NexThought Monday: Pay for Success … With an Important Twist

Did you ever wonder how to adapt the pay-for-success model to market-based social enterprises and inclusive businesses? How to catalyze and secure private investments that allow scaling? And how to make sure that each party involved has an incentive to outperform on impact?

At Roots of Impact, these are the main questions that kept us awake. We knew a good deal about social/development impact bonds, which use pre-defined outcome targets and pay out premiums if these goals are achieved. They remunerate investors who pre-finance the intervention and bear the risk of failure. They primarily engage and fund non-profit organizations. And, at least so far, they have specific missions – for example, prevention measures that bring cost savings to public budgets. But impact bonds have another positive side effect: They pave the way for embedding impact performance into financial solutions.

“So what about social enterprises with the ambition to act self-sufficiently?” we asked ourselves. How can a pay-for-success approach enable them to scale, fully in-line with their missions?

From the investors’ standpoint, many high-impact social enterprises with an earned-revenue model in developing countries are not yet attractive enough. Their financial returns are just too low in relation to the risk, many say. But in terms of social and ecological impact, these enterprises are highly effective. That doesn’t help them a lot when it comes to financing. Trapped in the middle between commercial business and social aims, they are forced to make a painful choice: profit or purpose? This phenomenon makes no sense to us. There should be no simple “yes” or “no” answer. Instead, we dared to believe that there must be a way to accelerate impact while creating additional revenue streams, a solution that enables sustainable business models while bringing new sources of capital to the table. In other words, we were looking for the Swiss Army Knife of development finance: a market-based blended finance solution that harnesses the pay-for-success approach.

Financial versus impact performance?

No doubt, impact investors tend to pursue near-market or even market-rate financial returns. One glance at the latest J.P. Morgan/GIIN annual impact investor survey is enough to prove the point. The majority of impact investors and development finance institutions are either unable, or unwilling, to sacrifice financial performance for the sheer sake of having an outstanding impact. But there is another truth: Donors and development agencies are keen to make the most effective use of their budgets. They strive to generate sustainable impact on a much larger scale. And rightfully so: the new Sustainable Development Goals are literally calling for it, as the World Economic Forum outlines in its 2015 guide to blended finance. And there is no time to be wasted.

In a recent article in The Stanford Social Innovation Review, Michael Etzel from The Bridgespan Group makes the case for philanthropy to bridge the pioneer gap and enter the game in a different way. He argues that donors should flood the “grey zone,” this delicate area between grant-type of returns (zero) and market rate returns, because this is where the majority of social enterprises are at home in addressing poverty, crime, homelessness, education, green energy, and other high-impact issues. Our thoughts went in the same direction. And the solution came when we investigated ways to align the interests of all stakeholders.

Step 1: by monetizing the value that social enterprises create for society, straight forward, without the need for a complicated structure.

Step 2: by convincing development agencies and philanthropic funders that they have much greater leverage with their monies when they pay premiums for measurable, positive impact and thus attract additional private capital.

Step 3: by selecting suitable social entrepreneurs and carefully designing the payment mechanisms that are related to their outcomes.

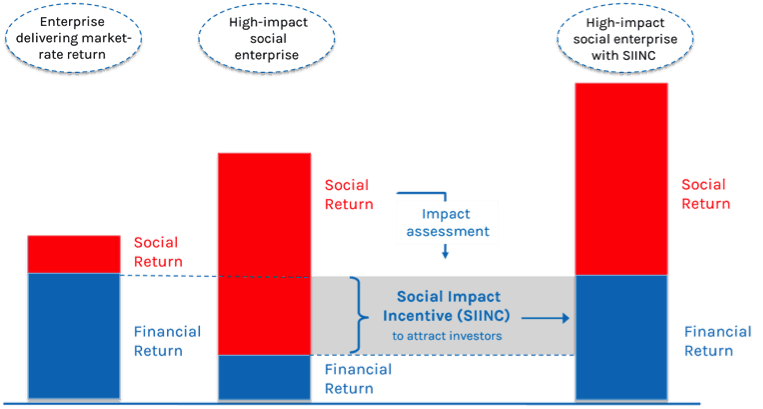

In seeking ways to achieve these three goals, we developed the Social Impact Incentives (SIINC) – a new way to incentivize impact. Under the SIINC model, the social performance of the enterprise becomes directly linked to its cash flow, increasing its appeal to investors. SIINC will make payments to the enterprise directly. This will help ventures maintain financial stability to pursue higher revenues, and thus higher profits in the future. This in turn will make enterprises more attractive for investments designed to bring scale.

But how exactly does the SIINC solution work? The following graph illustrates the effects on the return profile of a social enterprise for investors.

Above graphic:: “Closing the Gap with Social Impact Incentive (SIINC)”. Source: Roots of Impact

First implementation in Latin America and the Caribbean

“We are constantly looking for possibilities to use our funds with a significant leverage and catalytic effect,” recalls Peter Beez, Head of Focal Point employment and income at the Swiss Agency for Development and Cooperation (SDC), who is our partner in this project. “It is all about the power of incentives. We are creating win-win-win solutions to mobilize much more capital for the benefit of high-impact social enterprises and thus reduce poverty and exclusion.”

Based on valid and trackable impact metrics, SIINC provides the social enterprise with a means of establishing itself. Temporary payments accelerate the process of achieving the much-desired financial viability. It is not important whether such viability comes through public sector contracts or market-based revenue streams, or a combination of both. The goal is that sustainability is there to stay. Meanwhile, outcome funders and impact investors receive strong and ongoing social returns.

This model is now ready to be tested in the real world. The first implementation will be in Latin America and the Caribbean, where we at Roots of Impact have launched a Public Private Development Partnership (PPDP) with the support of Ashoka and in collaboration with the SDC and the Inter-American Development Bank (IDB). The funds are to be administered by the IDB’s Multilateral Investment Fund (MIF) through a specifically-designed facility. All project partners are pursuing the same goal: to establish the SIINC model as a game-changing innovation in development finance and impact investing.

The Ashoka Latin America offices provide the necessary help with the identification of potential target organizations. The sheer number of social enterprise candidates was a big surprise. Obviously, SIINC has hit the right spot with high impact ventures from the region. But in the end, the important twist in the model is in the right definition of incentives. They have to be based on measurable social outcomes to deliver on the promise. Participants should not expect binary results: Outcomes are relative and incentives have to be set respectively. We work closely with the social entrepreneurs – and don’t refer to them as service providers. They are fully responsible for delivering the results, both in terms of social impact and financial performance. They have to put heart and skin into it.

Coming from the venture capital and finance sectors we know too well about the power of incentives. They are not only relevant for rewarding individual performance. They also serve to create a different culture. We are convinced that by incentivizing people and organizations to achieve positive impact on society, funders and enterprises alike can realize their full potential for social good.

Just imagine for a second that we could adapt our model to big corporates: How effectively could they leverage their resources for social impact on a large scale?

Bjoern Struewer is the CEO and Founder of Roots of Impact, a dedicated advisory firm and market builder for impact investing and development finance. Roots of Impact offers advisory services to impact investors, public funders and strategic philanthropists globally, in particular for implementing high-impact strategies.

Christina Moehrle works as an advisor at Roots of Impact. She is a specialist in impact investing and social entrepreneurship.

For more information about SIINC, please visit http://www.roots-of-impact.org or contact us at info@roots-of-impact.org.

Photo courtesy of Fundación Capital.

- Categories

- Investing

- Tags

- impact investing