The Urgent Need to Address Climate Impacts on MSMEs: Recommendations for Designing Right-Fit Tools and Solutions

Micro, small and medium-sized enterprises (MSMEs) constitute 90% of businesses globally. In emerging markets – and particularly in rural and underserved communities within these countries – MSMEs are a critical link to basic goods and services, and a major driver of employment, providing over 50% of jobs and generating income for millions of households around the world.

However, despite their essential role, these businesses are underserved in several crucial areas that could further their growth or enable their resilience. These areas include the supply chains they use, their access to markets and information, and their access to financial services.

In recent years, tech-enabled startups have recognized the importance and opportunity of providing MSMEs with tools, products and services to grow and run their businesses. These startups have been developing innovations in predictive supply chain analytics and delivery, alternative credit scoring, and buy-now-pay-later financing products, in order to break down some of the traditional barriers small business owners face. At Mercy Corps Ventures, many of these startups are in our portfolio, like Wasoko, Boost, Pivo and Kwanza Tukule, and we’ve been excited to see them growing their market share and traction.

Like our portfolio companies, we know the importance of driving resilience for MSMEs in last-mile communities. To that end, we are also interested in understanding and investing in solutions to what we see as one of the most important disruptors to these communities: climate change.

However, when we started to organize initiatives and investments aimed at bringing the two topics of MSME support and climate resilience together, we could find very little discourse, research and product innovation focused on the interplay and overlap between these issues. We wanted to know:

- What impact is climate change having on small business owners (micro-retailers) in underserved communities in emerging markets? What are the knock-on effects in the micro-retailer’s community?

- How can micro-retailers build resilience to the impact of climate change, and how can startups enable this?

Given the lack of information that could help us to answer these questions, we conducted research of our own. Along with Hetal Patel, my colleague at Mercy Corps Ventures, and Circle Innovation, a human-centered design research partner, we interviewed nearly 450 micro-retailers across two markets in Africa – Nigeria and Kenya.

This research reveals the opportunity in providing the roughly 162 million MSMEs in developing countries with climate solutions, laying the groundwork for innovators, investors and funders to positively impact these enterprises with right-fit products and services that can build their climate resilience. In a new article series, we’re sharing highlights from this research. The article below explores several of our key findings and insights.

FOR MSMES, CLIMATE CHANGE IS HERE AND HAPPENING NOW

Ninety percent of micro-retailers we interviewed had heard of “climate change,” primarily through local radio or television. Climate change literacy as a concept is increasing in importance, and being able to use this terminology directly when interacting with micro-retailers is a critical first step to building their resilience to its effects.

“There is no one who is not affected by climate change,” said Adela, a female shop owner selling consumer goods in an urban area of Nigeria who participated in our interviews. “I close my shop when it is raining and I lose sales because I do not open at the usual times. So if I know how to change [to adapt to these climate-related impacts], I won’t be affected as much.”

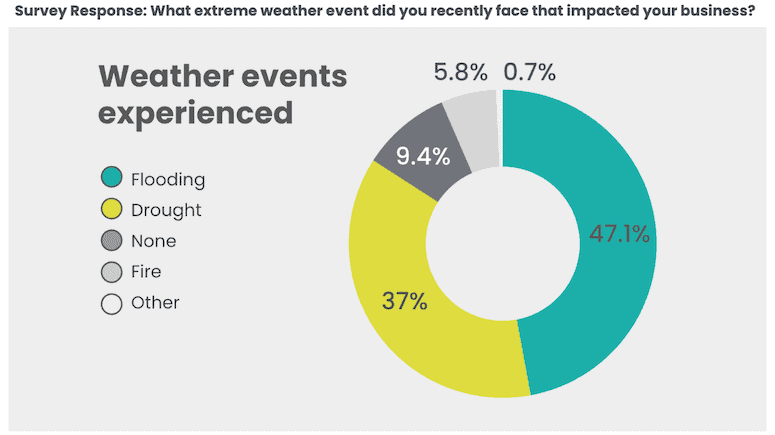

Our research showed us that Adela wasn’t alone in experiencing these challenges: 90% of the micro-retailers we interviewed reported that weather-related events had impacted their business. As illustrated in the chart below, their most commonly cited challenges were flooding and drought.

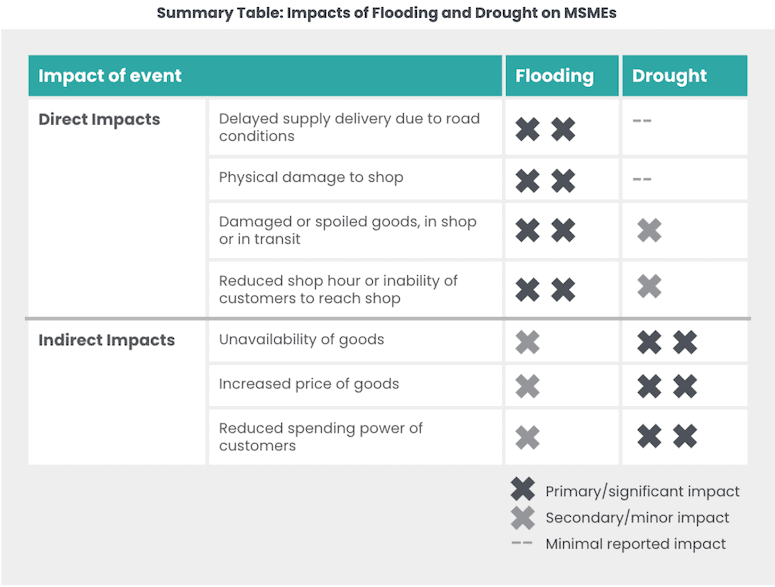

Flooding caused direct and immediate damage, both to the MSMEs we spoke with, and to their communities. Micro-retailers cited logistical challenges in the delivery of supplies, and physical barriers to reaching their shops. They raised the issues of spoilage or damage of goods, either in transit or in the shop, and infrastructure damage to their shop as key challenges. For instance, Mary, a female shop owner from an urban area of Kenya, told us: “I lost stock worth more than KES 30,000 (US $246) last year. Rice, sugar and 10 bundles of flour were ruined by the flood.”

The impacts these retailers described in the case of flooding were different from those of drought. In a drought, the primary challenge was the lack of availability of goods, as the production of meat, dairy and other produce declined, alongside a reduction in the spending power of customers who were involved in farming or agriculture value chains (see the charts below).

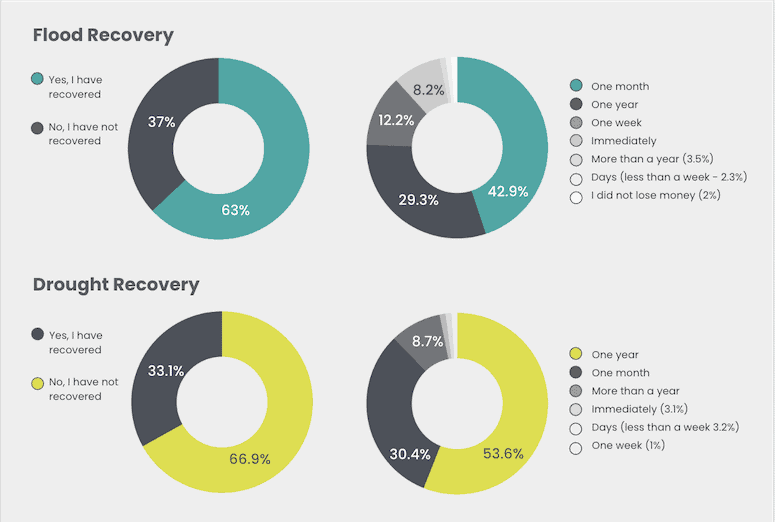

We found stark differences in the severity of the impact of flooding and drought on the micro-retailers interviewed and their communities. MSMEs face much more difficulty in recovering from droughts as compared to flooding, because droughts are longer-term and more deeply impact their customers: Most reported that it took them a full year to recover from a drought, whereas 63% had recovered from flooding after just one month.

Drought and flooding provide us with two archetypes of climate shocks – floods are faster-onset, with shocks to micro-retailers and communities that are quick to arrive and faster to recover from. Droughts take longer for the impacts to be felt, but they also take longer to diminish and are more difficult to recover from – their impacts are felt deeply in the production and availability of goods and in the overall income level of communities. This difference has implications for the products and services which can be most impactful in building resilience to shocks like these.

We also found that climate change exacerbates existing exclusion and barriers faced by MSMEs. One common example is the lack of access to financial products. Without access to credit products, micro-retailers rely heavily on cash flow and small amounts of savings to operate. In times of shock or in an effort to grow, they often turn to predatory loan products and make use of intermediaries with high fees. We found that extreme weather events only compound these existing challenges, by putting more pressure on cash flow and savings, or necessitating the use of additional loans to rebuild.

The dramatic differences in how droughts and floods impact MSMEs and their communities provide a window into the complexity of building resilience to climate change. This is a strong reminder to investors, funders and innovators that building climate resilience will require right-fit solutions that respond to the local context.

THE OPPORTUNITY FOR RESILIENCE

This research demonstrates an opportunity and an imperative to better serve the changing needs of micro-retailers in the context of climate change. We see a number of specific products and services that can increase the resilience of micro-retailers, and we believe that digital platforms already serving MSMEs – e.g., those that are providing stock ordering and management, or working capital financing – can be used as the rails to deliver these tools. Here are three examples of those products and how they can be implemented through digital platforms:

Weather Information Services

The micro-retailers we spoke to were often unable to prepare for weather shocks because forecasts were unreliable or completely unavailable. Many used noticeable changes in their environment, such as a sudden temperature change, lack of rain during a rainy season or heavy cloud cover, as a predictor of an impending shock – a method that doesn’t provide reliable notice of a shock, or specific information about how to prepare.

We see a clear opportunity for startups to include weather information in their offerings to micro-retailers. But instead of simply offering a weather forecast, they could also provide actionable insights on preparation steps, alongside financial products or supply delivery scheduling, to help them navigate upcoming weather events.

Credit and Integrated Savings to Recover from Weather Events

There’s a high demand for loan products that fit the cash flows and needs of micro-retailers during shocks. But current digital credit products on the market are too expensive and inflexible, and buy-now-pay-later products are specifically designed for stocking goods that will be immediately sold.

Credit products to enable preparation and recovery from shocks could take many forms, including:

- Short-term loans, able to be quickly deployed without physical verification of collateral or shop space. This can provide a cash infusion to support micro-retailers in fixing small shop damages in order to reopen after a shock, or it could enable them to prepare for shocks in advance by pre-purchasing stock or supplies such as sandbags to avoid flooding damages. This could be coupled with buy-now-pay-later products after a disaster, to support restocking.

- A rotating credit line for regular customers of the lender’s digital platform. These credit lines could be coupled with weather information, stock planning and predictive ordering, to enable micro-retailers to pre-stock and be better prepared for disaster events.

We found that 85% of micro-retailers had used their savings to recover from a weather event, most often to provide for basic necessities immediately following a shock. We see an opportunity for digital platforms to integrate savings products into their offering to MSMEs, as this was found to be a critical enabler of resilience. We also believe that startups can consider more sophisticated integrations with credit products, such as using savings as collateral against longer, more flexible credit for planning and preparedness.

Adaptation Solutions

Some of the shop owners we interviewed expressed interest in solutions to adapt their shops in the longer run and safeguard their income in the case of disaster. These solutions are particularly important in the context of a longer-onset shock like drought, where community income and supply stock are disrupted more systemically. These solutions could take many forms, including:

- Shop fortification strategies to guard against flooding damage, such as stronger walls, raised floors or shelves.

- Cooling solutions such as refrigerators to store perishables for longer, or to add additional income streams during periods of drought or high heat.

- Planning and pre-stocking of key items, to ensure stock availability during a shock – both in the case of supply delivery delays during heavy rain, or lack of availability of goods during periods of drought.

- Storage solutions to keep goods protected and to avoid spoilage during a shock, like strong plastic containers that can resist high heat or water damage.

- Diversification of products sold through the shop, enabling micro-retailers to maintain their income if shocks create stock shortages or delivery delays, or if some goods (like those with paper packaging, or those that require refrigeration) are spoiled during a shock.

Many of these solutions will require creative financing products specifically designed for micro-retailers in this context, such as loans with affordable interest rates and longer repayment periods. We also see potential for innovative approaches that maximize the affordability of these products through cost-sharing via shared resource services, such as those for energy, storage and cooling, that are jointly purchased and used by multiple retailers.

As climate change escalates, we have an opportunity to positively impact 162 million MSMEs globally with tailored products and services. Over the past seven years, innovators have driven rapid progress to serve micro-retailers and increase their income opportunities through digital platforms. Now, we must leverage these platforms to design right-fit solutions to the urgent and changing needs of micro-retailers struggling to navigate climate impacts. To that end, we see the insights and recommendations from this research as the first step in a wider dialogue that Mercy Corps will be continuing with the ecosystem. Meanwhile, we’ll also be taking action ourselves, by exploring how our portfolio companies can incorporate climate resilience into their offerings, and how they think about their customers’ needs and aspirations in the context of climate change.

Read Mercy Corps Ventures’ full four-part article series here.

Bethany Kanten is the Director of Strategy and Operations at Mercy Corps Ventures. This article was written in collaboration with Hetal Patel, Mercy Corps Ventures’ Director of Investments.

Photo courtesy of Mercy Corps.

- Categories

- Environment, Investing, Telecommunications

- Tags

- climate change, innovation, MSMEs, research, startups