A New Wave of Crowdfunding: Connecting Social Enterprises with Investors (for Greater Social Impact)

In a growing ecosystem where for-profit social enterprises are becoming more visible and investors equally interested, a significant problem remains: How do we connect the two and streamline them in a way that is both efficient and helps accelerate social impact?

The problem? Entrepreneurs with an early stage or growing for-profit social enterprise – an organization creating a societal need in the market while obtaining economic value – do not have readily access to impact investors. Nor do they have the opportunity to pitch their innovative business models to them.

But the prospects of becoming broader-scale enterprises, say consumer product companies (food, personal care, apparel, etc.), in search of funding to grow and scale can be just as limiting, as reported by The New York Times. Despite a few million dollars in sales under their belt, with no viable access to venture capital investment, private equity or loans, how then can their respective small company grow? Where does a small company go for funding when traditional avenues like these are a no show?

Increasingly, investors, on the other hand are inclined to do more meaningful than the traditional mutual fund and stock market. But typically, investment opportunities are miles away from earshot or eyesight and without proper infrastructure in place to access these for-profit social enterprises investors’ inclinations will be just that, mere interest.

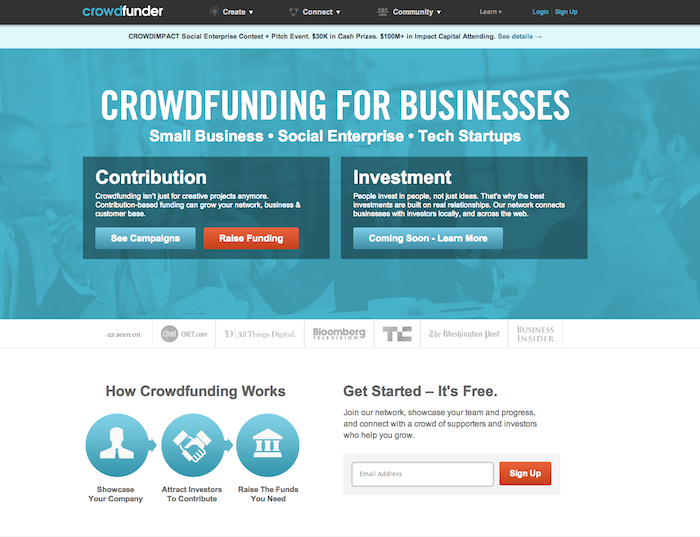

Yes, the communication pipeline and finance tool that democratizes access to funding is already in place via online crowdfunding sites (think Kickstarter and Indiegogo) where entrepreneurs showcase their company, attract investors to contribute, and raise the funds they need.

Now, Crowdfunder, an online social network and crowdfunding site for early-stage and small businesses, is taking this platform one step further, adding another element to the mix: The Social Enterprise Hub.

The Social Enterprise Hub, an online community within Crowdfunder, serves to connect entrepreneurs with like-minded impact contributors and investors, enabling them to raise funds for their for-profit social enterprise and achieve greater social impact.

“We’re really excited about accelerating impact investing, people funding these types of companies because they’re effectively funding causes and impact alongside that,” explains Chance Barnett, co-founder and CEO of Crowdfunder. “They’re not only investing for potential purpose, whatever it is that they’re committed to helping at that social enterprise that they’re investing in, but they’re also investing for profits and those things don’t have to be separate and live in separate worlds these days.”

Serious players in the field have added legitimacy to this model, furthering growth and development to the Social Enterprise Hub. Partners such as SOCAP, Toniic, Singularity University, X PRIZE, and InVenture, to name a few, have teamed up to select enterprises to be featured on Crowdfunder’s Hub platform.

No stranger to contributing funds in the form of donations via crowdfunding, Crowdfunder’s business model is as a non-investment funding platform for startups and young businesses looking for early-stage funding or funding for any stage in the business life cycle. This usually means small capital rounds, however, the next phase abuzz in the crowdfunding world soon to make its mark is equity and debt-based crowdfunding.

In contribution crowdfunding, participants contribute online to a startup or a young business and receive non-monetary rewards or offerings – products or services – in return. By contrast, equity crowdfunding gives accredited capital investors access to ownership shares – not surpassing the businesses’ $1 million worth of equity – and the promise of future revenue as shareholders of established small or medium business demonstrating signs of exponential growth and market potential.

Another finance tool set to make its mark in the crowdfunding space is debt financing. Established companies that otherwise mirror a more consistent and sustained revenue stream would best fit the debt-funding model, enabling these companies the opportunity for loan-like investments whereby supporters, who do not receive ownership shares in the business, are repaid with interest on a set schedule.

The business-growth tools outlined, both equity and debt-based crowdfunding, will soon be incorporated into accredited crowdfunding sites for the benefit of early-stage and small businesses. This comes after the Jumpstart Our Business Startups Act or JOBS Act, a bipartisan legislation was signed into law by President Obama in April 2012 to encourage funding of US small businesses and easing securities regulations.

For impact investors and social enterprises this comes at a great time and equals a win for both: Investors will be able to invest nominal sums into a business with few regulations, while social enterprises will see an increase in the company’s funding pool and, with strategic planning, value their business’ growth and intended social impact.

Crowdfunding has gained traction via its core online revolutionary finance platform, and now, connecting social enterprises with impact contributors and investors.

- Categories

- Social Enterprise, Technology