‘Results’ Don’t Equal ‘Impact’: What the Social Business Sector Can Learn from Non-Profits’ Approach to Impact Measurement

Most social sector actors agree that impact assessment is important. But in working with organizations across the for-profit and non-profit worlds, I’ve observed big differences in how the two sides of the spectrum tend to define and measure their impact – and these differences have implications for the social sector as a whole.

Non-Profit vs. For-Profit Definitions of Impact

When I worked in the international NGO industry, both as a Peace Corps volunteer in El Salvador as well as with various organizations throughout Central America and the United States, everyone seemed to be more or less on the same page in terms of the process for determining the impact we were aiming to create. When designing a new program, we would use a specific set of tools to help develop a project management and evaluation plan, which involved setting goals and creating targets for impact.

A lot of this planning, which is common in the non-profit world, is done to assuage donors who ask for an array of different metrics to prove that their dollars are going towards impact at the beneficiary level. Whether or not impact is actually achieved in the end is something that only time and evaluation plans can determine, since it happens over the long-term. Yet non-profits often recognize this reality, reflecting their long-term impact goals in their programmatic planning, and linking these goals to their measurement systems. This may be due in part to the fact that non-profits’ projects tend to last longer – they often run projects in communities for years, and they have to show that they have created systemic change or sustainable impact over the course of their work.

In comparison with the non-profit sector, impact investors and social entrepreneurs don’t always have a strategy when they first start to plan out and evaluate the impact they wish to create. Their primary focus is on ensuring that their business or investment is profitable, with a secondary focus on the potential for impact. This makes sense since they are reporting to other, profit-focused groups for whom they will need to create a return on investment. But this also means that their systems become focused on creating profit and building their business model first, then – once they have that figured out – going back and trying to measure the impact they have created. This basically ensures that they have no baseline data, and can’t really say definitively if their business or investment has created the impact they said they wanted to create when they started it. Indeed, they often end up blurring the lines between their short-term business results and their broader impact, using the former as a stand-in for the latter. I believe that this might be one reason why impact investors and social entrepreneurs as a whole struggle to come up with a unified definition of what counts as “social impact.”

This is not to say that non-profits are creating impact and for-profits are not, but that the terminology begins to become interchangeable when entrepreneurs and investors talk about results and impact – two terms which are actually very different. While most projects and investments produce results – whether they be short-, medium- or long-term, impact can take generations to achieve. In order to truly measure and know whether your enterprise or organization has achieved systemic impact, you will most likely have to keep measuring long after your investment has been exited or your project has concluded in a community.

For example, if you are an impact investment fund, you typically measure the following common metrics to show your investors that you are creating impact:

- Number of jobs created

- Number of direct beneficiaries

- Revenue generated

- New investment capital received (from outside investors)

Some funds take measurement a step further and also measure at the sector level or beneficiary level (like number of women benefitting from having a new job, higher salary or access to a new product or service). But the metrics listed above are generally accepted as the standard “impact metrics” for funds reporting their portfolio-wide impact.

Yet if you then look at what this means on a grander scale, it tells you nothing about quality and focuses more on quantity, which to me means that these enterprises aren’t showing impact, they are simply reporting on results. A job created means little if it’s not a quality job with good working conditions, benefits and the chance to rise within the company, for example. That’s why impact investors and social entrepreneurs need to go beyond just reporting numbers that do not indicate whether there was actually a significant social and/or environmental impact.

An Intuitive Tool for Impact Measurement

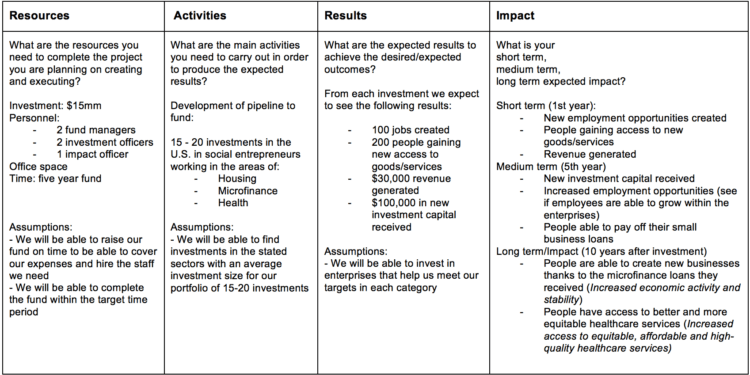

One commonly used tool in the non-profit sector that could be extremely useful for the impact investment and social entrepreneurship fields is the logical framework model (or LogFrame Model/Theory of Change). This model connects resources to activities to results and impact. The LogFrame model isn’t new or fancy, and it’s so intuitive that it may seem simple. Nevertheless, many impact investors and social entrepreneurs don’t use it or haven’t heard of it.

The model allows you to not only see the difference between results and impact but also to understand how they are connected and how to create overarching impact goals for your enterprise or investment fund. The beauty of the LogFrame model is that every section connects to the next, going both backwards and forwards in the process. This way you can see what needs to be done during each step in order to stay on track and reach the overarching goal of your impact – even if it’s not realized until after your investment or project has been completed. The model also allows you to note any assumptions you may be bringing to the table that might affect the goals of the project or investment – as well as any potential negative externalities that might be created.

Simple LogFrame Template

Example for an Impact Fund

As you can see in the chart, the exercise is simple: It’s something that I use with entrepreneurs and investors to train them on building out their mission, vision, goals and overarching impact, as well as help them note any potential unintended negative impact that could be created. The longer-term results should translate directly into the impact you wish to create with your fund/enterprise. The steps that come before that should be directly linked – creating a roadmap and benchmarks towards your overall impact goals.

Separating the terms results and impact, and understanding the differences between the two will be key if we in the social business sector want to prove that we are actually creating impact over the long term. Yes, results can in the short term create some measurable impact, on metrics like employment and wages earned. But if in 10, 20 or even 50 years, all we have to show are results-based metrics like jobs created or number of lives touched, we won’t really know whether our work has reduced poverty levels or helped communities achieve economic sustainability and security – just a few of the overarching goals we all say we want to achieve through impact investing and social entrepreneurship. Even more importantly, we won’t be asking the key questions needed to assess the sector’s growth and development over time, to ensure that it’s reaching its impact goals and mitigating any potential negative effects that its activities can create.

Sarah Sterling is the Director of Impact at Pomona Impact.

Image courtesy of qimono via Pixabay.com.

- Categories

- Impact Assessment, Social Enterprise