Inclusive Innovation: How Two Mobile Technology Startups are Changing the Game in Microfinance

Securing a bank loan can hardly be called an easy or pleasant task for anyone. But for many in the developing world, it’s even more difficult. An estimated 2.5 billion people worldwide lack access to formal financial services, increasing their vulnerability and making it difficult to break the cycle of poverty.

The traditional microfinance model attempts to address this challenge by offering people in underserved regions small microloans to start income-generating businesses. But while this approach has had considerable positive impact for some clients, its limitations can be significant. Loan terms are often prohibitively expensive and inflexible, especially for borrowers with no credit history. And if you live in poor, rural neighborhoods, these loans may not be available at all.

Fortunately, a number of innovative new startups are overcoming these limitations through advances in mobile technology. In my role as director of the Vodafone Americas Foundation, I’ve seen the impact these startups are making firsthand through our Wireless Innovation Project® (WIP) competition. WIP is an annual competition that awards grants to startups, researchers and entrepreneurs developing wireless-related innovations for social good. Over the past 10 years, participants in the competition have presented solutions for all kinds of issues, including financial services. These innovative startups are using mobile technology to truly make an impact on financial systems in the developing world, at both the individual and group level.

Building Credit With Mobile Data

Often when we think of innovation, we think of huge scientific leaps. However, through the WIP competition, we learn that innovation can also mean taking something existing – like credit scoring – and making it even better. Tala (formerly InVenture) won a WIP grant in 2012 for its platform InSight, a text message-based, learn-while-you-go money management tool that allows micro-businesses and households to report financial metrics and track their spending and income. Tala uses this data to create a new kind of credit score for its customers, helping them bridge the gap into formal banking.

While the system was initially used to offer small loans to businesses in developing countries that did not have formal credit history, it has evolved into a formal credit assessment platform that analyzes mobile data across 10,000 indicators to assess the fiscal responsibility of all sorts of low-income borrowers. Today, Tala’s credit scoring platform is available as an Android application that seamlessly assesses would-be borrowers’ financial potential and provides instant loans. In lieu of traditional credit reports, Tala’s machine-learning algorithms examine network diversity, social connectedness, geographic patterns, financial transactions and thousands of other mobile indicators. Anyone with a smartphone in Tala’s markets can download the app, apply for a loan, and receive an instant decision regardless of their financial history, allowing many without formal financial history to build credit.

Tala has now raised $30 million in Series B funding, and the platform has expanded to East Africa, the Philippines, Latin America and South Asia to offer instant credit decision-making and personalized loans. The entire process, from app download to loan disbursal, takes about five minutes.

Extending the Reach of Mobile Microfinance through Groups

While companies like Tala use mobile technology to help individual borrowers, innovative new solutions like DreamSave – a winner in our 2017 Vodafone WIP competition – apply a similar model at the group level. California-based technology startup DreamStart Labs is currently piloting DreamSave with women’s groups in Tanzania in close partnership with Project Concern International, a leading global development organization with operations in multiple countries worldwide.

DreamSave is designed for village savings and loan groups, which serve as informal community banks throughout the developing world. Each week, members of these groups make small contributions to a central investment fund, which is then used for business loans to members. Unlike outside bank loans, all interest payments go back to the group, so when one member’s business grows everyone benefits.

While savings groups are helping millions of people break the cycle of poverty, managing them isn’t always easy. Each month hundreds of transactions are calculated by hand. Cash deposits are stored in simple lockboxes, putting women in the groups at a high risk of theft and violence. And members who work hard to make smart investments are still completely invisible to formal banks.

DreamSave makes it easy to manage savings groups without all the complexity and risk. Members decide how they want to run their group, and DreamSave does the rest – managing records, calculating interest, and making it fun and easy to track personal goals. The platform uses machine learning and behavioral science technology to automate record keeping, enforce lending policies, and accelerate financial growth. As transactions are recorded, DreamSave automatically builds credit history at the group and individual level.

Startups like Tala and DreamStart Labs are working hard to provide reliable, safe financial services in places where they were previously unavailable. Through mobile innovations, they are empowering individuals and groups to build a better future for themselves and their communities, and in turn, a better economy for future generations.

Note: This post is one of NextBillion’s 12 most influential posts of 2018.

June Sugiyama is the director of Vodafone Americas Foundation.

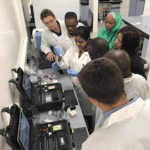

Photos courtesy of Tala.

- Categories

- Finance, Technology