has been working for the World Bank Group for seven years in business planning, strategy, and energy access in the Middle East and Africa.

Photo credit: Ken Teegardin, via Flickr.

[yop_poll id=”12″]

- Categories

- Energy, Investing, Technology