Don’t Fear the Algorithm: The Risks and Benefits Of Machine Learning in Finance

Across the world, billions of people lack access to basic financial services – like savings, loans and insurance – which are essential to financial well-being and wealth-creation. Ironically, the people who lack access to these financial tools are also the people who need them the most. Far too many ambitious entrepreneurs and promising small business owners are deprived of financial opportunities simply because they don’t have a credit history.

Some think this is a problem of risk. At JUMO, we disagree.

We believe that the lack of access to financial services is fundamentally a technology problem – and it’s a problem that providers are beginning to solve. Now, for the first time, a proliferation of digital payments solutions – such as mobile money services – are connecting developing communities in profound new ways and opening up greater financial choices. But delivering on this financial potential is no simple task.

JUMO’s mission is to radically advance financial inclusion by connecting entrepreneurs, small businesses and tradespeople in emerging markets to local banking services. We do this by teaming up with digital payments companies to reach un(der)banked customers with great financial product choices from local banks. Our technology platform uses behavioral data to understand new customers that banks traditionally cannot reach, and offer them savings and borrowing choices.

The Benefits of Machine Learning in Finance

Machine learning is a critical component of this process, as it allows us to enhance our predictive ability to better identify these qualifying customers. As a result, we are making significant strides towards our goal of creating the world’s leanest and lowest-cost banking infrastructure. This helps our bank partners offer loans at the lowest possible rate, and it helps our customers to achieve higher-yield savings.

We’ve proven that our model works. Twelve million customers in Africa and Asia have saved or borrowed on the JUMO platform, and roughly 70% of these customers are micro and small businesses. We’re incredibly proud of our progress so far – but we know there’s more we can do.

That’s why we recently kicked off a major engineering project across our Cape Town and San Francisco offices, using new machine learning techniques to hone our predictive risk models. As a test case, we wanted to look at fraud — one of the most challenging areas of our work. This work is important: Even marginal improvements in our ability to predict which applications and accounts represent fraud risk means more loans and savings in the hands of genuine entrepreneurs and business owners.

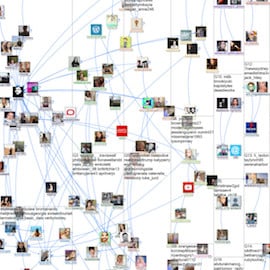

To test our approach, we looked at Ghana, running new and advanced machine learning algorithms on signals associated with a pool of lending applicants. The goal was to identify combinations of signals — from income size and deposit frequency to mobile phone battery life and mobile wallet transaction patterns — that would serve as more accurate indicators of likely fraud than existing models.

To reiterate, our goal with this work was not to identify more fraudulent activity, but instead to reduce the frequency of false positives — applicants screened out of our products because of the false prediction of likely fraud. And in short, it worked. Thanks to this project, we’ve seen a significant increase in the pool of applicants we are able to connect to products from our banking partners.

This approach is not without its challenges. Given our market, we know we must be extra vigilant in order to prevent new and hidden biases from emerging and unfairly screening out good applicants in new ways.

Avoiding the Downsides of Algorithm-Assisted Banking

For example, consider a farmer in the agricultural sector just ahead of an anticipated drought. In a traditional lending model, this farmer would see a decrease in income just as their risk, and therefore the price of capital, increases. The result: The farmer is more likely to default. Though this result would, in one sense, prove the predictive model right, it would also prevent the farmer from benefiting from financial access, right when this access could make the greatest difference in their life.

There is a better way to manage this situation. It would make more sense to drop the price of borrowing as soon as we identified a drought. The result would increase the likelihood of the farmer successfully managing repayments, which would decrease the risk of them defaulting. This example demonstrates just how dangerous algorithmic systems used by traditional financial institutions can be in people’s lives.

However, the rewards of using a different method can be transformative. In a single market, for example, using machine learning techniques to leverage huge datasets into actionable insights has allowed us to significantly increase eligibility for our products without increasing the cost of risk. This means we can give more consumers access to finances and create more opportunity for our bank partners to serve new customers.

When applied at scale, this technology will help us to put financial opportunity in the hands of millions more people. That means helping ambitious entrepreneurs, community leaders and local tradespeople to build businesses, create jobs, and increase both their personal wealth and their living standards.

For decades, access to financial services in emerging markets has been plagued by massive inequity fueled by poor information and the negative bias of algorithms. Solving this critical issue is within our grasp. For us and many other technology companies working on this problem, getting it right is not only possible, it’s imperative.

Andrew Watkins-Ball is the founder and CEO of JUMO.

Photo provided by author.

- Categories

- Finance, Technology