‘The First Wealth is Health’: Exploring the European Microfinance Award 2021’s Focus on Inclusive Finance and Health Care

“The first wealth is health,” wrote Ralph Waldo Emerson. How particularly true this is for the global poor, for whom health is often the dividing line between the path to prosperity or a slide into destitution. To make matters worse, the combination of typically volatile and precarious incomes and the absence of high-quality universal health care where they live means low-income communities not only need access to health care, but also the ability to pay for it.

For these households, paying for health care is a two-fold problem: First, accessing and affording quality health care may often be insurmountable challenges. And second, even for those who are successfully treated and fully recover from an illness or injury, the financial burden of the health shock can cast a shadow for years after.

This is why “Inclusive Finance and Health Care” is the topic of the €100,000 European Microfinance Award 2021, which seeks to highlight initiatives that facilitate access to quality and affordable health care for low-income communities.

The Health and Poverty Trap

The problem is enormous. The WHO estimates that in 2015, over 926 million people incurred catastrophic out-of-pocket health spending exceeding 10% of their household budget, with over 208 million people spending over 25% of their budget on health expenses. The severe financial hardship caused by these expenses pushes 100 million people into poverty each year. This challenge has grown considerably in the last year, and the consequences of the pandemic on the world’s most vulnerable may take years or decades to undo.

The problem is also fundamentally a human one. When facing the emotional stress of a health emergency, people often seek out any options, no matter how costly, to access treatment. For poor households, this can mean taking on debt, selling income-generating assets — or even selling their own homes. And when the health shock prevents an income earner from working, the loss of assets to pay for treatment is magnified by the loss of income. This risks a negative feedback loop: Poverty leads to bad health, which generates further poverty.

To break this loop, low-income populations need the means to access and pay for day-to-day “maintenance” health care (dentistry, optometry or prescriptions, for example), while also being protected from the devastating financial consequences of high-cost health emergencies — as well as chronic conditions that require treatment that’s unaffordable to all but the wealthiest of families. These needs follow a continuum, which can be subdivided into four levels based on an individual’s health situation and the financial pressures it entails.

At one end is regular and preventative maintenance: the small but regular expenditures for vaccines, insecticide-treated nets (ITNs) to guard against malaria and other miscellaneous needs, including investments in hygiene. Some, like ITNs, are very cheap, while others, such as installing plumbing, may be more costly. But the majority are typically affordable to most households. As a result, these preventative needs can usually be met with existing savings, small and short-term credit, and non-financial services such as health camps.

Level two includes the majority of health ailments: influenza, minor wounds, snake bites, many digestive disorders and even recurrent bouts of malaria. Most of these require medical (possibly urgent) care, but the cost is typically modest and affordable to most people. However, the challenge for these situations is that, even when predictable, they are still unplanned, meaning that cash-strapped households don’t have the funds at hand to address them on short notice. On the other hand, most of these needs can be met effectively by savings and short-term credit.

Level three includes serious chronic diseases: diabetes, certain disabilities, HIV and other long-term conditions. Most can be managed for years with modest costs, but they require continuous expenditures and can be a challenge to solve through financial services alone. In some cases, a combination of health insurance, savings and credit may meet the need. However, many chronic conditions may require expensive drugs that cannot be sustainably met without outside support.

Finally, at level four are serious and often sudden episodes of ill health such as severe accidents, heart attacks and other emergency situations requiring costly in-patient care. These typically impose the biggest financial costs, with potentially catastrophic effects on low-income households. On the other hand, most individuals will only rarely experience level four episodes, which is what makes them perfectly suited to insurance that spreads the risk — and cost — across a large group of clients.

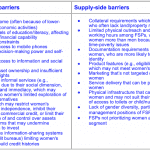

Needs also vary depending on the person and their context, as well as the illness. Some people may miss out on preventative care because of the costs of taking time away from work. For others, volatile incomes may mean delays in the treatment of fairly minor illnesses, turning treatable conditions into major or chronic problems. Rural and remote communities may not have certain medical services available at all. The poor and vulnerable can also be intimidated by health care professionals and may be reluctant to seek advice, or even embarrassed to reveal poor literacy or numeracy. And the needs and role of women in household health, both as child-bearers and as primary caregivers, are especially important. Understanding these complex needs is crucial for financial service providers (FSPs) looking to help their clients access health care.

The role of the financial inclusion sector — and the European Microfinance Award 2021

Those FSPs that serve poor households are well-positioned to facilitate health care access for their clients. The universe of potential interventions is wide. FSPs can provide services like dedicated credit, savings and (especially) insurance products to meet the broad spectrum of health needs described above. They can offer other financial products too, from pre-paid medicine to vouchers.

Moreover, FSPs’ strong and frequently high-touch relationships with clients (often mostly women) create an invaluable opportunity to offer a whole range of non-financial and value-added services. These could include bulk purchase discounts on pharmaceuticals, diagnostics and medical supplies; telemedicine consultations, health camps, check‑ups and screenings; health advice and information materials; and guidance on care providers and their respective specializations. This opportunity is enhanced by the fact that FSPs sometimes connect with these clients through group models that link members together with high social cohesion, making it easier to reach more people with these useful services.

All these financial and non-financial initiatives can be delivered across new digital platforms and incentivized with loyalty schemes. Meanwhile, the specialization needed for health care delivery means that many programs are designed to operate in partnership with a broad array of stakeholders in the health care sector, such as local clinics, pharmacies, NGOs or hospitals.

The role of the financial inclusion sector in innovating in this area has never been more relevant, so we are especially pleased that this year’s European Microfinance Award is focusing on the role of inclusive finance in health care. The net for applicants is being cast wide: Applications are welcome from any organization in eligible countries that facilitate access to health care among low-income populations through financial inclusion. This includes many different types of financial service providers that directly provide and/or facilitate access to health care. It also includes non-financial organizations that facilitate health care access, via partnerships or other relationships with FSPs.

The call for applications closes on April 13th and the evaluation process will culminate in the fall, with the winner of the €100,000 prize announced on November 18th during European Microfinance Week.

We look forward to applications from a diverse field of organizations in the financial inclusion sector that are pioneering ways to increase access to quality and affordable health care for low-income communities. Additional information on the topic, eligibility requirements, and application and evaluation processes can be found on the European Microfinance Award website.

Daniel Rozas is Senior Microfinance Expert and Sam Mendelson is Financial Inclusion Specialist at e-MFP.

Photo courtesy of Joe Cummings / European Microfinance Award.

- Categories

- Finance, Health Care