Redefining Shareholder Value: Why Respect for Communities is the Foundation of Impact Investing

Respect for communities is a focus that may seem obvious to impact investors. In global and domestic emerging markets alike, we are motivated to improve communities by respecting residents and their needs.

But to traditional investors, this approach may seem to turn the conventional model of value creation on its head. After all, isn’t the fund manager’s priority to maximize shareholder value?

The answer to that question is yes – but like fellow impact investors, we believe that value extends beyond basis points. At Enterprise, we improve lives and communities through the preservation and creation of well-designed, affordable homes, and connect them to resources like healthcare, schools, jobs and transportation. In our experience, the truly valuable investment places inclusive community benefit on the same footing as maximum shareholder returns. Using this more encompassing definition of “value” will mean investments deliver greater returns to all.

That’s why we start every investment with one question: Does it respect the community? I even say it aloud. This question is at the heart of everything we do, and it guides our approach throughout the course of our investment.

Work with the Community to Tailor the Investment

Respect starts by recognizing a community’s uniqueness – its energies, opportunities and assets. Enterprise has learned that the people who live and work in an area are a powerful resource for uncovering both strengths and needs, so we prioritize partnering with developers who believe the same.

In 2006, for example, we began what has become a continuing partnership with Seawall Development to revitalize the Remington neighborhood of Baltimore. The area was struggling in the mid-2000s: It had a 19% residential vacancy rate, a 23% poverty rate and a median household income of $28,000 – just 75% of the city-wide average.

Before laying a single brick, Seawall knocked on doors and held community meetings to get unvarnished input; they then engaged Baltimore’s government. This approach brought Remington residents and city officials into planning for the first of what are now five major investments – totaling $55 million in equity and debt – we have made in the area. In that first development, Miller’s Court, we helped finance the conversion of an abandoned can factory into affordable rental homes for teachers and office space for programs that provide enrichment opportunities for children in the Baltimore public schools.

Over time, some of the people who rented at Miller’s Court wanted to plant more permanent roots in Remington. The Seawall team saw this as another opportunity to help existing residents achieve a goal – turning vacant houses into homes.

Enterprise provided Seawall with the final piece of “but for” capital — that is, “but for these dollars, healthy, inclusive revitalization could not have proceeded” — for a series of developments that have made Remington a thriving neighborhood with amenities that residents wanted. There are new rental and retail options, as well a food hall that created jobs and brought people into the area. We also supported the opening of a job training facility, and we have another project with Seawall in pre-development.

Critical to Enterprise continuing to invest with Seawall is their commitment to respecting residents by redeveloping in a manner that avoids displacement. Seawall’s revitalization has focused on the long, arduous work of assembling vacant and blighted land from a disparate set of owners. Many of these owners had abandoned the community and were unwilling to invest in repurposing their property because they saw Remington as being too risky. But existing residents knew better, and the Seawall team listened. The result: Revitalization continues to attract new residents, businesses and other amenities that existing residents have sought for years. And there’s an added benefit: home value appreciation that is helping long-term homeowners build wealth.

No one can change the trajectory of a neighborhood alone. This perspective and collective effort helped create developments that fit Remington, leveraging community involvement to deepen the benefit of investments. It amplified the level of available resources, increased public/private partnerships, avoided relying too heavily on any one person or organization and helped assure that revitalization would outlast political changes.

Though there remains much to do in Remington, its residents are part of a more vibrant community. The vacancy rate has fallen by one-third, the poverty rate by 8%, and median household income has risen (in real terms) by one-third.

Verify and Measure with Data

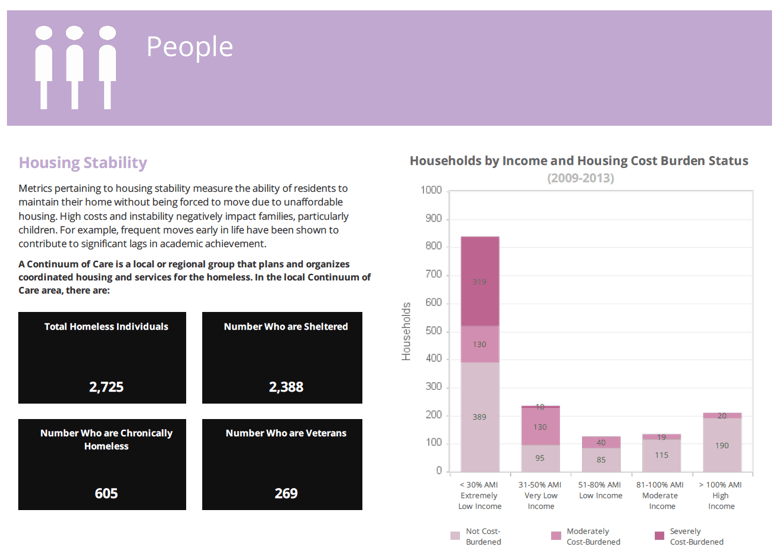

Enterprise adds data to community input when we consider investments. Our Opportunity360 platform provides an understanding of any census tract in the country based on five criteria that reflect a strong, sustainable community: housing stability, education, health and well-being, economic security and mobility. These measurements help reveal where investments can produce impressive returns.

By documenting key criteria, Opportunity360 also helps communities track change over time. It provides another way to see what kinds of developments produce benefits – for both the community and investors.

Broader Value Creation Doesn’t Sacrifice Risk-Adjusted Financial Returns

We strongly believe in a thoughtful risk-return profile. Spreading value creation among multiple beneficiaries, including the community and shareholders, mitigates against investment risk. Multiple studies have shown that impact investments tend to offer risk protections that traditional investments lack, and that they also tend to outperform traditional investments in bear markets.

At Enterprise, every investment we make must deliver credible, measurable community benefit and financial returns consistent with the risk profile. Because we believe that a sustainable portfolio must be balanced across risk and return, Enterprise provides a full range of fund options – from debt funds that deliver a very low-risk annuity, to conventional equity funds that provide the opportunity for higher financial returns commensurate with greater risk. All of them support transformative but respectful community change.

In all our impact investment work, we aim for balance – to balance the needs of multiple constituents, to balance data with on-the-ground input, to balance the risk and return profile of a sustainable portfolio. Most importantly, we aim to create communities that offer balanced opportunity: to long-time residents and newcomers, to homeowners and renters, to people working jobs of all kinds. Fulfilling that commitment is the ultimate way to show our respect – by bringing value to our communities and the investors who impact them.

Lori Chatman is the president of the Enterprise Community Loan Fund and a senior vice president of Enterprise Community Partners.

Photos courtesy of author.

- Categories

- Investing