Seeking a Happy Ending: Will Nigeria’s New and Improved Financial Inclusion Strategy Work Better Than the Last One?

Two interesting, potentially game-changing things happened in Nigeria in July.

First off, the Central Bank of Nigeria (CBN) finally admitted something it’s been hinting at for some months now: The 2020 goals as described in the National Financial Inclusion Strategy (NFIS) are not feasible, at least not at the current pace. Secondly, the Bank has released an exposure draft of the amended NFIS.

This course correction is a welcome development. Between 2012 (when the first NFIS was released) and now, there have been many developments within the financial inclusion ecosystem and the country as a whole, necessitating a recalibration of efforts and targets.

The original NFIS was not a total failure. It gave us a tiered Know Your Customer (KYC) regime, agent banking guidelines and some decent consumer protection policies. Nevertheless, some of the proposed solutions in the document are no longer appropriate today due to the proliferation of new technologies and innovative practices. For example, increasing the distribution of point of service (POS) terminals across the nation was a major target of the 2012 NFIS, but there are now more cost-efficient channels for distributing financial services, making the issue of POS terminals a moot point.

The refreshed NFIS focuses on outputs and outcomes, while it wisely avoids prescribing specific approaches or business models – a critical weakness of the original NFIS. This creates space for actors to be innovative in their business models and service delivery.

The refreshed NFIS identifies five priority areas crucial to increasing financial inclusion in Nigeria all the way into 2020 and beyond. This article, infused with insights from our research, focuses on these priorities – and how the CBN and other government bodies can better advance them.

1.) Creating a conducive environment for the expansion of DFS

The refreshed strategy recognises the critical role of digital financial services (DFS) in the financial inclusion agenda, and aims to address constraints to DFS growth, including:

- Telecommunications: While urban areas boast 4G networks, 2G still reigns in some regions of Nigeria. The new NFIS recognises the necessity of universal telecommunication access across the country for DFS to thrive. This will require: implementation of the March 2013 National Executive Council resolution on right-of-way (which is meant to standardize the cost of permits for telecoms companies to deploy infrastructure on federal or state roads across the nation); incentives to providers; and access to the Universal Service Provision Fund (a special fund established by the federal government to facilitate universal access to information and communication technologies in rural, un-served and under-served areas in Nigeria).

- Providers: The current regulatory regime places restrictions on financial services providers, forbidding participation by mobile network operators that had led DFS growth in other markets. With financial inclusion being the focus, the new NFIS recommends opening up the sector to new players (regardless of the type) which should increase access to financial services nationwide.

- Consumers: DFS remains cost prohibitive for some. Many unbanked and underserved consumers live below the poverty line and thus find it difficult to afford financial services. The ecosystem needs to figure out ways to lower costs for intended users.

- Knowledge: Ignorance about DFS, and a lack of understanding about their workings and benefits to the end user are deterring the expansion of these services. Expanding DFS requires not just building infrastructure but also increasing the likelihood that people will use it: People can’t use services they don’t know about or understand. A major feature of the previous NFIS was its financial literacy agenda and target milestones. The new NFIS also recommends that stakeholders keep up with financial literacy efforts in order to reap the dividends of an engaged consumer base.

2.) Enabling the rapid growth of agent networks with nationwide reach

Agents are a relatively low-cost financial service point facilitating, amongst other services, the conversion of cash into digital money and vice versa. Presently, distribution and access to financial services is provided by bank branches, ATMs, agents and so forth, but they lack capacity. The high penetration rates of mobile devices has not translated into high adoption of DFS, and thus requires blended high- and low-touch mechanisms.

Third-party agents that operate with lower cost structures than bank branches are an alternative. The Committee of Bank Managing Directors has recently launched the shared agent network expansion facility to build a network of up to 500,000 agents in the next two to three years. However, the effective scaling of agent networks can only be sustainable when operational constraints such as profitability, liquidity management and fraud are addressed.

3.) Reducing KYC hurdles to opening and operating a bank account

Earlier this year, it was revealed that more than 60 percent of adult Nigerians lack any form of identification whatsoever. The inability of many unbanked citizens to establish identity or satisfy KYC requirements means they are prohibited from opening or operating a bank account.

The 2012 NFIS was instrumental in the establishment of the tiered KYC regime in which banks were permitted to have flexible account opening requirements for low-value and medium value accounts. This opened up financial access to previously excluded consumers, in spite of their being “identity poor” – albeit with limited transaction thresholds. However, in order to truly open up financial services to all Nigerians, a proper and all-inclusive identity framework is critical, and building it requires a harmonisation of all silos of identity records housed within the government’s ministries, departments and agencies.

4.) Create an environment conducive to serving the most excluded

The fourth priority area seeks to reduce inequality in access by making it easier for providers to serve the most excluded.

In the quest for financial inclusion, there is still little known about the unbanked and underserved poor who make up the most excluded segments. While a lot has been said (and written) about Nigeria’s high unbanked population, there is a need for qualitative data beyond the numbers; these are living people with wants and needs, daily habits, challenges and aspirations.

This data could help the private sector better target them with tailored services, thereby enhancing product market fit. It would also help with designing marketing efforts, as providers would better know and understand their target audience. Conversely, it could also help development actors and policy makers to improve their selection of beneficiaries, as well as improving their decision-making on the nature of the interventions that beneficiaries require.

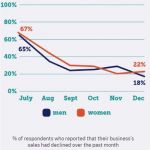

Speaking of the most excluded, the Global Findex Report published this past April revealed that, aside from the fact that financial inclusion levels in Nigeria have stalled and are even declining, Nigerian women are excluded twice as much as men. Thus, this enabling environment should also seek to bridge the gender gap in financial access.

5.) Drive adoption of cashless payment channels, particularly in government-to-person and person-to-government payments

The fifth priority area tasks government with accelerating the spread of digital payments through government-to-person and person-to-government payments. The benefits of this are threefold: to (a) establish trust by leading by example, (b) help drive the business case for building and growing distribution networks, and (3) put in place a forcing mechanism to include large numbers of unserved and underserved people.

Our research on the impact of government payments on financial inclusion reveals that recurring government payments, especially federal and local government payments, have greater impact on formal financial inclusion than informal inclusion. So the digitisation of payments such as government salaries, National Youth Service Corps allowances, conditional cash transfers and other Social Investment Programmes would have a significant impact on formal financial inclusion. However, this obviously requires amendments to government payments guidelines.

With the announcement of a new and improved NFIS and an invitation to industry stakeholders to critique and offer feedback on ways to improve it, the CBN is set to usher Nigeria into another chapter of its financial inclusion journey.

Hopefully, this time around, the story will have a happy ending.

Olayinka David-West and Ibukun Taiwo are members of the Sustainable and Inclusive Digital Financial Services initiative at the Lagos Business School.

Image courtesy of Shardayyy via Flickr.

- Categories

- Finance, Telecommunications