It’s Hard Out Here for a Personal Finance App: CFSI offers tips on creating a successful app for the underserved in a tough competitive landscape

As mobile access has exploded worldwide, smartphone ownership has skyrocketed among low-income Americans, spawning countless financial management tools that underserved consumers can carry in their pockets. Personal finance apps can be a useful way to provide services, offer timely financial guidance, and help users create and keep financial goals on track. And as smartphones become more accessible and powerful, their potential to successfully help underserved consumers manage their money continues to grow. But how can developers create sustainable offerings that help improve their users’ financial health?

To find answers to this question, the Center for Financial Services Innovation (a NextBillion Content Partner) took a closer look at the existing landscape of personal finance mobile apps and the process of creating a successful app. In the summer of 2014, we mapped the characteristics of 246 unique apps from Google Play’s “Popular Free” and “Popular Paid” Finance apps lists and the iTunes App Store’s “Popular Finance Apps” list. The apps were selected based on the order they appeared on each store’s webpage, in order to focus our research on the apps consumers are most likely to find and use. We excluded apps tied directly to financial institutions (e.g. Bank of America’s mobile app) to focus on the type of standalone apps that CFSI has supported via FinCapDev competitions, and the current innovations we’re encouraging through the first Financial Solutions Lab challenge. In addition to this assessment, we reviewed existing reports and articles on app development and the process of building sustainable, successful apps. Several key findings emerged from our work:

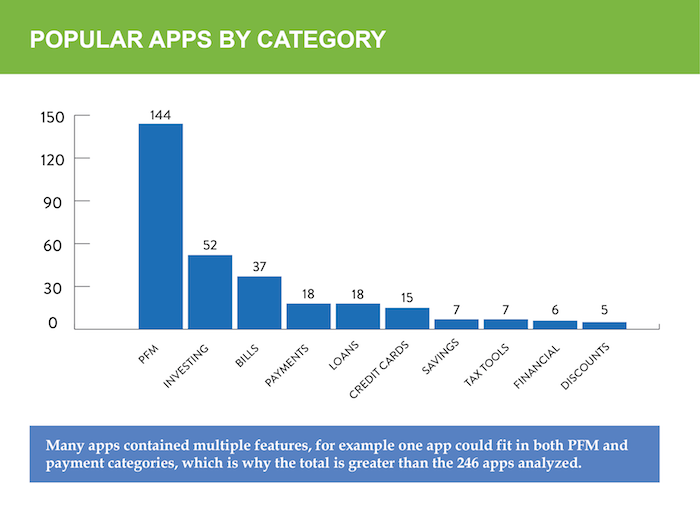

1. There are an enormous number of Personal Financial Management (PFM) apps available. The chart below shows a breakout of the features found in the popular finance apps studied. We found that over half (144 of the 246) of the apps we looked at had PFM features that help users track and manage their budgets via manual updates and/or syncing to existing bank accounts. It’s possible that this concentration is a function of mobile apps being seen as most helpful when they focus on day-to-day financial management. However, the market saturation of PFM tools suggests there is room for personal finance apps to focus on other areas of financial health, such as building savings and helping users pursue long-term goals. It also means that unless new strategies or innovative tools are incorporated, creating additional PFM apps would be redundant.

Note: Many apps contained multiple features, for example one app could fit in both PFM and payment categories, which is why the total is greater than the 246 apps analyzed.

2. It’s not easy for independent app developers to be financially sustainable. Mobile app developers in general face a cutthroat economy, in which 17 percent of app developers who are interested in making money actually make nothing at all. Over half of app developers make less than $1,000 per month. This highly competitive environment makes it important for personal finance app developers to create high-quality offerings that fulfill a unique consumer need. It’s also important for them be efficient in building their apps. For instance, it may be more useful to use existing third party tools for texting and push notifications, than to attempt to build such app features from scratch.

3. App users are incredibly fickle. App users will not hesitate to delete an app that has one technical issue or starts to bore them. In fact, overall, 80 to 90 percent of apps are eventually deleted from users’ phones. If an app developer wants their app to be not just downloaded, but actually impactful to users, a smooth first experience is crucial. Only 16 percent of users give an app more than two tries if it fails initially. It’s clear that developers must carefully create technically sound and appealing mobile apps to get, and stay, in the hands of users. And to appeal to low-income users, who are often dealing with scarcity of both time and mental bandwidth, intuitive usability must be a particularly high priority. Successful apps must also evolve and respond to user wants and trends in order to be successful, long-lasting tools that can have a greater impact on users.

4. Acquisition and distribution are still challenging for fully developed apps. After building an innovative, fully functioning app, there is no guarantee it will become popular. If an app does achieve popular status it is much easier to maintain it, because popularity begets popularity: high app store rankings = more downloads = bigger social media presence = more downloads = higher app store rankings. Developers can enhance their presence by utilizing App Store Optimization (ASO), which is the app store equivalent to search engine optimization. Through ASO, a mobile app’s rank is enhanced so that the app appears higher in an app store’s search results. Additionally, designing focused marketing campaigns and utilizing distribution partnerships – such as nonprofit programs aimed at building financial health – can be helpful in expanding an app’s reach among low-income users.

The Big Takeaways

Developers should look at existing apps to make sure the apps they propose to develop offer something new to potential users and can be distinguished from the masses – particularly with PFM apps. To be more economically savvy in building apps, developers should investigate potential partnerships and be prepared to face a picky user base. Finally, once a unique and functional app has been created, acquisition and distribution efforts are instrumental to becoming and remaining popular.

With a focused plan for creating and spreading personal finance apps app, developers can create successful offerings that have the capacity to help the financially underserved and improve consumer financial health. For examples of some apps that are taking a successful approach to improving financial health among underserved consumers, take a look at the finalists and winner of our FinCapDev competition.

You can also find out how CFSI is encouraging innovators to develop new mobile apps to solve household cash flow issues through the Financial Solutions Lab (FSL). Have an innovative solution? Apply today for the first FSL challenge.

Theresa Schmall is an intern in the Innovations Lab at CFSI, where she assists with the ongoing management, tracking and reporting of CFSI grantee projects and events.

- Categories

- Technology

- Tags

- mobile finance