NexThought Monday 12/16/13: Is India looking at financial inclusion backwards?

Sixty percent of the population in India does not have a bank account, and more than 50 percent of farmers in the country do not have access to any kind of institutional credit. While these exclusion statistics paint a gloomy picture, the reality is even worse, as most bank accounts opened in recent years are dormant. The primary reason for India’s financial exclusion is lack of depth in its banking infrastructure – of the country’s 600,000 habitations only about 36,000 have commercial bank branches.

Setting-up and operating a bank branch is very expensive and challenging. That’s one reason financial institutions have turned to technology to enable branchless banking. Technology-based branchless banking is promising in theory as transaction costs are less than 10 percent of that incurred at bank branches. Service providers and financial institutions have experimented with multiple technology platforms, but the one that has attracted the most attention has been the mobile phone. With the ubiquity of mobile phones, they’re the only platform that provides a digital link to almost every household in the country.

Even so, the growth of mobile finance has been very slow and patchy. In branchless banking through mobile, the phone itself is only a small part of a big puzzle. Other pieces involve creating compelling products and services, creating an agent network, training agents (the consumer interface of branchless banking services who provide a bridge between cash and mobile money) and managing the network’s capital risk. Getting all the technology and operating model pieces to coordinate with each other to enable flawless service delivery is a very challenging task.

In addition, one of the most critical and important elements of effective mobile money is choosing the right target market and strategy. Today, branchless banking and the mobile money agenda is driven by government programs with government-to-person (G2P) transactions (including payments from social welfare programs), and in some parts by person-to-person (P2P) remittances. Unfortunately, it seems likely that the volume of G2P business has compelled service providers and financial institutions to choose the toughest market sub-segments to start with – the underserved rural poor.

A better approach, particularly in rural areas, would be to invert the existing approach: Target rural business segments, develop solutions, gain experience and gradually introduce the service to tougher segments, such as low-income households.

Here, we explore some of the key elements of effective mobile money and also present an alternate strategy for advancing financial inclusion through mobile money.

Inverting the market approach for mobile money

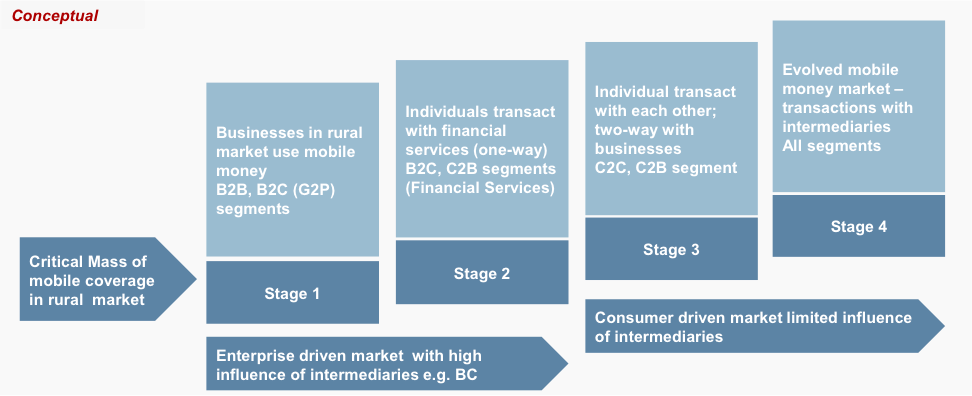

Rather than tackling direct market-building in the toughest segment (rural households), a more effective strategy would be to build the market through other actors in the rural ecosystem. This could require starting with the rural business segment first – i.e., enabling business-to-business (B2B) transactions on the mobile money platform and then gradually moving to P2P household segments. The advantage of this approach is that it provides households with ample time to start trusting the transaction system – though it goes without saying that the back infrastructure must be tailored for business segments. The graphic below provides a brief summary of this multi-stage approach to building the market for mobile money

Stage-wise strategy to roll-out mobile money services in rural markets

Stage I: Business-to-Business Segment

The B2B segment is a good starting point to take mMoney beyond government-to-person transactions. With India’s retail boom, many large enterprises and multinational corporations have strengthened their supply chains in rural areas. The businesses at the receiving end of the supply chain make for a large and attractive segment for mobile money adoption. Moreover, under new regulation, private companies can function as agents (business correspondents) for branchless banking. Further, in many B2B cases agent networks may not be necessary, as some enterprises may have periodic access to physical banks. The advantage of deploying mobile money in rural enterprises is that they act as ambassadors to develop trust with rural households.

Stage II: Business-to-Consumer (B2C) Segment

There is a large scope to introduce targeted mobile solutions in the B2C segment, because mobile money can lower administrative costs and tackle security concerns that accompany cash handling for businesses. Some of these targeted transaction types could include salary and payment for agricultural produce. With businesses evangelizing mobile money, beneficiaries may begin to trust the system further. Targeting businesses in Stage I & II will enable service providers to operate in transaction segments which have a high throughput and frequency.

Stage III: Consumer-to-Business Segment

After generating trust and familiarity, the next step could involve encouraging consumers to settle payments through mobile money. Correct positioning of such services along with a robust cash access and management infrastructure will be essential to ensure proper payment process.

Stage IV: Consumer-to-Consumer Segment

Finally, we believe mMoney will reach a stage where people will be ready to transact with each other.

As part of this four-staged approach, continuous customer education, product innovation and enabling budgeting tools will be essential for market development. In addition, considerable business model innovation will be required to set up and manage agent networks, and to retain customers with targeted products and services.

Conclusion

With half the global population still unserved by the banking system, proliferating mobile money practices could ultimately replace physical bank transactions. But in India’s current framework of bank-led models, the service delivery network is complex and there have been no commercial successes. That’s why mobile money operators will need to continue innovating on products, but also focus on overall strategy and solution design.

Though a completely cashless transaction ecosystem is ideal, the reality is that cash will still play a key role in the rural landscape. To compete with cash and ensure the uptake and sustainable usage of their products, mobile money operators will need a well-designed strategy and target market. The approach described above is based on the launch experience of banking services such as Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT) and other similar services by the Reserve Bank of India. That said, it still needs to be tested extensively, and there needs to be more thinking on other approaches as well, as the sector evolves to meet the country’s growing need for financial inclusion.

Raghavendra Badaskar is a manager at Intellecap’s business consulting practice where he works on inclusive business strategies and impact investing sectors.

- Categories

- Uncategorized