Measuring Environmental Performance in Microfinance

To meet the SDGs, the industry needs to establish lasting metrics

Three of the Sustainable Development Goals (SDGs) for 2030 include:

(1) ensuring availability and the sustainable management of water and sanitation;

(2) ensuring access to affordable, reliable, sustainable and modern energy; and

(3) promoting sustainable agriculture.

But what is the role of the microfinance industry in reaching each of these goals? How can the industry integrate the principles of environmental sustainability into its daily operations? How can microfinance become more “green”? Of the 1,100 microfinance institutions (MFIs) reporting social performance information to the Microfinance Information Exchange (MIX) in 2014, 40 percent reported that they raised clients’ awareness of environment impacts. Additionally, 34 percent claimed to have some form of environmental risk management in place and 19 percent said they offer environmentally-friendly credit products.

However, the current approach guiding MFIs puts the focus on qualitative forms of measurement rather than on outcome and outreach indicators. The microfinance sector lacks a set of established metrics to track its green performance management. For instance, some funders and networks promote an exclusion list, or the types of partners they avoid because of poor environmental practices. Other MFIs are implementing pre- and post-disbursement assessments of the environmental risk of financed activities; yet we don’t know how many loan applications are rejected because of their environmental risk. As for other areas such as poverty reduction, employment generation and female outreach, microfinance stakeholders need to agree on and facilitate green reporting standards to measure the role of the sector in reaching the SDGs.

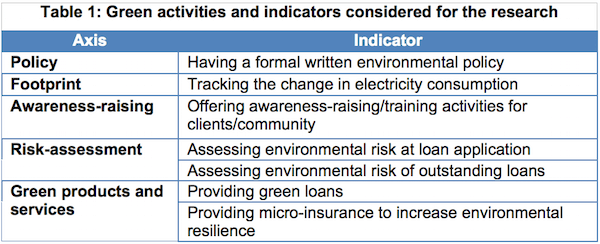

To this end, MIX and the European Microfinance Platform (e-MFP) Microfinance & Environment Action Group have taken the first step by testing indicators relative to five axes (Table 1) to establish which quantitative green indicators are easy to track and useful for decision making.

Invitations to take part in this survey were sent to representatives of 204 MFIs that had previously reported to MIX, or were already known for implementing at least one type of environmental practice. The results of the survey, covering 87 MFIs from Latin America and the Caribbean (28 percent), Eastern Europe and Central Asia (24 percent), South Asia (24 percent), East Asia and the Pacific (11 percent), sub-Saharan Africa (8 percent) and the Middle East and North Africa (5 percent), are published on MIX’s website and summarized in a Tableau dashboard.

Tracking the number and value of green loans turned to be the first and easiest step toward green performance outreach monitoring: 89 percent of MFIs offering green loans reported the number and/or amount of outstanding green loans, and 60 percent and 85 percent of respondents consider these figures easy to track and useful for decision making, respectively. On the opposite side, tracking the environmental risk of loans prior to or post-disbursement is decidedly the most difficult as it requires MFIs to put in place not only strict operational policies but also specific assessment and tracking tools in concert with support organizations. However, the fact that lending is the greatest indirect source of an MFI’s environmental impact makes external risk management a key area to be addressed.

Our study found that an important gap persists between the usefulness of an indicator and the MFI’s capacity to track it. For instance, 84 percent of MFIs consider assessing the environmental risk of outstanding loans to be useful for decision making, but 63 percent find it difficult to track. Support organizations, and notably technical assistance providers, have the opportunity to create training tools that enable these institutions to incorporate green quantitative indicators into their dashboards. At the same time, institutions do not always have enough incentives to track indicators even when they have the ability to do so. For instance, 53 percent of MFIs that offer green loans reported that they do not track the number and/or the amount of this type of credit product despite finding this information both useful for decision making and easy to track.

Therefore, funders have an important role to play in designing incentives that encourage MFIs to establish a comprehensive green management strategy and track progress toward their goals.

Top image: Adedotun Ajibade via Flickr.

Armonia Pierantozzi is Senior Social Performance Analyst at MIX, a nonprofit data analytics organization that promotes financial inclusion through data and insight.

- Categories

- Environment, Impact Assessment