Shift to ‘innovative’ financing to achieve 2030 SDGs pushed

Monday, October 30, 2017

If countries in Asia and the Pacific, like the Philippines, will achieve the Sustainable Development Goals (SDGs) by 2030, their governments must turn to innovative financing models.

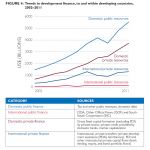

In a report, the United Nations Economic and Social Commission for Asia and the Pacific (Unescap) Korea’s Science and Technology Policy Institute (Stepi) said meeting the SDGs worldwide could amount to $2.5 trillion.

The Unescap and Stepi said the amount cannot be financed by donors and governments alone, thereby requiring the use of innovative financing models.

“It is imperative to implement innovations that can divert private capital toward development objectives to help bridge the SDG financing gap,” UN Undersecretary-General and Executive Secretary of Escap Shamshad Akhtar said.

“The Innovative Financing for Development in Asia and the Pacific report aims to spark ideas and knowledge sharing to help stimulate further action to develop the innovative financing solutions urgently required for the advancement of the 2030 agenda,” she added.

These innovative financing models include the Women’s Livelihood Bond (WLB), which provided $8 million for microfinance institutions in Cambodia, the Philippines and Vietnam.

Source: Business Mirror (link opens in a new window)

- Categories

- Impact Assessment, Investing