How Behavioral Science Can Improve Digital Services: Exploring the Impact of an Innovative Accelerator Program on Social Enterprises in Latin America

Why do we like and engage with certain content on social media? How do our limited attention spans affect our ability to focus on a certain topic? Why do we choose to sign up for certain services over others? How do we decide whether to spend, save or borrow?

These types of questions are part of the study of behavioral science. As defined by Hans Frech, a researcher at the Common Cents Lab – a behavioral sciences laboratory based at the Center for Advanced Hindsight at Duke University and focused on improving financial well-being – behavioral science refers to “a new set of disciplines that emerged as a result of different investigations into how people make decisions and why we behave in one way or another.”

There are many applications of behavioral science that aim to improve the effectiveness and reach of social initiatives. For example, Rare, a conservation-focused non-profit organization, utilizes behavioral change to encourage communities to adopt environmentally friendly practices that benefit both people and nature. And FeedMyCity, a community kitchen initiative in India, used behavioral science to effectively communicate its funding needs to donors, enabling it to scale its services during COVID-19.

Behavioral science is a relatively new field of study in Latin America. But lately, its applications have been growing in the region, and there has been an increase in the use of behavioral science to address problems impacting financial inclusion and other social needs. This has revealed some surprisingly straightforward solutions to persistent problems: For instance, actions as simple as replacing the word “savings” with a more colloquial term such as “set aside” can increase customer enrollment in savings programs.

Even before COVID-19, most Mexicans faced complex challenges that prevented them from achieving financial health. Mexico’s minimum wage is far below the amount needed to keep a family of four above the poverty line, and 53% of Mexican adults do not have a savings account. Considering COVID-19’s toll on Mexico’s healthcare system and economy, and to mitigate the dramatic increases in poverty and debt levels that the pandemic has caused, New Ventures – a Mexico-based accelerator and investor – recognized the need for initiatives that improve financial health and increase resilience in underserved communities.

New Ventures decided to apply the study of behavioral science to the issues of financial health and financial inclusion through a program called SUMA (meaning “sum” in Spanish), launched in 2021. We’ll explore this program and its impact – and share some lessons it has generated – below.

The design of the SUMA accelerator program

The SUMA program was designed in partnership between New Ventures and the Metlife Foundation, whose mission is to help millions of low- and moderate-income people achieve financial health, and with whom New Ventures collaborated previously through FLII (the annual Latin American Impact Investing Forum organized by New Ventures). Metlife Foundation is also the founding partner of the Common Cents Lab, whose vast knowledge and resources we drew on.

The goal of the program was to:

- Provide hands-on behavioral science learnings to social enterprises, based not only in Mexico but across Latin America and the Caribbean, that can positively impact the financial health of vulnerable communities.

- Design and implement behavioral science interventions that increase savings and other positive behavior changes to improve users’ financial health.

The program’s first phase kicked off with a virtual conference, where experts from Common Cents Lab and other specialist consultants discussed the importance and main applications of behavioral science. During the second phase, 23 social enterprises from across Latin America participated in the development of behavioral maps for their users, in order to diagnose and address the factors that influence their behaviors. Finally, in the third phase, six of the enterprises were selected by New Ventures to carry out behavioral experimentation with their users. These enterprises included Acceso, Acreimex, Alfi, Fundación Capital, New Story and Power Pal Pueblo.

Applying behavioral science to digital services

At Acceso — a social business builder with operations in Mexico, El Salvador, Colombia and Haiti — our goal is to create fundamental and lasting economic change in the lives of rural farming families and communities through holistic value chain support and market linkages. One key service we offer farmers and farmer-oriented organizations is our agtech service/platform Extensio, which we use to share weather, good agricultural practices, gender topics, and climate smart agriculture and market information en masse via WhatsApp and SMS messages. We applied behavioral science learnings to improve the effectiveness and increase the usage of the information we deliver through Extensio.

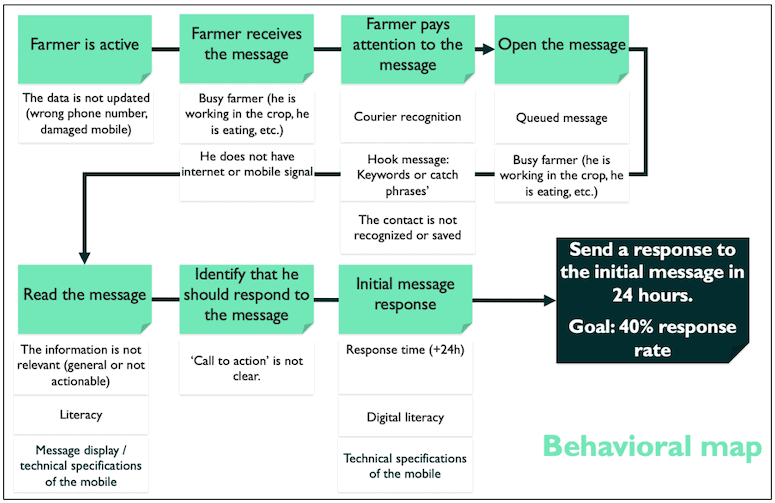

In designing a behavioral map during our participation in SUMA, we considered the flow of information to farmers and the potential obstacles they faced in accessing that information, such as connectivity, language barriers and phone specifications, as illustrated in the graphic below.

Sample behavioral map developed by Acceso

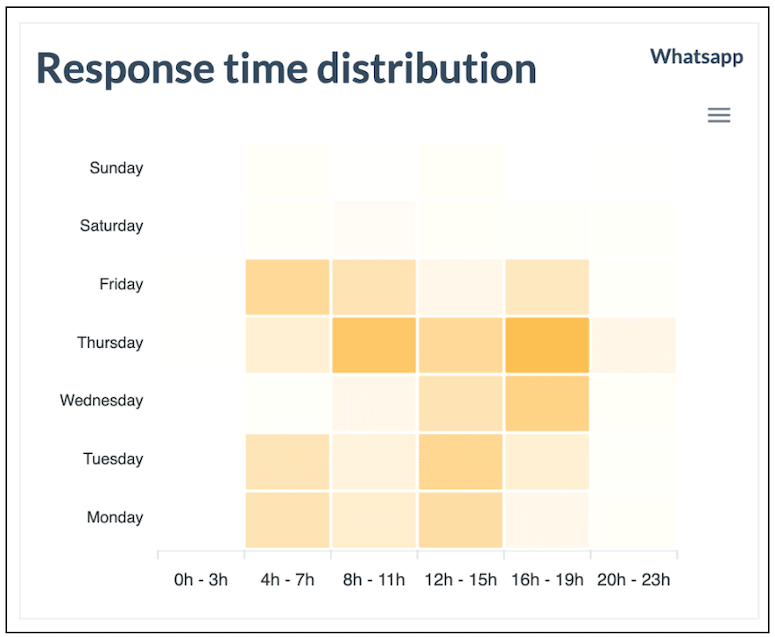

We realized that by identifying and addressing farmers’ barriers, we could improve the response rate and application (usage) of the messages. For example, by monitoring what time of day and which days of the week farmers were most responsive (also known as a “heat map”), we could send the messages during specific windows so that they were more likely to be received and read. For instance, we found that messages sent in the morning have more than 50% more interaction than those sent in the afternoon.

Sample heat map: distribution of responses by hour as measured by Acceso’s agtech system

Also, making messages more concise and to the point, with less text and more graphics, led to a higher probability that farmers would respond. Our response rate increased from approximately 15% pre-SUMA to 40% after we applied the lessons we learned in the program.

We combined user testing (a demonstration of sample content delivered in person), in-person and phone surveys, and focus groups (spaces for farmers to share opinions with us directly) with data analysis to draw conclusions on farmers’ communication preferences and levels of comprehension. Overall, the biggest lesson we learned from these efforts was to remove our own biases and understand the experience of using Extensio through the eyes of our users, to deeply identify the barriers and motivations they have regarding their decisions and actions.

Other accelerator participants also realized improvements to their services, as shown in the examples below:

- Power Pal Pueblo: Today, the penetration of smartphones and the internet in Mexico allow more communities to obtain better financial services and savings tools. But for these technological solutions to improve their financial health, it’s important to maximize their versatility and ease of use. Through SUMA, Power Pal Pueblo developed a deeper understanding of the profile of some of its potential users, which clarified that they generally do not save due to lack of income and distrust about receiving money. Also, the enterprise discovered that it is a mistake to use the excuse of “low technological adoption in rural communities” when considering uptake of savings initiatives through its digital tools.

- Acreimex: Through SUMA, Acreimex analyzed how people save, what method they use and what their main difficulties are in saving. The company’s goal was to provide its clients with a financial scheme that would allow them to strengthen their economic capacity over time, and for this it was essential to understand how clients perceived its savings products. Acreimex used its learnings from SUMA to create a program that encourages savings among its clients by enabling them to save while paying off their loans.

Future applications of behavioral science

The approaches revealed through behavioral science may seem basic, but they have been shown to positively impact customers’ actions, not only related to financial decisions but in many other areas as well. It is our hope that the principles of behavioral science will become more widely known and applied, particularly by social enterprises working in the digital space, to better address the needs of low-income populations.

We encourage those who are interested to further explore the work of the Center for Advanced Hindsight at Duke University and Rare’s Center for Behavior and the Environment, to learn about practical applications and examples of behavior-centered design for improving program impact. And we welcome you to reach out to New Ventures to learn more about behavioral science resources and other accelerator programs for social enterprises in the region, and to contact Acceso to learn more about our technology platform Extensio and our other social businesses and programs.

Juan Pablo Marichi is an Investment Analyst at New Ventures, and Santiago Mesa Bogotá is the Manager of Agtech at Acceso.

Note: Acceso is a NextBillion partner.

Photo courtesy of Acceso.

- Categories

- Agriculture, Finance, Social Enterprise, Technology