Surviving the ‘Valley of Death’: A New Funding Database Aims to Help Agtech Companies Avoid Early-Stage Failure

The agriculture sector plays a critical role in the livelihoods of people around the world – yet it’s facing an uncertain future. Food producers, who are mostly located in emerging markets, will experience extraordinary challenges in the coming years, as the global population is predicted to exceed 9 billion by 2050. What’s more, climate change will aggravate the growing competition for water and fertile land for food production.

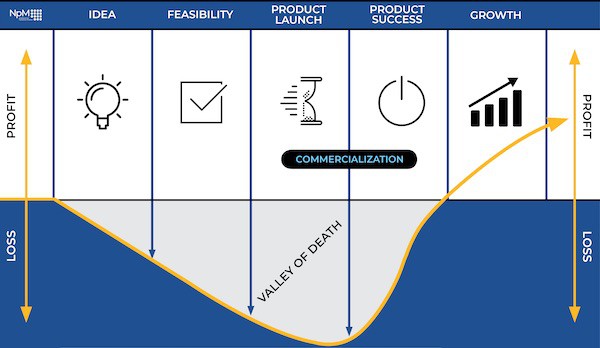

Small- and medium-sized enterprises (SMEs) in the agriculture sector will be an essential part of any solutions to these challenges. Yet in developing countries, funding these SMEs presents challenges of its own, whether they be early-stage companies or businesses that initially benefitted from subsidies. For instance, the most critical phase for early-stage companies is from the period of idea generation to the time when the product becomes a success. During this phase, these companies have limited financial resources they can use to innovate and commercialize their products before achieving steady revenue streams. Since many young businesses fail during this period, this financial gap is often referred to as the ‘‘Valley of Death’’ (see figure below).

The critical stages of early-stage companies

To help bridge this financial gap for early-stage companies, NpM has compiled a database of funds available for agtech companies. It includes funds that can be used by agri-food and agtech companies seeking growth capital – and it’s available free of charge. The uniqueness of the database is that it includes almost all the funds available that target agtech companies in Africa.

The agtech database was launched in May 2019 with the support of the Netherlands Space Office (NSO). It builds on the list of funds used in “Critical Capital for African Agri-Food SMEs,” a study that analysed the supply and demand of risk capital for agri-food businesses in sub-Saharan Africa. NpM expanded the geographical scope of that study by including funds targeting all of Africa, as well as over 20 countries in Asia, in the database.

As Joanna Ruiter, Satellite Applications Advisor at the NSO, explains: “Companies who develop a proof of concept and who can create impact often aren’t financially sustainable yet. To reach that next phase, impact investment is essential – because reaching scale is an inevitable condition for sustainability. The database will be a guide for agtech companies on the search for funding possibilities. This database also shows the large number of funding opportunities available: there is plenty of capital available for innovative solutions. But one thing has to be made clear; an investor is not funding projects, but investing in businesses.”

The database currently consists of more than 190 investors with funds ranging between €1 million and €2 billion. Users can navigate through the database by selecting fund size, geographical scope, investment size, type of investment instruments, whether funds are available for businesses only in the agricultural sector or in multiple sectors, and whether funds consider themselves to be impact investors. In addition, it is possible to see which funds are providing support for business development goals (BDS) (meaning that non-financial services and products are offered to entrepreneurs, aimed at skills transfer or business advice), and which are participating in the NSO’s Geodata for Agriculture and Water (G4AW) programme.

The G4AW programme highlights another way we’re working to support small agriculture businesses, beyond resources like the funding database. The programme was commissioned by the Dutch Ministry of Foreign Affairs, and it consists of 23 pilots focused on improving food security and availability in developing countries by using satellite data. Through these pilots, G4AW provides food producers with relevant information for food production, with the goal of increasing sustainable production and the efficient use of water in the agricultural, pastoral and fishing sectors. The programme also promotes and supports private investments in information services, by providing a platform for partnerships between public and private organizations.

Catalina von Hildebrand, Programme Manager of G4IFF, explains its approach: “The G4IFF workstream aims to make geodata-based applications available to financial institutions. This additional source of information can be used to improve credit scoring models through data on weather and soil moisture. Consequently, financial institutions can efficiently and effectively asses a farmer’s credit risk, and improve smallholder farmers’ access to tailored financial services such as input finance, working capital and investment capital.”

These overlapping approaches share a common goal: to maximize agricultural productivity and innovation in developing countries, in order to improve farmers’ livelihood and prepare them for the dual challenges of climate change and population growth. The NSO and NpM have worked closely together on the G4AW and G4IFF programmes to achieve these objectives. We see the agtech database as a complement to these initiatives – a useful resource for agri-food and agtech companies seeking growth capital. If your agriculture company is operating in Africa or Asia, we hope the database will help you to avoid the ‘‘Valley of Death’’ and to build a sustainable, well-funded business that can meet the challenges of our time.

Aarno Keijzer is Programme Manager at NpM, Netherlands Platform for Inclusive Finance.

Photo courtesy of Neil Palmer (CIAT).

- Categories

- Agriculture, Technology

- Tags

- agtech, business development, data, failure