Daring to Think Big: Why It’s Time to Scale Impact-Linked Finance

It has been more than three years since Roots of Impact dared to think big and add an important twist to the pay-for-success model with Social Impact Incentives (SIINC). In our vision, the social performance of an enterprise had to be directly linked to its cash flow, with SIINC making payments to the enterprise to help maintain its financial stability. This, in turn, would allow it to pursue higher revenues and profits and increase its appeal to investors. And our model worked.

Yet in the time since we co-created SIINC with the Swiss Agency for Development and Cooperation in 2016, reality has shifted quite a bit. On the one hand, many high-impact enterprises still face the notorious pioneer gap or lack the resources to go deeper in terms of impact. On the other hand, the market has begun to accept that effective SDG financing will require novel, collaborative approaches and an openness to investing in impact across the entire returns continuum. In other words: The name of today’s game is blended finance.

Motivated by a number of live SIINC programs and their first encouraging results, we’re now jumping head first into the void between impact vision and market reality. The mission: scaling approaches that work. This follows our belief that rewards for positive impact can be built into financing instruments across the board. In a recent report in collaboration with the Boston Consulting Group, we asked ourselves one important question: “Is it possible for reward mechanisms to create win-win-win situations for donors, investors, enterprises and end customers alike, to avoid market distortions AND set the right level of incentives?”

Accelerating Impact-Linked Finance

The answer to this question is a definitive “yes.” By accelerating impact-linked finance through models like SIINC, all eyes continue to be on the main creator of value: the organization on the ground. Financial rewards are linked to positive impact and go directly to the enterprise creating it. As a natural effect, stronger financial performance creates a gravitational pull that attracts investors. This remains the basic idea behind SIINC and we are proud to see it working in practice.

For example, Clínicas del Azúcar, a network of one-stop-shops offering high-quality, cost-effective and specialized diabetes healthcare services in Mexico, exceeded results expectations for reaching base of the pyramid clients for the second SIINC measurement in a row. This was a positively surprising outcome – not least for co-founder Javier Lozano: “I was very excited by the results, and definitely by some unexpected outcomes because of SIINC, like the aligning of the executive team that produces results even beyond the scope of the project.” So why should we stop here with impact-linked finance models? There are many more areas where integrating rewards for positive impact can create a broad scope of effective financing instruments.

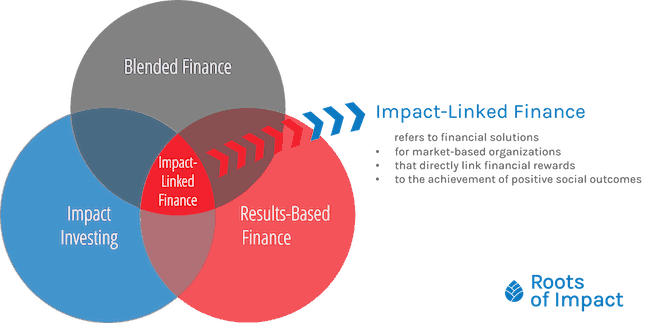

Imagine the best of three worlds coming together:

- the use of public funding to mobilize private sector investment (blended finance),

- the linking of positive social outcomes to financial rewards (results-based finance), and

- the targeting of market-based organizations to achieve risk-adjusted financial returns alongside impact (impact investing).

One core element of these three areas is a strong drive for additionality: Target organizations should be empowered to deliver outcomes that would not have happened anyway. An integral part of this goal is to structure finance so as to avoid windfall profits and market distortion. This will allow impact businesses to reach beyond their boundaries – an impact galaxy in expansion.

The Role of Outcomes Funds

No doubt, scaling impact-linked finance will be a challenging mission, with many roadblocks and bottlenecks ahead. To get there, concrete solutions must pave the way. One such solution involves outcomes funds, i.e.: innovative financing vehicles in which payments only occur if pre-agreed societal outcomes are achieved. Though these funds are not a panacea, they are a very hot topic right now – and rightfully so. There are, however, a number of tricky questions:

- How can such funds ensure that the emphasis is on the end customers’ welfare? (i.e. outcomes over outputs)

- How can they set the appropriate level of incentive payments for businesses generating outcomes? (i.e. not too high, nor too low)

- How can they efficiently generate and verify relevant data?

The theory behind an outcomes fund is that it can be more efficient in allocating capital than output-based aid or traditional grant-making. This can be achieved through a better targeting of resources. But how exactly? In our minds, the playing field must be levelled for all potential targets of investment, so that resources are allocated towards those with the greatest potential impact. There should be no preference for organisations at a certain stage, or those operating in a particular context: In other words, early-stage, local enterprises should get a real chance for support even if they do not appear to be the cheapest provider of an intervention.

This was the motivation for us to partner with the Lean Data and Energy teams at Acumen and create a “Blueprint for an Outcomes Fund in Off-Grid Clean Energy.” At the core of this blueprint is a mechanism that is sensitive to the context of a range of enterprises. Rather than focusing on the cost of the intervention as the primary factor, it considers more variables to determine the right level of incentives. These variables include the number of lives impacted, an inclusivity ratio (to factor in poverty levels), actual improvement in household welfare, and the specific context of the target region. Or to put it simply: One-size-fits-all impact pricing doesn’t do the trick.

Another major issue for outcomes funds is data collection and verification: Here, new approaches and technologies such as Acumen’s Lean Data, machine learning and blockchain have a strong potential to create value. By making data collection less costly and allowing for real-time verification and payment disbursement, the impact engine will get a further boost.

Sounds a bit like science fiction? Maybe. Yet with the 2030 Sustainable Development Goal targets approaching quickly and the SDG financing abyss in clear sight, it’s never too early to dare to think big.

If you’d like to receive webinar information and updates on Impact-Linked Finance, we’d be happy to keep you in the loop – just click here to sign up for our newsletter.

Bjoern Struewer is Founder and CEO, Rory Tews is Program Manager and Christina Moehrle is an advisor at Roots of Impact.

Photo courtesy of Bartosz Hadyniak/Roots of Impact.