Good for Investors, Good for Business: Helping Financial Advisors Embrace Sustainable Investing

The chorus of investors demanding sustainable investing has hit a fever pitch. Sustainably invested assets grew an estimated 34% worldwide between 2016 and 2018, to $30 trillion, and 38% in the U.S., to $12 trillion. This growth was driven, in part, by increasing retail investor interest in sustainable investing approaches. And it’s not just interest among millennials—although as much as 90% of millennial investors are interested in sustainable investing—but among Generation Xers and baby boomers too, and among both women and men. Nearly three-fourths of all investors believe that environmental, social and governance (ESG) impact the risk profile of their investments.

This demand has not gone unnoticed by financial advisors. According to one advisor we interviewed, “You’re going to run into [sustainable investment] during your career. If you ignore it, you’re going to lose the edge to another guy.” Others assert that incorporating sustainable investment into advisory offerings can help attract new clients and competitively position advisors relative to their peers. Further, sustainable investing is increasingly seen as a way to help curb client attrition. Research indicates that two-thirds of adult children and 70% of widows leave their family advisor after receiving an inheritance or after a spouse’s death. Offering them sustainable investing options might keep them around.

But meeting increasing client demand for sustainable investing can be challenging, if not downright overwhelming for advisors. Some clients are motivated by their values, others by financial performance. Some want to avoid investments with poor ESG performance, others want to emphasize investments that solve environmental and social challenges, and still others want to engage with companies to improve their ESG policies and practices. This is to say nothing of the wide range of sustainability issues that clients care about.

To help advisors get past their anxieties about sustainable investing and harness its business-building potential, the Money Management Institute (MMI) and our organization, The Investment Integration Project (TIIP), recently published Fundamentals of Sustainable Investment: A guide for financial advisors. This new guide addresses pervasive industry myths about sustainable investing, disentangles the complicated web of vocabulary used to describe the approach, and provides practical recommendations on how to integrate sustainable investing into advisor practices.

The guide is part of a suite of new resources being developed by MMI, with TIIP and in partnership with Morningstar, including workshops, forums and an online education curriculum for advisors. A forthcoming MMI webinar on May 23rd will discuss key findings from the guide and provide an overview of these efforts.

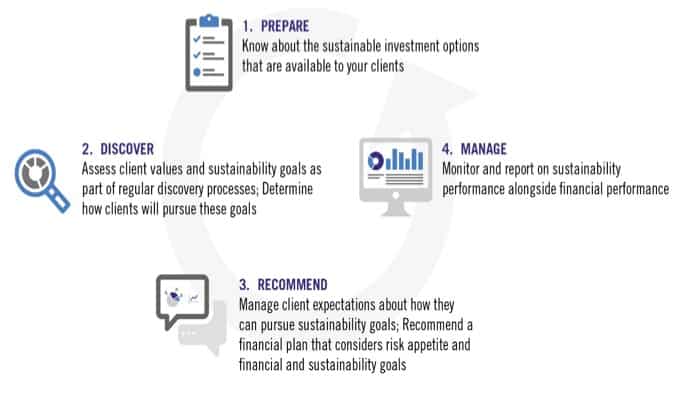

At the core of the guide is TIIP’s recommendation that advisors adopt a four-step process for talking with their clients about sustainable investment (see figure below). We developed this process in direct response to pleas from advisors interviewed for the project, in order to help them answer questions like “When should I raise sustainable investing with clients? What, exactly, should I say? How do I translate the discussion into action?” and so on.

As we describe in the guide, the first step in discussing sustainable investment with clients is not actually discussing it with them at all. Rather, it is preparing for the conversation so that advisors can explain the sustainable investment options available to them, make appropriate recommendations, and answer their questions.

In other words, financial advisors should not start a conversation with a client about sustainable investment if they do not know how they might be able to support them in pursuing their sustainable investment goals. Specifically, advisors should learn about whether their product platform directly offers sustainability-focused strategies or can facilitate access to them, and whether they can provide customized sustainable investment options to certain clients. It is important to know how home offices and other affiliated platforms select products and construct portfolios, and to be able to describe one or two products to clients by way of example.

Steps for discussing sustainable investment with clients

William Burckart and Jessica Ziegler (2019). Fundamentals of Sustainable Investment: A guide for financial advisors. The Investment Integration Project and Money Management Institute.

Life events, liquidity events or other related points of change (e.g. marriage, death, divorce, strategic planning periods) are among the best opportunities to discuss sustainable investment with clients. They represent times when clients typically reevaluate their financial goals and make any number of adjustments to their financial plans and investment approaches, and therefore provide a natural segue into discussions about goals and strategies. Our guide provides an example checklist that advisors might adapt and use to help guide these conversations.

The process for developing and recommending a sustainable investment plan is the same as the process for vetting conventional plans and approaches: First understand what the client is looking for and then solve for it. That is, when recommending a sustainable investment strategy, advisors should consider the client’s performance expectations, risk appetite and other important contextual factors as they normally would (e.g. insurance issues, tax considerations, capital gains and losses, estate plans), alongside their consideration of the client’s sustainability goals.

Individual investors can contribute to positive change, but none are influential enough to singlehandedly save the world. Financial advisors should be realistic and direct with clients about their ability to create big change with their sustainable investments. They should also be transparent about the availability of products that align with their sustainability goals, and the speed with which they can adjust their plan and portfolio to reflect these goals. Especially eager clients might want to quickly and dramatically transition their entire portfolio to sustainable investment strategies, but the tax and other implications might mean that a slower transition is more prudent.

Finally, financial advisors need to have a sophisticated enough understanding of sustainability data, analysis and reports to communicate relevant information to their clients. While asset managers are largely responsible for collecting and analyzing sustainability data from corporations, financial advisors need to be able to interpret sustainable investment reports for their clients, so that they can assess and manage a strategy’s alignment with (and progress toward) achieving sustainability goals. In our guide, we provide three examples of hypothetical sustainability reports with accompanying instructive commentary for advisors.

There is no denying that sustainable investing will have a profound impact on the future course of the financial services industry. Fundamentals of Sustainable Investment offers advisors a toolkit of sorts that they can use to equip themselves with the knowledge and know-how to confidently navigate this new terrain, whether they are looking to expand their business or to strengthen their relationships with existing clients.

William Burckart is President and COO of The Investment Integration Project (TIIP).

Jessica Ziegler is Director of Research at TIIP.

Photo courtesy of Helloquence.

- Categories

- Investing

- Tags

- ESG, impact investing