1.3% Isn’t Enough: The Case for More Diversity in Investment Fund Management

As a first-time fund manager building an impact-focused venture capital (VC) fund in Southeast Asia, I am deeply passionate about the value of fund management. I see the role of fund management as an important part of impact investing because it helps to set development priorities by leveraging finance: By deciding where to direct impact-focused investment capital, fund managers can have substantial influence on the overall direction of the global development sector. And more broadly speaking, fund managers in traditional investment funds can have a similar effect in gradually bringing an impact element to mainstream investing.

Currently, investment in SDG-aligned sectors falls short by about $2.5 trillion every year. That’s an enormous gap to fill. We can only cover this impact capital deficit by dissolving the line between impact investing and traditional venture capital. The current system of viewing impact and profits as two separate things has not served the planet or its inhabitants well.

A more conscious approach to capitalism can change this dynamic, filling the SDG finance gap and addressing many of the problems the world faces. And fund managers are essential players in the transition to a sustainable economy that puts emerging countries on a path toward self-sufficiency and resilience. Using our unique access and influence in financial markets, fund managers can both nurture entrepreneurship and innovation, and steer the businesses we support toward more equitable and impactful models.

Though investment capital can become a driving force to bring change to society and create a more positive world, this will only be possible when we have more diversity in the industry.

The case for diversity in asset management

Currently, women- and minority-led funds account for just 1.3% of the US $69 trillion investment industry in the United States — even though investment teams led by women and minorities perform better than funds that are managed by white men.

Until now, the asset management community has been very difficult to enter, due to persistent barriers that particularly impact first-time female and minority fund managers. Cultural and gender biases can make it difficult for women and people of color to raise capital from private and institutional investors. And fund managers generally need to commit 1-2% of the total capital for a new fund themselves, which prevents many women and minority fund managers from entering the industry. It’s a chicken and egg situation: Unless we break these societal, cultural and financial barriers, we can’t bring diversity to venture capital or asset management in general. And without more diversity in the industry, these barriers will be hard to break. That’s why we need to make a concerted effort to democratize venture capital to make it more accessible for people from diverse backgrounds, making it easier for them to start venture funds and play a role in creating a conscious economy.

Diversity at the asset management level will also define what kind of capital allocation happens in the broader investing ecosystem. Diversity can help us achieve inclusion, equality and equity at all levels. As Ndeye Thiaw, managing partner at Brightmore Capital puts it, “Diverse approaches lead to better investment decisions as they avoid ‘groupthink’ and allow the analysis of a single issue (or investment opportunities) from many different angles.”

The economic case for directing capital to diverse fund managers

According to David Bank at Impact Alpha, “Compared to the tens of trillions in the commercial capital, and even hundreds of billions in philanthropic capital for grants, capital to de-risk deals, bet on first-time fund managers, and target tough geographies and hard-to-reach customers may total only in the low billions.” That’s nowhere near enough to change the status quo in fund management. Supporting diverse fund managers can help change this dynamic.

There are three reasons why investors should consider directing their capital to emerging funds run by diverse fund managers from underrepresented groups:

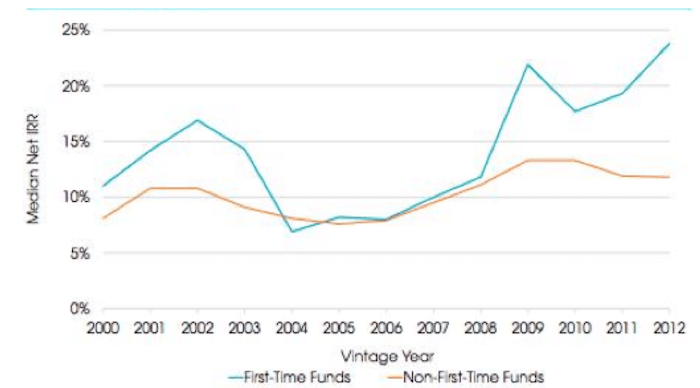

- Performance: Most emerging firms raise smaller funds than their more established counterparts. As a result, in venture capital, smaller funds generally outperform larger ones, as even a single successful investment can generate strong fund-level performance. And data shows that first-time fund managers usually outperform more experienced general partners (see the chart below).

- Pipeline diversity: Smaller funds provide access to a unique pipeline, especially if their managers come from diverse backgrounds. Less-diverse fund managers often talk about the pipeline issue when explaining their lack of investments in companies with diverse founders — but data shows that this is a myth. In contrast, studies also show that gender diversity among investors leads to more investments in diverse enterprises — for instance, female VC partners invest twice as much as their male counterparts in female founders. It’s clear that investor diversity can have a significant trickle-down impact on the diversity of a portfolio.

- New fund models: Greater diversity among fund managers promotes more unique, impactful and efficient venture fund models that are better suited for emerging markets. These might include revenue-sharing funds, venture studio funds, and blended investment vehicles.

Conclusion

We need to mobilize capital to a new breed of fund managers who are not only skilled businesspeople but also women and/or people of color. These fund managers think like venture capitalists and investors, but they are more likely to see finance as a tool to create impact. Boosting their involvement and influence in the industry can help fill the enormous investment gap in SDG-aligned sectors like health, education, energy, agriculture, etc. Over time, this can create a more equitable economy and drive trillion-dollar investments into SDG-aligned ventures, so that conscious capitalism will no longer be a small subset of venture capital/private equity, but will become a dominant contributor to this asset class.

Investing in diverse first-time fund managers will allow them to experiment, building new investment theses, differentiating their portfolios, and developing innovative financing instruments and new fund structures. Introducing diversity into fund management can also lead to a virtual circle, creating more diversity throughout the venture ecosystem.

As Sir Ronald Cohen said, “Capitalism has served us well over the last 250 years, but it has become untenable in its present form. It needs radical change.” Let’s bring that same spirit of radical change to the narrative of who raises capital and how it gets deployed, by diversifying and humanizing finance.

Sagar Tandon is a founding member of Moonshot Ventures.

Photo courtesy of WOCinTech Chat.

- Categories

- Investing

- Tags

- impact investing, SDGs