No One Should be ‘Scared to Live too Long’ – Innovating Insurance for the Elderly

I grew up in Cape Town in a middle-income household where, like many South African households, we employed a domestic worker. Her name is Pearl, and over the years I developed a close relationship with her. Eventually, I left Cape Town to work in Johannesburg as an actuary at an insurance firm.

After about five years I returned home and came across Pearl working in the hallway, but my perspective had changed 180 degrees since I last saw her. This wasn’t just Pearl my childhood companion; this was a woman in her late 60s whose body was clearly old and sore. I asked her why she still worked, given that I knew my parents would continue to support her if she stopped. Her answer was “Tyron, I work as much as I can [she worked at multiple employers on different days of the week] because I need to earn enough to support my family.” Pearl had children and grandchildren relying partly on her paycheque for support – to put food on the table and contribute to the kids’ education. She said she would sometimes wake up in the middle of the night, heart beating and eyes wide open, worrying about what would happen when her body finally got too old to work. Who would look after her family? Who would look after her?

Pearl then said the sentence that changed my life: “I am scared to live for too long in case I become a burden on my family.” I found it impossible to forget our conversation, and in a few months, we started Nobuntu to find a way to fix something deeply broken in our society.

That sentence – “I am afraid of living for too long” – is something we have heard time and again in talking to elderly low-income South Africans. It’s haunting to sit in an elderly lady’s township dwelling and look into her eyes as she says those words. Just writing about it brings an overwhelming feeling of helplessness and emotion – the urge to do something coupled with the disgust at how society has failed our elders.

You see, the South African insurance and pensions market, while very developed and innovative, is geared toward higher-income brackets where profit margins are, simply put, higher. The costs associated with onboarding a person are traditionally too high to be feasible for lower-income businesses, and the capital required to support guarantees puts it far out of reach of the ordinary low-income citizen. The result is a lack of access to products that can help low-income South Africans manage the financial risks they are exposed to.

It doesn’t need to be this way.

In a world where almost everyone has a phone (mostly feature phones in the South African low-income market), and where digital technology continues to make advances alongside big data and AI-driven innovation, things can be done better. We have reached a crucial juncture where we are able to combine old capital-efficient product designs with the latest in technology, to bridge the gap between an appropriate, sophisticated pensions product and lower-income populations.

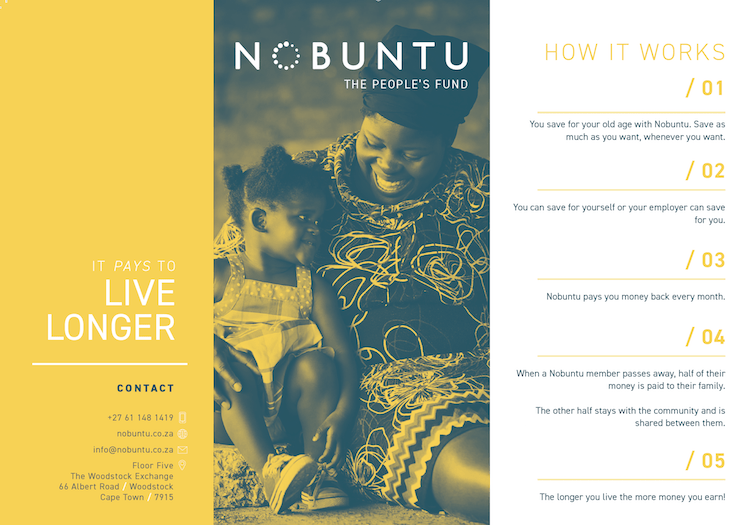

At Nobuntu we are repurposing the concept of a tontine, an ancient insurance design for sharing risk within a community, with a structure in which those who live longer are subsidized by those who pass away earlier. This takes the form of a pension offering that employers invest in on behalf of low-income employees. The employee then becomes a member of Nobuntu and may also invest. As their funds earn returns, monthly payments are paid to members. Yes, this is not a typical “pensions” feature like you may be used to in formal markets. This design feature is meant to actually encourage people to invest more. It also helps them meet short-term needs – and we offer/encourage the option to reinvest these proceeds. When a member passes away, half of what has been invested is paid to the member’s family, while the other half is paid to surviving members. The portion paid to surviving members is calculated based on each surviving member’s age and how much they have contributed to the fund. It also depends on the Nobuntu pool of which they are a member – with pool membership kept anonymous. The underlying funds are held with a large South African asset manager, and the mix of assets are chosen based on the individual’s age and time remaining before retirement.

As a financially sophisticated reader, you may be wondering “What happens at retirement?” – or you may be looking for a retirement-linked payment or term structure. This product, which we still call a “pension,” ignores the word “retirement,” which is simply not a useful term in the lower-income sector where people work until they cannot anymore. “Old age” is a more appropriate term than “retirement.”

We are thus able to offer customers an income that actually increases as they get older. This means living longer is now a good thing that pays well, rather than something to fear. Because the risk is shared amongst members, the vehicle is very capital efficient. We also make use of automated digital onboarding and automated personalized customer communications built for feature phones and smartphones. For example, a customer can send us a message saying “balance” and our chatbot will respond directly, giving them their current balance. By making use of integrations into various publicly available data sources, customer behaviour analysis and biometric tech, we also make it much easier to ascertain if someone is alive. This automation makes it much cheaper to service low-income customers. Since Nobuntu earns revenue through an administration fee, and not through the retention of underwriting profits (which is what makes it capital efficient), we are incentivised to be as efficient as possible in our administration efforts.

Earlier this year we received grant funding from the DFS Lab (a for-profit, U.S.-based entity, working closely with the Gates foundation) in order to build out this tech further, based on the use they see in it to enable financial inclusion in developing markets. That was a huge win for us, and a fantastic endorsement of the direction we are taking.

The challenges we face, though, are significant.

Our chief challenge is obtaining regulatory approval in order to offer our product at scale. We need an insurance partner with an insurance license, which allows us to sell our product commercially. Yet in a market set up to serve higher-income groups, it is a tough sell to get an insurance partner to back a firm like Nobuntu. The inevitable balance is between taking a product to market that meets our customers’ needs (this is what drives us as a business and as people) and one that meets a partner’s shareholder requirements. This dichotomy between having a social impact versus making money lies at the heart of for-profit impact ventures, and we are experiencing it firsthand in our struggle to get our product to market.

Another big challenge is that insurance is also an old, slow-moving industry where disruptive change is only just starting to take hold. The barriers to entry in insurance are enormous and the gatekeepers typically are conservative. While we have seen that the appetite to work with new technology and innovations exists, getting from interest to actual commitment is a long and tough road. Add to this the inherent belief that the lower-income market is notoriously difficult to break into – many have tried and failed – and you start to get a feel for the challenges we face when walking into a meeting with a potential partner or investor.

The obstacles are imposing and frustrating, but an advantage of being driven by a social imperative is that we have access to a much stronger and more sustainable power source. We will overcome these challenges eventually, but the race is on. The equation is quite simple: Find a way to build a product that has positive impact yet meets a partner’s needs – while overcoming years of legacy perspectives. Oh, and don’t run out of money!

Tyron Fouche is the CEO of Nobuntu, a South African social insurance venture that offers an innovative peer-to-peer pensions solution for low-income earners.

Photo by Rod Waddington via Flickr.

- Categories

- Finance, Social Enterprise