Beyond Shock, Money or Mandate: Why African Banks Aren’t Taking Bold Climate Action — And What it Will Take to Move Forward

Africa is one of the most climate-vulnerable regions in the world. Across the continent, some countries are experiencing more intense rainfall, while others face worsening droughts. In East Africa, for example, drought frequency has doubled since 2005. And climate change has already shaved off several percentage points of GDP growth in some economies. For countries striving to reach middle-income status, climate change is as much a developmental issue as it is an environmental one.

Many of the sectors most critical to African economies are acutely exposed to this variability. Agriculture, which remains predominantly rain-fed across the region, underpins daily livelihoods and is a major source of foreign exchange for many countries. Manufacturing is largely agro-linked, with agro-processing constituting a large share of manufacturing activity — and it relies heavily on a power grid that’s increasingly dependent on renewable energy. Tourism, too, is deeply tied to natural ecosystems. In short, climate change threatens the very foundation of many of Africa’s economies.

In response, climate finance has emerged as a growing solution. According to the Climate Policy Initiative, Africa received almost $44 billion in climate finance in 2021–2022, a 48% increase over the previous two years.

This represents less than a quarter of what is needed per year through 2030, but this article is not about making the case for more climate finance. That case is clear.

Instead, this article explores the role, will to act and cadence of actions of domestic financial institutions in the climate fight. Governments and development partners continue to urge domestic financial institutions to “do more” — to supplement global flows, lend to climate-resilient businesses and shape national green agendas. But progress has been slow.

One reason for the lack of momentum, simply, is that banks haven’t had to change. Their financial success still does not depend on it. At least in East Africa, where we have worked extensively within and with commercial banks, the top banks are reporting strong year-on-year profits, despite mounting climate risks. During the 2023-2024 period, based on our calculations, the top three largest banks by market share in Kenya, Ethiopia, Tanzania, Uganda and Rwanda recorded on average between 16% and 31% profit growth. Many smaller banks saw even higher percentages. And in fact, banks across Africa are outperforming their counterparts in other markets on Return on Equity — a trend that is expected to continue, according to McKinsey’s 2023 Global Banking Annual Review. With results this attractive, there is limited impetus for change. Climate change may be knocking at their countries’ doors, but it is not yet knocking at banks’ doors — at least not loudly enough.

AFRICAN BANKS AREN’T TAKING BOLD CLIMATE ACTION

Until climate shocks directly affect African banks’ bottom line — and importantly, at a seismic scale — these banks may not be compelled to act. COVID-19 proved this point: The pandemic delivered such a sudden and sweeping blow to bank portfolios that borrower risk profiles changed overnight, followed by a sudden rise in provision expense as a result of real and expected credit defaults. In response, institutions rapidly restructured loans, adopted more hands-on monitoring approaches — and in some cases, diversified away from the clients most exposed to global market shutdowns. Banks’ behavior changed quickly, but only because the blow to their profitability was large, direct and impossible to ignore.

Climate risk, by contrast, feels like a slow boil. While droughts and floods strike almost every country in the region nearly every year, they have not yet happened at a large enough scale to force a system-wide response, as COVID-19 did. In short, the climate threat feels diffuse and, crucially, not yet immediate.

Compounding this, the financial case for climate lending has rarely been framed in ways that resonate with how banks operate — namely, as a clear money-making opportunity in the near to medium term. Commercial lenders have been the focus of extensive appeals and warnings, from across the development sector and in broader media coverage, about the moral or planetary imperative of boosting climate finance — but these attempts at persuasion have not yet proven to be an effective driver of institutional behavior. Without a clear story about where the profit will come from and how soon, climate remains a peripheral concern rather than a portfolio opportunity for these institutions.

We see three overlooked levers of change that could shift financial institutions toward more climate lending: shock, money and mandate. To change these lenders’ approach:

- A climate shock would need to hit with the scale and urgency of COVID-19;

- The financial case would need to be both clear and compelling, ideally articulating a money-making opportunity; or

- Regulatory mandates would need to require climate action, while also enabling it through meaningful guidance and incentives.

Until one or more of these conditions is met, we’ll remain on the current path: a slow one, where financial institutions and development actors talk past one another — starting from different assumptions and speaking different languages.

A FIVE-STAGE FRAMEWORK FOR UNDERSTANDING BANKS’ ENGAGEMENT WITH CLIMATE FINANCE

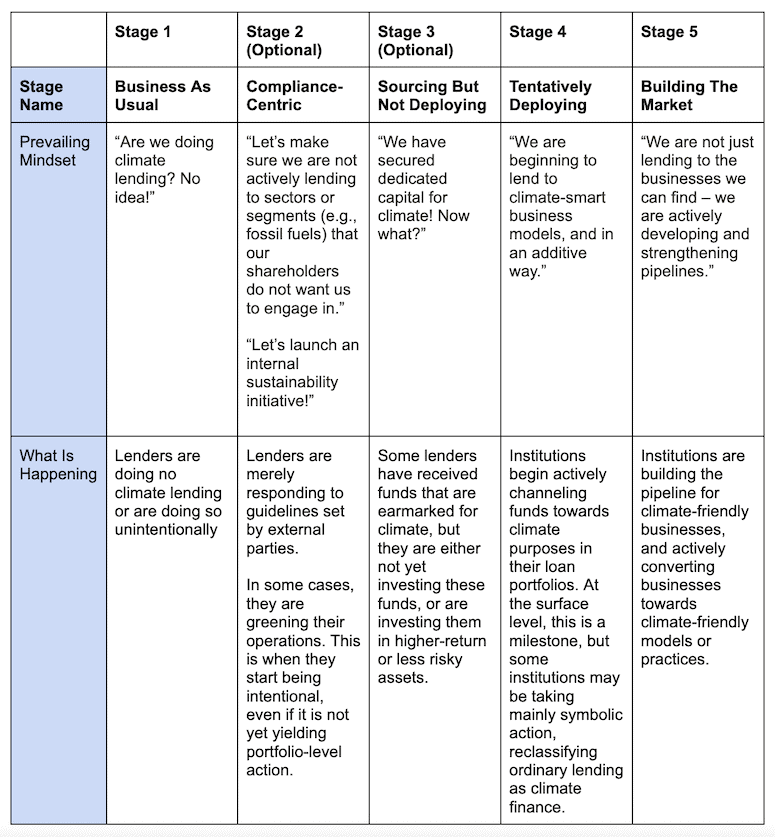

The framework below outlines the current pathway as we see it, based on our work with financial institutions navigating climate finance. It lays out five stages that institutions typically move through (two of which are optional and sometimes skipped), representing activity levels that range from unconscious engagement to intentional market-shaping. For each stage, we describe the prevailing mindset and contrast it to what is realistically happening (see the chart below), while also discussing the pitfalls to watch out for.

Perception vs. Reality in Financial Institutions’ Climate Finance Journey

Stage 1: Business as Usual

At this stage, financial institutions often do not believe they are doing any climate finance — or more precisely, they do not recognize it as such. Their lending may go to solar distributors, regenerative farmers or energy-efficient agribusinesses, but these are labeled as SME or agri-finance, not “climate.”

There is no internal taxonomy, tagging or climate lens: Climate finance remains invisible, unmeasured and undervalued.

Yet though they may have the mindset that they’re not involved in climate lending, many institutions are already financing adaptation or mitigation without realizing it. This reflects a deeper issue: Climate finance suffers from a definition problem, in which it can be difficult to determine whether a business activity should be classified as climate-related. This is especially true for lending focused on climate adaptation, where the needs are highly country- and sector-specific (meaning there is no one definition for what an adaptation investment would entail).

As a result, these institutions’ contributions go unrecognized and unsupported, reinforcing the belief that banks are not part of the solution.

Stage 2: Compliance-Centric

This is often the first visible shift. Banks begin to appear engaged on climate, but engagement is reactive, driven by regulators, donors or industry trends. There is little clarity on what climate finance entails — only a growing sense that “something must be done.”

In a primary effort, this might include greening the operations of the financial institution, such as by moving to paperless banking, improving branch energy efficiency, and installing solar panels at headquarters and/or on branch buildings. This is the easiest step to take. It requires no systematic change management: Behavior change is contained within a small group; it does not involve rebalancing the portfolio; and on its own, it provides something impressive to add to the annual reports, giving the illusion of action.

In a secondary effort, financial institutions may begin acting on climate from a compliance lens, responding to regulatory pressure. In several countries across the region, such as Kenya and Tanzania, regulatory actors have asked banks to disclose the level of climate risk in their portfolios — often with minimal guidance. Financial institutions may develop ESG checklists that integrate exclusion lists and upgrade their data systems to facilitate the identification process.

In short, at this stage, “climate” may show up in strategy documents, but core business practices remain unchanged. But our view of this stage is not negative: “Greening” activities may offer powerful signals to bank staff that “climate matters,” and open the door for real change down the line.

Stage 3: Sourcing But Not Deploying

At this stage, intentionality is increasing, but institutions may be running into genuine challenges and distractions to the cause, with no straightforward solutions.

Some banks pursue climate-aligned funding because it often comes with a lower cost of capital. For them, climate is secondary. The primary goal: Fill a liquidity vacuum through cheaper, long-term funds. Funders are often aware of the cheap-capital motive and accept it.

However, opportunistic motives are not always the issue: Institutions may also be genuinely unclear about how to deploy climate funds. Some seek climate funds with a genuine intent to expand green lending. But once the capital arrives, internal constraints — limited pipeline development, weak technical capacity or misaligned incentives — mean the money either sits idle or finds its way into safer alternatives, such as government bonds.

The capability element cannot be overlooked. And it relates to another factor limiting institutions’ engagement: the challenge of determining what counts as a climate investment, among the vast number of possible interventions that could be considered climate-related. Even if you narrow the focus to standard areas like “climate-smart agriculture” and “renewable energy,” interventions within those categories may look vastly different in different African markets — and this dependence on local factors increases the level of difficulty for banks. Opportunities for climate investments are shaped by market, sector, value chain, enterprise type and even product type. That is five layers of complexity, and most banks are not resourced to unpack them. Hence, some institutions get stuck not because they lack commitment but because they lack clarity, and that clarity requires intensive, highly-tailored detail that does not yet exist (though it could).

It is also important to recognize that sourcing and deploying climate finance are both significant undertakings, and that one does not imply nor require the other. We have seen development actors celebrate sourcing and conflate it with using/deploying. At the surface level, this makes sense, given the inputs (dedicated staff, specialized knowledge, hard-to-come-by partnerships, and ample time) required. But it is worth stating outright: Banks don’t need earmarked funds to do climate lending — and having these funds doesn’t guarantee that this lending will happen.

Stage 4: Tentatively Deploying

This is where real momentum begins, where portfolio-level action is happening and with some degree of intentionality. Reaching this stage is no small feat. Climate finance at the lending or portfolio level, not just at the “earmarked funds” or “institutional projects” level, is a new endeavor for financial institutions. It requires harmony between their business, credit, risk and treasury teams, which takes enormous effort and time — along with a grasp of the multi-layered specificity referenced in Stage 3, and significant experimentation and patience.

But there is a caveat: Some institutions that appear to have reached this stage are still operating at Stage 1.

Imagine this fairly common scenario: A government or donor requests evidence of climate lending. Lacking sufficient guidance on how to identify and originate genuinely climate-aligned transactions, the financial institution instead combs through its portfolio to identify “accidental” climate loans that might count. Tea? Coffee? Perfect. These sectors are agroforestry-based (check), are forced to employ climate-friendly operational practices by international buyers (check), and are also favored by banks (consolidated value chains, large off-takers). It’s easy to rebrand these as “climate finance” loans, with no behavior change required from the institution.

We know this firsthand. We have seen bank teams who, when pushed on their climate lending commitments, will scan the portfolio with this lens: “Who among our existing clients is installing solar? Anyone recycling? Any greenhouses going up?”

In a context where the complexity of deploying climate finance is not sufficiently acknowledged, lenders will default to shortcuts. The risk: a narrative that celebrates what already exists instead of enabling what could.

Stage 5: Building The Market

This is where financial institutions go beyond passive, accidental or tentative engagement and begin actively shaping the climate finance ecosystem — just as they do in sectors such as housing or retail.

No African lending institution has reached this stage yet, to our knowledge. What could it look like if they did?

Banks at this stage would not just lend to “green” firms. They would also influence borrower behavior: nudging enterprises towards climate-aligned practices, and using tangible financial benefits such as longer loan tenors, better interest rates and add-on services, such as post-investment Technical Assistance. They might begin to distinguish between businesses with climate-aligned models — such as solar irrigation companies or regenerative farms — and those whose operations are climate-improved, such as a factory managing wastewater responsibly. In other words, they would have a deeper understanding of the complexities of doing climate lending, as well as the ability to tailor their due diligence and borrower engagement accordingly.

Reaching this stage would be a tall order, requiring significant internal change management, the willingness to bet on emerging sectors, and evidence that these efforts are or will be economically worthwhile (again, the money-making case).

SEEKING A SHARED UNDERSTANDING OF BANKS’ CLIMATE JOURNEY

The way many lending programs and incentive structures are designed suggests a misreading of where financial institutions actually are in their climate journey. Most are in Stages 1 or 2. A few are entering Stage 3. Yet strategies often assume they are further along, ready to deliver last-mile climate lending.

Banks also often misjudge their own stage. Mention “climate finance” in a room of lenders, and you will hear wildly different interpretations: They may mention ESG checklists and solar panels on rooftops, but they rarely mention core lending activities that advance climate objectives at scale.

We based this framework on those conversations: If climate stakeholders hope to see banks play a key role in scaling climate finance, we need a shared understanding of where we are, where we’re headed, and what it will take to move forward — along with a healthy dose of skepticism and a high bar for accountability. We hope this framework offers banks a mirror they can use to frankly assess their progress in their climate journey, while providing funders and policymakers with a tool they can use to match their interventions to banks’ institutional reality.

Carla Legros is an independent consultant and strategist in agricultural and inclusive finance; Anthony Mbithi is a Kenyan banking executive with over two decades of experience across tier 1 and tier 2 institutions.

Photo credit: Wavebreakmedia

- Categories

- Environment, Finance, Investing