Courage, Optimism, Defiance: Impact Investment Exchange Founder Durreen Shahnaz Discusses her Journey of Empowerment

When she was growing up in Bangladesh, Durreen Shahnaz tended to rebel against tradition, preferring boys’ clothes to saris, and exploring the streets on her bike rather than staying indoors. Yet one thing she did not rebel against was the focus on charity that was central to her family’s Muslim faith. In the past three decades, she has been guided by her maverick spirit while staying true to her humanitarian values – a theme one can see clearly in her work.

After a U.S. education in economics, international relations and finance, Shahnaz held a series of positions across an array of sectors, from working on Wall Street at Morgan Stanley, to exploring microfinance at Grameen Bank, to launching successful social enterprises of her own. This path eventually led her to found Impact Investment Exchange (IIX), the world’s first social stock exchange, along with IIX Impact Partners, one of the largest crowdfunding platforms for impact investing, and IIX Foundation. She is the recipient of the 2017 Oslo Business for Peace Award and the 2016 Asia Society Asia Game Changer Award, and was named the 2017 GSG Impact Market Builder of the Year.

We spoke with Shahnaz to discuss IIX – currently celebrating 10 years in the service of “women, peace and parity” – as well as her own motivating forces and the experiences that have shaped her approach to investing. (Her responses have been edited for length.)

Katie Beasley: You’ve spoken frequently about your experience growing up in Bangladesh: witnessing the Bangladesh Liberation War, giving alms to beggars and the burden of being the fourth in a family of girls. In your view, how did these early experiences set the stage for your unconventional career path?

Durreen Shahnaz: My vision, courage and defiance to build a more inclusive world arose out of my personal story—journeying from the back streets of Bangladesh to the Wall Streets of the world. Growing up in war-torn Bangladesh opened my eyes to the realities of inequality and the need to empower underserved communities—especially women—to build a sustainable, peaceful future. Growing up a girl in a conservative Muslim environment made me DEFIANT. I did not believe that my gender defined my worth, so I set off to prove them wrong. Moving to the U.S. at 17 validated the potential I saw in myself and gave me the COURAGE to shape big dreams for how I wanted to change the world. Eventually I became the first Bangladeshi woman on Wall Street, where I realized that financial markets were both a powerful force in society, as well as an elite club that excluded large communities around the world.

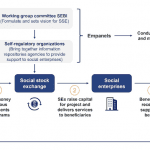

Impact Investment Exchange (IIX) was born out of this bold vision to transform financial markets by innovating a new approach to sustainable peace. Since then, our work has grown to span the entire social capital markets value chain – empowering impact enterprises that are addressing the root causes of inequality and conflict; valuing and including their most vulnerable beneficiaries in financial markets; changing financial systems to drive sustainable development; and building opportunities for anyone, anywhere to contribute to a more inclusive world. In practice, we accomplish this through our proprietary impact assessments and catalytic accelerator program; our innovative and blended financial products; and our education and advocacy work.

KB: What is your earliest memory of a time you exhibited entrepreneurial tendencies? Why do you think this tendency grew into a successful lifelong vocation for you – and what might prevent other aspiring women entrepreneurs in emerging countries from following a similar trajectory?

DS: My passion as a child was to collect stamps. I had never left Bangladesh, but I loved to study the stamps and the related history of their countries. Although I could barely speak or write English, I had a “pen pal” overseas to improve my English and expand my stamp collection. Then I wanted to take my stamp collection to the next level and started trading and selling stamps. My stamp business grew, but then I had a payment issue. My mom was so angry at me (because “girls are not supposed to do business”), that she took away my collection and gave it to a male cousin. This was my first taste of entrepreneurship and the “risks” associated with it.

When I first started working in New York, I remember having to learn not only the language of finance, but how to dress right, how to be comfortable working in a very male environment, how to use U.S. sports lingo and how to laugh at myself – all of this while maintaining the stamina to work 100-hour weeks. All this would not have been possible if I did not have an ultimate goal in mind. I had an incredible sense of responsibility towards Bangladesh and the rest of the developing countries. My sense of defiant optimism has enabled me to pursue my dreams in spite of the odds, and we need more women entrepreneurs to have the opportunity to do the same. This inspired me to found, grow and eventually sell my first company oneNest, which was an online marketplace for handmade goods. oneNest worked with and empowered over 500,000 women by giving them access to markets.

Through my personal experience as a serial entrepreneur, I saw first-hand the barriers that women face at every turn to grow their businesses. Now with IIX, after having supported impact enterprises around the world for the past decade, I’m excited that we will be dedicating more of our work to empowering women-led and women-focused entrepreneurs in developing countries. Through a partnership with the Australian government, IIX will soon be launching Equity@Scale, a program that provides women entrepreneurs with access to business mentoring, investment readiness, technical assistance and capital raising support.

KB: You’ve approached social impact from the perspective of both an entrepreneur and an investor. How would you distinguish the impact you’re making via investing at IIX from the impact you made as a social entrepreneur with oneNest? Was there any reason you decided to migrate from one approach to the other?

DS: IIX is unique in the space of impact investing precisely because we are able to bridge the gap between investors and enterprises. More than just investing, IIX brings an entire ecosystem approach – by supporting trailblazers with impact assessments, technical assistance and our award-winning accelerator program ACTS; connecting them to investors through our Impact Partners crowdfunding platform; creating innovative financial products such as the Women’s Livelihood Bond that unlock greater private capital and amplify public resources; and sharing our experiences and methodologies with the next generation of leaders. We developed this ecosystem approach because it is what is needed to catalyze society-wide participation and effect real, long-term change.

Through this approach, our work has grown to span 46 countries, and we have unlocked US $109 million of private sector capital to support 146+ enterprises, avoided over 1 million metric tons of carbon and impacted nearly 77 million direct and household lives.

IIX’s work and approach make us a unique social enterprise—one that is nimble and is growing exponentially. Our reach, growth and impact are a testament to our success.

KB: What are some of the most impactful and innovative women-owned and -focused social enterprises you’ve encountered in your work at IIX – and do they share any common elements that are key to their success?

DS: I have had the privilege to work with inspiring impact enterprises who are innovating solutions to some of the toughest social and environmental challenges. At IIX, we see those innovations which are empowering society’s most vulnerable communities—especially women—as having the most potential for long-term, sustainable growth. One example is SOLshare, which is providing rural women in Bangladesh with light for the first time in their lives through an “Airbnb” model for solar energy. Another example is ATEC Biodigesters in Cambodia, which is giving women access to clean energy and clean cooking solutions that reduce their exposure to household air pollution and increase their families’ livelihoods.

KB: In your view, what are the most urgent challenges facing the global fight for gender equality? How is IIX confronting them?

DS: Much of our work—from our impact assessments to our innovative financial products—seeks to tackle one of the toughest challenges in the world – the systematic exclusion of women from financial markets and from a dignified life. Because women have a unique capacity to reshape their lives, families, communities and countries, we must shift deeply embedded dynamics that treat women as victims, to empowering them as solution builders.

One of the key barriers to the global fight for gender equality, especially as impact investing becomes mainstream, is the extent to which we are truly giving underserved women a voice, and ensuring that our financial markets are valuing them for the force that they are in society. At IIX, we’re addressing this challenge through Values, a platform solution that helps enterprises better serve vulnerable communities by incorporating their voices in impact measurement.

By giving value to those who are excluded and invisible to financial markets, we can better ensure the long-term sustainability of impact enterprises, as well as the sustainability of investments. By tying the voices of beneficiaries to impact assessments, and impact assessments to investment dollars, we also hold everyone accountable to building an equitable and inclusive future.

KB: Who were some of the mentors that inspired you and shaped your desire to pursue social impact in your career? What guidance would you give to women seeking their own professional mentors?

DS: My journey as an entrepreneur was a lonely one. Finance and Wall Street were male-dominated – with little resources for women such as myself to access mentors. When I started my first company, investors and VCs would not meet with me. These experiences have given me a deep understanding of the challenges that women-led and women-focused enterprises face—limited access to human capital in the form of technical assistance and investment readiness support; social capital in the form of mentorship and skills development; financial capital in the form of investment and capital; and economic capital in the form of access to markets and business networks.

That is why IIX is looking to change these deeply embedded dynamics through our Equity@Scale program. With a decade of experience building the impact investing market and driving women’s empowerment across the world, IIX will leverage its ecosystem and gender-focused approach to support the growth of 500 impact enterprises across Asia. With an emphasis on shifting gendered power dynamics in favor of women entrepreneurs and accelerating the growth of gender lens investing, Equity@Scale will incentivize impact enterprises to integrate women throughout their value chain. The program will also provide impact investing ecosystem players (including investors, foundations, banks, financial service providers, lawyers, corporate partners and mentors) with the tools and resources to apply a gender-lens to their business approaches, processes and strategies of engagement.

I want the younger generation of women entrepreneurs to have the opportunities in mentorship that I did not have.

KB: Is there any additional advice you would give to young women looking to spearhead new forms of change in the social impact space, as you have done throughout your career?

DS: The world needs more ambitious, optimistic and defiant women. Hold onto the truth that you are right and that your dreams will come true. Be defiant to the system that puts chains on you, but at the same time keep your optimism that you can make the world a better place. The world needs you.

Katie Beasley was a communications specialist at NextBillion.

Photos courtesy of Impact Investment Exchange, via YouTube.

- Categories

- Investing