COVID-Era Innovations With Long-Term Impact: How the Pandemic Is Changing Investment in Frontier Markets

Attractive trends have drawn many investors to Africa, with its growing middle class, rapid urbanization and leapfrogging innovations. At the same time, high transaction costs, small deal sizes and risk — real and perceived — have kept a lot of investors on the sidelines.

COVID-19 hasn’t helped. It has made it harder for investors to split their time across continents or fly out to meet founders and kick the tires on their businesses. There is a silver lining, though. Some of the innovations brought into existence by the COVID crisis will have long-lasting positive effects.

To take one example: The pandemic has moved even high-value purchases online, and normalized remote interactions. In the long term, these changes may help ease difficult challenges that predate the pandemic. COVID-era travel restrictions may ultimately shorten the distance between African and American businesses and investors, strengthening alternative channels that don’t require so many plane tickets. One big question now is whether these new technologies and structures can unlock growth and investment in Africa.

One Solution to COVID Restrictions: A Virtual Deal Room

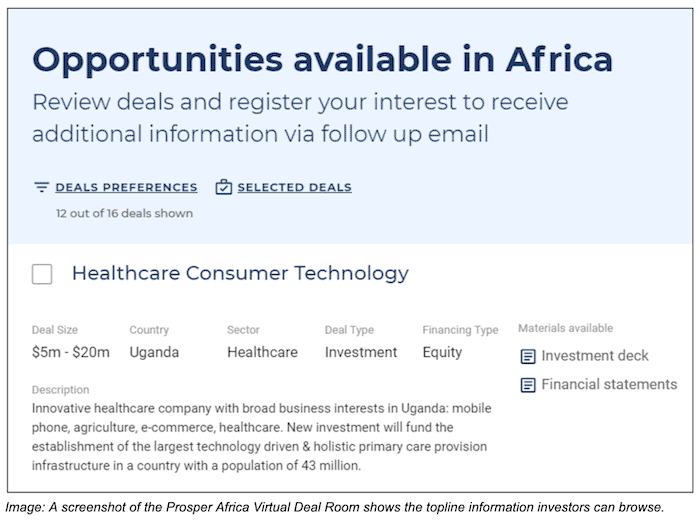

Prosper Africa is betting on it. This U.S. government initiative to increase two-way trade and investment between the United States and Africa is piloting a virtual deal room to raise awareness of viable transactions on the continent. For each transaction, the platform offers a tight summary along with the deal size, country and transaction type. It makes it easy for investors and companies to skim for opportunities that could be a good fit. Users register their interest in certain deals, and if they are a good match, they receive a package of information that gives them a head start on their due diligence.

The deal room is just the tip of the iceberg — an entry point into a support system to help mitigate risk, get to deal closure and ensure transactions are successful. For example, staff supporting the platform can connect users directly to transaction counterparties, and link them to other U.S. government resources such as trade financing, investment advisory support and more.

Behind the Prosper Africa virtual deal room are three key players: Prosper Africa Deal Teams stationed in U.S. embassies across Africa, CrossBoundary, an emerging and frontier markets investment advisory firm, and Asoko Insight, a leading data and market intelligence provider for Africa. With deep knowledge and networks on the continent, these players are serving as eyes and ears on the ground for investors and traders who can’t travel right now, who want reliable company information at their fingertips, or who may not be familiar with African markets and opportunities.

“I used to build investment pipelines for family offices, and a tool like this would have made my job so much easier,” says Vanessa Holcomb Mann of USAID INVEST, a program that supports Prosper Africa. “It takes a lot of legwork to track down deals and related materials.”

Prosper Africa Deal Teams, CrossBoundary and Asoko have done much of this pre-screening work — gathering information, meeting with entrepreneurs, and making sure that investors and trade counterparties will receive solid pitch decks and other documents. “We are not replacing investor or corporate due diligence,” says CrossBoundary’s Stephen Murray, “but we have been working in these markets for a long time and we have a good sense of where the opportunities lie.”

Well-Timed Tools with Long-Term Impact

With the world still in the grips of the pandemic, many businesses and investors have adopted a long-term posture that limits in-person work and travel. Private investors that paused new investments early in the crisis to focus on triage and portfolio management have since adapted to the new normal and found ways to work within it. Tools like this virtual deal room are well- timed, as they can help restore investment flows to their previous volumes.

“Investors may not be able to fly to Ethiopia or Nigeria right now,” says Greg Cohen of Asoko Insight. “It’s important that they are able to view deals, quickly understand if they’re quality, and start the due diligence cycle with more open eyes.”

The availability of these new tools doesn’t mean that investing and trading is likely to lose its human touch entirely in the long term. Once the current crisis has passed, most people will be eager to travel again to meet potential partners, demo products and tour facilities. Still, the last year will have lasting effects on how we live and work going forward. “There is an increasing comfort with doing more due diligence virtually and online. It’s clear that we will need both desktop and on-site due diligence moving forward, but the percentage that can be done at your desk is going to remain higher than pre-COVID,” says Murray.

International Development Agencies: Lowering the Barriers, Increasing Investment

The benefits to investors and traders are clear, but another group also stands to benefit from lower due diligence costs: international development agencies. Traditionally responsible for humanitarian aid and poverty reduction around the world, international development agencies also have a stake in lowering barriers for investors in emerging and frontier markets. Doing so can help mobilize private capital into post-conflict, frontier and emerging markets, to create jobs and address challenges that are too large to solve with limited aid funding.

Advisor intermediaries play a key role in all markets, but they are especially important in emerging and frontier markets where local networks and local context have outsize value. “Intermediaries are the gatekeepers,” says Cohen. “The advisors across the continent are the ones with the networks of deal opportunities, and they understand these complex markets. I don’t think you will ever lose this intermediary layer.”

Increasingly, development agencies are working with these advisor intermediaries to subsidize transactions that have a positive social and environmental impact and strengthen investment ecosystems. With their front-line knowledge, transaction advisers can help development agencies determine the type of concessional capital that’s needed in a given market or sector, helping donors use their resources strategically and avoid wasteful subsidies.

These intermediaries offer development agencies a deeper understanding of opportunities, potential sources of capital and the viability of different business models in different markets. They can also increase the sustainability of development programming. “When donors work with intermediaries, the differentiating part of the approach is that it’s not just about executing a deal. It is also a market-deepening exercise,” says INVEST’s Holcomb Mann. “When more successful deals get done in a market or sector, it establishes a track record, deal flow and investor interest. This groundwork reduces the need for donor-supported advisory services and drives demand for these services on a commercial basis.”

Investment and trade facilitation is not designed to replace traditional humanitarian or development aid. Instead, it aims to draw in the private sector to tackle the aspects of development challenges that have market-based solutions. It is by working together that governments, development agencies and the private sector have the best shot at sustainable, lasting change.

Kristin Kelly Jangraw is the Director of Communications for USAID INVEST.

Prosper Africa is the U.S. Government’s initiative to increase two-way trade and investment between the U.S. and Africa. USAID INVEST mobilizes private capital that is aligned with international development goals, and it supports Prosper Africa.

Photo courtesy of August de Richelieu from Pexels.

- Categories

- Coronavirus, Investing, Technology

- Tags

- COVID-19, impact investing