With the 2030 SDGs Looming, the Public and Private Sectors Team Up for Global Health

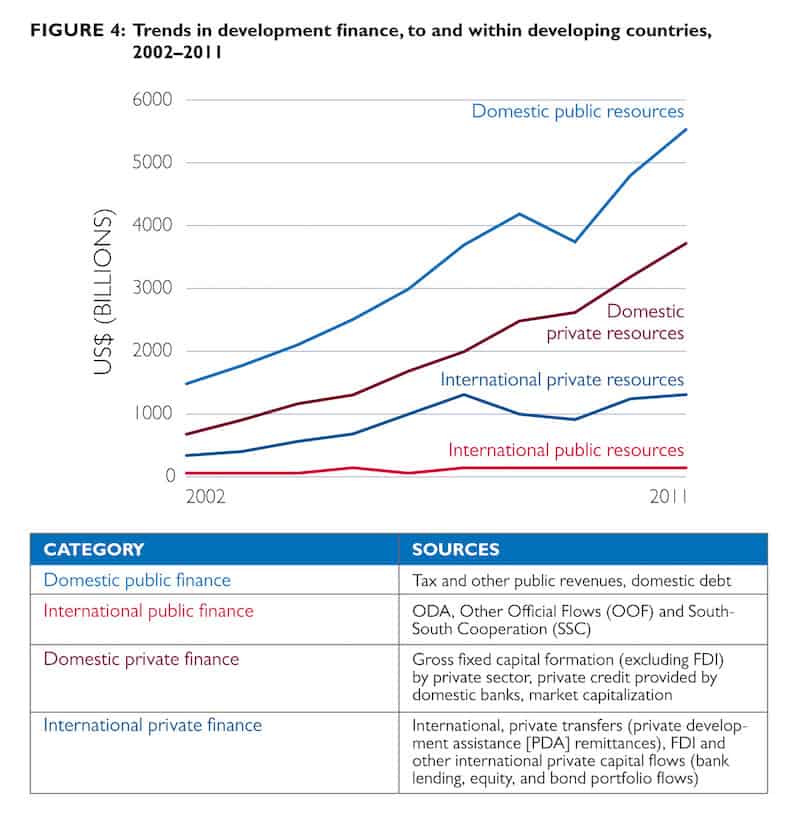

There is a common misconception that when it comes to financing global health, only actors like international donors and local governments are involved. However, the development finance landscape is shifting: Official Development Assistance (ODA) has plateaued or decreased, and non-ODA resources coming from the domestic public sector, as well as the domestic and international private sector, are on the rise. The increasing private sector resources, in particular, indicate growing interest in investment opportunities that can achieve socIal impact. Importantly, markets in low- and middle-income countries (LMICs) are becoming more viable and attractive for private capital investment. Because some of these countries have the highest burden of many global health issues, there is great opportunity for the public and private sectors to join forces.

Source: Investing for Impact report.

This is timely because, although the global health community has made significant progress over the past couple decades, there is still a large funding gap and a lot of work left to do to meet the Sustainable Development Goals (SDGs) by 2030. This is where innovative financing and the private sector can play a major role.

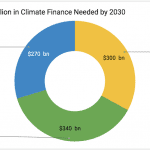

Donors like USAID, the Global Fund, DFID and the Gates Foundation have provided a substantial amount of funding toward global health — spending reached nearly $8 trillion in 2013 and is expected to reach around $18 trillion in 2040, according to The Lancet. Despite these large contributions from traditional donors, there is still a critical funding gap of $2.5 trillion annually in developing countries alone in order to achieve the SDGs.

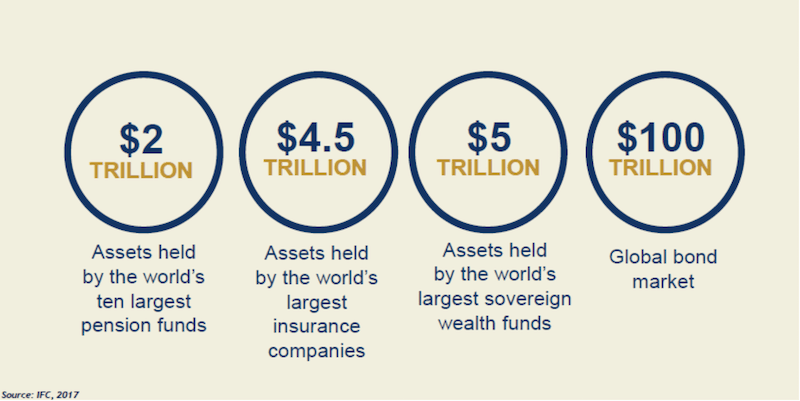

To close this gap, donors are applying more nontraditional methods of funding that engage different sources of capital. According to the International Finance Corporation and seen in the graphic below, there are trillions of dollars in private capital that can be tapped for development, amounting to $2 trillion in assets held by the world’s 10 largest pension funds, $4.5 trillion in assets held by the world’s largest insurance companies, $5 trillion in assets held by the world’s largest sovereign wealth funds and $100 trillion in the global bond market.

Nontraditional financing methods, such as pooled investment funds and development impact bonds, mobilize this private capital to create more sustainable, outcome-based funding, as highlighted in USAID’s Investing for Impact report.

Source: IFC

As these methods pick up momentum, public and private sector actors who do not typically work together are forging partnerships to combine their expertise and resources for maximum impact. One exciting and unique initiative is a recent partnership among USAID, Merck for Mothers, the UBS Optimus Foundation, PSI, Palladium and HLFPPT that resulted in the creation of the Utkrisht Impact Bond, a development impact bond (DIB) aiming to reduce maternal and newborn deaths in the state of Rajasthan, India.

The partnership launched the DIB late last year and signals a spark for future innovative financing mechanisms in the global health space. Through this first-of-its-kind DIB, the UBS Optimus Foundation raises capital from its private investors, which then goes to Palladium, PSI and HLFPPT. Those three organizations will work with private health care facilities in Rajasthan to help them achieve rigorous quality accreditation standards that could potentially reach up to 600,000 pregnant women and newborns over the next five years. An independent evaluator, Mathematica, will determine if the facilities meet the accreditation standards, and USAID and Merck for Mothers will repay a set amount only if the facilities have met these standards, reducing the financial and programmatic risk they face. If this initiative proves successful, the government of Rajasthan will invest in and scale up the intervention, demonstrating how sustainability has been built into the DIB.

In addition to this DIB, donors are looking for more ways to apply nontraditional financing approaches to help catalyze investment into important areas. For example, one recent USAID report, titled Closing the $2 Billion Gap, developed in partnership with the Financing Alliance for Health, identifies an estimated $2 billion funding gap for community health programs in LMICs. Community health programs are critical to achieving the health SDGs and nontraditional financing mechanisms can help donors, the private sector, and country governments introduce, scale and sustainably fund community health programs.

To highlight these funding opportunities and the recent launch of the DIB, as well as to continue the momentum of private sector engagement in global health finance, USAID and the UBS Optimus Foundation co-hosted an event at the UBS Offices in New York City in February this year. The event featured expert panelists from JustActions, the Financing Alliance for Health, PSI, the Rockefeller Foundation and Instiglio, who discussed their experiences and learnings from applying nontraditional financing approaches, and how these approaches can help us achieve the SDGs.

Moving forward, donors like USAID are actively seeking ways to continue working with the private sector. These partnerships can take many forms and directions, and each can provide unique opportunities for having the most impact in LMICs. Funding for global health is no longer able to follow its traditional path. Instead, it is time for the public and private sectors to team up and unlock the private capital that could bring us closer to meeting the SDGs.

Rachel Fowler is a program analyst with USAID Global Health’s Center for Accelerating Innovation and Impact.

Top photo credit: Paul Brown, GAPPS/USAID

- Categories

- Health Care, Investing