A Boon for Online Commerce: How COVID-19 is Transforming the Industry in Bangladesh

COVID-19 has been merciless to the world and its economy in general, with extended lockdowns and social distancing measures harming businesses from both from the supply- and demand-side perspective. But it has helped a few sectors – like digital/contactless payments, e-commerce and Facebook commerce (or f-commerce) – to grow.

Though panic, uncertainty and increasing unemployment slowed down demand in these sectors initially, they quickly recovered due to their innovation, agility and the ongoing paradigm shift in consumer behavior from physical to digital means of buying, selling and paying. To take just one example, Amazon doubled its net profit in the second quarter of 2020 (compared to the second quarter of 2019), as customers shifted to online shopping due to the lockdown. As a result of these changes, the e-commerce and fintech industries (in general) have seen a V-shaped recovery – especially in emerging economies such as Bangladesh.

The Pandemic’s Impact on E-Commerce and F-Commerce in Bangladesh

According to news reports, Bangladesh currently has 2,500 e-commerce sites selling products worth over $2 billion, making it the 46th largest country globally in terms of e-commerce revenue. Additionally, according to the monthly business review (2019) of the Industrial Development Leasing Company of Bangladesh Limited, more than 300,000 Bangladeshi stores are operating through Facebook. Of these stores, women own 50%. Facebook has transformed Bangladesh’s online business landscape. The social media platform boasts 30 million users and 50,000 business pages in the country.

During the initial stages of the pandemic, e-commerce almost halted in the country, and the industry lost $78.64 million directly in revenues. But thanks to burgeoning digital financial services and mobile financial services, e-commerce and f-commerce started innovating, and soon these businesses began recovering rapidly, with some even scaling to new heights.

According to the e-Commerce Association of Bangladesh (e-CAB), which serves as a common platform for the industry, the country’s e-commerce sector has been revolutionized during the COVID-19 pandemic. Online sales increased by 70–80% in the last quarter (July-September 2020), and online shopping has generated $708.46 million in revenues during these pandemic times. Not surprisingly, sales of essentials and grocery products were the main contributors to this trend. To cite one example, Chaldal.com, an established player in this market, saw daily orders spike to 16,000 during the pandemic, compared to 2,500 before March 2020. Their average check-out size also increased by roughly three-fold, from $15 to $45, while their virtual medicine platform’s daily order numbers rose by almost seven-fold.

Bangladesh E-Commerce and F-Commerce Trends During COVID-19

Based on secondary data and discussions with a few players, MSC has observed some interesting market trends in Bangladesh’s growing e-commerce and f-commerce sectors.

- E-commerce shoppers are mainly urban. About 80% of e-commerce buyers live in metropolitan centers like Dhaka, Gazipur and Chattogram. The other two major cities for e-commerce are Narayanganj and Sylhet. Among e-commerce users, 85% are between the ages of 18-34. Clearly the e-commerce industry attracts young consumers living in urban areas, while leaving a large market outside of major cities untapped. Logistics chains and the cost of serving far-flung areas in a nascent industry are some of the reasons.

- Recognizing the needs of customers and the market potential, some players have changed their business models. These changes have included adding essential services such as medicines and groceries to their product offering, providing door delivery services, and integrating with other suppliers. For instance, online players such as AjkerDeal.com and PriyoShop.com, which had never sold any groceries or essentials, have joined this new segment of essential goods. And Advanced Chemical Industries Limited’s Shwapno, a market leader, has collaborated with the food delivery platform FoodPanda to launch a delivery service online and through phone calls, in addition to its mobile app. This collaboration is part of FoodPanda’s on-demand groceries and medicine delivery service PandaMart.

- Lockdowns and panic buying have led to a surge in online sales of medicines, safety products and sanitizing kits. Pharmacy.com, one of the few e-commerce businesses to offer pharmacy products via a digital storefront, has seen a substantial rise in sales. Many other pharmacies are expanding into online-based sales during this pandemic period.

- Most of the f-commerce businesses in Bangladesh sell non-essential items such as clothing, lifestyle products, baked goods, arts and crafts, and jewelry. As consumers became more conscious of their expenses and prioritized spending on essential items in the early days of the pandemic, non-essential businesses took a massive hit in terms of sales. But after the first few weeks of lockdown (from March to April of this year), these f-commerce platforms started regaining traction, and their recovery during the country’s Eid festivities helped to minimize their losses.

Case in point: ShopUp

ShopUp, a startup in Bangladesh, illustrates how the country’s businesses have leveraged e-commerce and f-commerce to adapt to the challenges and opportunities of the pandemic. ShopUp is an online platform that hosts over 500,000 micro, small and medium enterprises (MSMEs). These MSMEs get easy access to business-to-business procurement of goods, last-mile logistics for delivery, digital credit and business management solutions through the ShopUp f-commerce platform, where consumers can also buy their products.

After a month’s stoppage of operations due to the pandemic-induced lockdown, ShopUp pivoted its model and improved revenues by selling essential items such as medicine, food and groceries (where previously it had mostly hosted MSMEs selling clothes, electronics, etc.) Thanks to this adaptability, the number of neighborhood shops transacting weekly on the ShopUp platform grew by 8.5 times between April and August 2020. Additionally, to cope with the pandemic’s impact, many smaller retail shops in Bangladesh have moved to online channels such as Facebook to reach new customers. These online channels have created a massive long-tail demand for last-mile logistics. ShopUp’s last-mile logistics team, RedX, is partnering with these shops and is now the largest last-mile delivery service provider in Bangladesh, processing 13 times more parcels daily than it did in April.

Omidyar Network‘s 2018 infusion of seed funds provided a shot in the arm for ShopUp, which has helped it navigate the current crisis. It has managed to retain its entire workforce without pay cuts, despite a 50% decline in business during the pandemic. With a relatively stable runway of 18 months, ShopUp has pledged to raise funds for at least 1,000 MSMEs which have growth potential but require support to survive amid the lockdown. Siffat Sarwar, ShopUp’s Chief Operating Officer, aptly sums up the situation, saying, “COVID has significantly hampered sales of all the entrepreneurs. But it has also brought in opportunities, because customers are adopting online commerce rapidly. Every problem also brings with it a set of options, if you can adapt.”

The Challenges to E-Commerce and F-Commerce

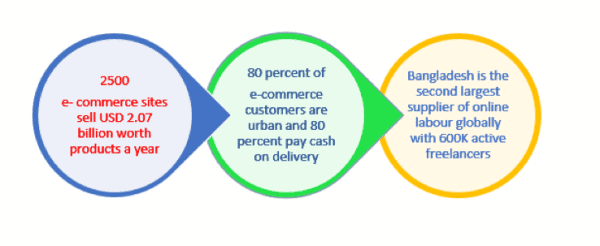

As illustrated in the figure below, the e-commerce market in Bangladesh provides an enormous opportunity for gig workers. But despite the millions of transactions taking place daily through e-commerce and f-commerce platforms, there exist two critical challenges.

Figure 1: Online commerce landscape in Bangladesh

First, most e-commerce and f-commerce platforms accept both digital payment and cash on delivery (COD). Not surprisingly, COD, estimated at around 80%, dominates the payment system. However, COD has its own challenges. They include customers’ last-minute payment decline (in which customers change their minds about their purchase after the product is delivered to their doorstep, leaving the vendor or platform to accept the cost of transport as a loss), additional time taken to complete the transaction as customers gather cash to pay, and the risk of carrying cash from customers’ homes to the business hub. COVID-19 adds another risk in terms of cash acting as a potential vector of infection. These challenges impact delivery efficiency, and ultimately the overall operation. If mobile and digital financial services providers can collaborate with online commerce players to incentivize and nudge customers to pay digitally, these businesses can grow faster. Based on the typical users’ profile in the e-commerce sector, digital payment methods should be easier to adopt than cash payments, and able to replace COD.

Second, there are regulatory gaps. With challenges in the existing National Digital Commerce Policy of 2018, customers and entrepreneurs face challenges such as fraudulent activities, fake products, uncompetitive pricing, customer harassment and quality issues in the existing industry. These challenges make both the customer and the entrepreneur vulnerable. Authorities such as e-CAB, the Metropolitan Chamber of Commerce and Industry, and the Ministry of Commerce should formulate and enforce regulatory actions. These regulatory measures should include product quality, customer satisfaction, monitoring transactions, pricing, competition and taxation. The Bangladesh Competition Commission, under the Ministry of Commerce, can play a significant role in monitoring the market for quality control and consumer rights protection.

Meanwhile, as per current practice, many e-commerce and f-commerce platforms have been working on their consumer protection policies based on their internal codes of conduct. One option could be for these platforms to explore an industry-wide online/digital consumer protection framework as an intermediate step. Nevertheless, unless there is a set of laws and regulatory frameworks, fraud and mistrust in online purchases will grow.

The way forward

COVID-19 has been a catastrophe for most businesses and segments of the global economy, especially in developing countries. Bangladesh is no exception to that. However, some sectors took this crisis as a “nudge” to go digital. The unprecedented growth of e-commerce and f-commerce in Bangladesh, despite the pandemic, illustrates the likelihood that various segments of users will continue to seek opportunities to use online marketplaces. This growth creates an excellent opportunity for the fintech industry to move even faster to enable cashless transactions, provided the ecosystem players can work together and build a value proposition for all stakeholders.

Moreover, financial institutions can also leverage the rise of e-commerce and f-commerce. Banks and other financial service providers have the opportunity to build digital credit products in this space, leveraging the data generated by both suppliers and customers. Bangladesh stands at the cusp of more widespread innovation in online commerce, and it can learn from relevant examples from many countries, in both developed and developing economies. This opportunity could enable it to accelerate the sector’s growth, both during the pandemic and as the world transitions to the new normal.

Samveet Sahoo is a Senior Manager at MSC India; Mohammad Nazmul Avi Hossain is a National Consultant for Bangladesh at MSC; and Khandaker Shaoli Hassan works with MSC Bangladesh with a focus on payments and distribution. MSC is a NextBillion partner.

Photo courtesy of Prachatai.

- Categories

- Coronavirus, Finance, Technology

- Tags

- COVID-19, digital payments, e-commerce, MSMEs