Mainstreaming Impact Finance: Major Momentum and Gaps in the Transformation of the Financial Industry

A few weeks ago, the Business Roundtable – a group composed of leading American CEOs – made headlines by announcing that they were shifting from shareholder primacy (putting their shareholders first) to a commitment to all stakeholders. The move signaled a new level of mainstream corporate interest in sustainable business – but it wasn’t the first sign of this evolution. In the world of finance, the past few decades have seen a slow shift from more traditional investments to socially responsible investing (SRI), ESG (environmental, social and governance as three central factors to measure the sustainability and ethical impact of an investment), and about a decade ago, to impact investing.

These three types of investments can be loosely grouped under the banner of “sustainable finance.” But despite the significant progress made in sustainable finance since the 1970s, challenges remain.

A Major Gap in the Sustainable Finance Model

Some large companies are very good at showing that they have good governance, and that within the company they are sustainable and responsible. The problem is that they are not bound to demonstrate the same qualities for their value chain – their supply and distribution remain someone else’s responsibility. That’s quite a glaring gap.

Think of it this way: If you don’t include all your impact within your economic or financial model, it is much easier to make things look good. For example, a fashion company may track and report on key performance indicators (KPIs) that make them stand out as leaders in sustainability within their industry, such as working conditions and labor rights. But if they do not factor in the fact that the chemical dyes they use end up downstream from them and affect the whole ecosystem (to name but one example), the cost of preserving the environment or cleaning up pollution is shifted to someone else. It becomes a hidden cost; an externality.

In its corporate report, however, this company may look outstanding thanks to their occupational health and safety program, protection of worker’s rights, and any other number of data points they do report on. This does not mean these issues are not important – merely that they represent an incomplete picture.

A Comprehensive View of Impact

What is needed is improved reporting that goes hand in hand with an enforcement mechanism, so that if the results of the reporting are negative or not up to par, something is done about it.

Building on lessons learned from across sustainable finance initiatives in the impact investing industry, as illustrated by AlphaMundi’s practice, we do not rely on reports by our portfolio companies themselves to determine if they are sustainable. Instead, we’re committed to identifying and tracking what impact means. To do so, we follow global standards such as the International Finance Corporation’s recently established Principles that enhance the transparency of reporting and provide an impact validation mechanism, and the Global Impact Investing Network’s IRIS+, the common impact measurement framework of the impact investing industry.

Applying these sorts of tools to the example cited above, the fashion company would have to be transparent about what they are measuring, and who is doing the measurements. Third party reporting, complemented by community input, would transform their corporate report from an internal narrative to a more complete representation.

Mainstreaming Impact Finance Practices

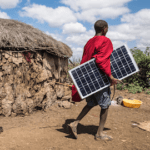

Even though many consider impact investing as a niche, I believe we need to mainstream these impact finance practices to transform the rules of the game, and bring sustainable finance into the realm of the Sustainable Development Goals (SDGs).

Ten years ago, this goal seemed unlikely. When impact investing began, no one knew if the industry would deliver on its promise of financial and impact returns. Since that time, it has not only delivered on this potential, but has regularly exceeded expectations.

Based initially on emerging markets with a focus on private equity and private debt, today impact investing has shown its value across most asset classes and all geographies. More and more innovative investment products are being created – from real estate to cash, listed equity and bonds – which is exactly what is needed for the industry to grow.

Although some sceptics might say that impact investing amounts to a “mere” US $500 billion in investments so far – as compared to the US $300 trillion or so under mainstream management overall – that is beside the point. Whatever the current totals, our common goal should be to increase the percentage of global capital that can measure its impact, and hence contribute significantly to achieving the SDGs.

If we wanted to take it a step further, it would be ideal to rethink fiduciary duty and redefine the standards that are used to determine if asset managers are diligent in their pursuit of risk-adjusted returns for their clients. This restatement of fiduciary duty requirements would put the onus on mainstream assets managers to justify why they don’t propose sustainable finance products to their clients and prove that they cannot earn the same risk-adjusted returns with such products.

A more systematic education of investors, fund managers and other finance professionals on sustainable finance, instruments and practices is also needed. This could develop a common understanding and shared knowledge, bridging gaps between capital owners, asset managers and the providers of SDG-related investment opportunities. The inclusion of a sustainable finance chapter in CFA exams, the regulatory requirement for asset managers to pass a sustainable finance certification every other year, and the integration of the sustainable finance agenda in the KPIs of financial industry professionals are some of the tools that are already being considered to achieve this.

With the climate breakdown one of a myriad of sustainability challenges we face today, it is imperative that we harness all available resources to shift our habits and systems to sustainable alternatives. Using the guiding framework of the SDGs, it is only together – across sectors, industries, skillsets and geographies – that we stand a chance to make significant progress.

This is the message that will be conveyed not only by a few impact investment firms, but by key stakeholders of the financial industry that will be present in Geneva, a natural hub for such initiatives, through the first Building Bridges Week taking place in October in Switzerland. The event will feature the United Nations Development Program’s SDG Finance Geneva Summit, taking place on Wednesday Oct. 9 at the Credit Suisse Forum.

Here, 200 senior investment professionals, international development experts, family office principals, large corporates and seasoned emerging markets entrepreneurs will gather to showcase transformative SDG-related investment products and SMEs. Together, they’ll discuss both lessons learnt from the first decade of impact investing and the industry’s future prospects, and forge new partnerships to redirect mainstream capital to SDG-aligned investment products and ventures.

The event has the potential to further catalyze the ongoing transformation of finance, leveraging the industry’s power as a force for sustainable impact in a world that greatly needs it. If this transformation continues, it could demonstrate the truth behind the words of Dennis Gabor, the 1963 Nobel Prize in Physics, who said: “We are still the masters of our fate. … The future cannot be predicted, but futures can be invented. It was man’s ability to invent which has made human society what it is.”

Note: AlphaMundi is a partner of the SDG Finance Geneva Summit 2019 and of the Building Bridges Week.

Tim Radjy is Founder and Managing Partner of impact investing firm AlphaMundi.

Photo courtesy of Devanath.

- Categories

- Investing