The Secret Ingredient in Product Design: How Crossing the ‘Emotional Gateway’ Can Boost Financial Services

Mary in Tanzania walks into a bank branch for the first time. She sees a long line and waits for an hour, feeling scared and anxious as she doesn’t want to ask the wrong question.

João in São Paulo walks into a bank branch – he has to walk through a rotating door that is also a metal detector and gets stuck half-way through.

Ly in Cambodia opens an account with an microfinance institution, but a month later doesn’t know what to do with it.

Ly in Cambodia opens an account with an microfinance institution, but a month later doesn’t know what to do with it.

Anne who just graduated high school in the United States nervously opens her mobile banking app – she’s worried that she may not have any more money in her account.

Though the countries and contexts are very different, the emotions associated with financial services are somewhat universal – angst, fear and nervousness. It is rare to hear someone waking up in the morning with a huge smile saying, “I’m so excited about my bank account.”

Negative emotional associations with financial services increase when people are resource constrained, or when they don’t understand what happens to their money when it’s deposited in a bank. Add on a digital dimension, where those who are illiterate or don’t have a phone have yet another hurdle to surpass, and you have a recipe for failure.

There is a common exception to this rule: savings groups. Savings groups exist under different configurations around the world, but the premise is the same everywhere: A group of people in a community, often but not always women, save a set sum of money together every month, or every week, or even every day. They either allow one of the members to take the “pot” of money each time (called a RoSCA – Rotating Savings and Credit Association) or save it over time, lending the “pot” that continues to grow as members continue to save, and ultimately sharing out the accumulated money after a period of time, usually close to a year (called an ASCA – Accumulating Savings and Credit Association). These groups are found in Brazil, Tanzania, Nigeria, South Africa, India and dozens of other countries. They are called different local names and may work slightly differently in each country, but the emotional component is always the same. People love and trust their savings groups. They are familiar and have always been around.

How can formal financial service providers (FSPs) offer services that appeal to users in this way? What can FSPs do to create the kind of trust and affinity that people have for informal services like savings groups? They need to get one thing right: crossing their customers’ emotional threshold. If a person feels emotionally connected to a product or service, if it feels familiar, if there is trust, then a customer will feel good about using it.

Linking Known and Unknown

By 2015, the Aga Khan Foundation (AKF), in partnership with the Financial Sector Deepening Trust, had established more than 9,200 cash-based, ASCA-format savings groups with 180,000 people in the poverty-stricken southeast region of Tanzania. Two-thirds of all members were women. AKF’s most recent data shows that their groups have collectively and over time saved over $60 million since they began, and they’ve had an 83 percent annual continuation rate.

Although AKF’s savings group initiative has provided unprecedented access to finance to their group members, the approach has its challenges. Their members have been increasingly concerned about a lack of safety for their cash boxes, which can store millions of shillings, or tens of thousands of dollars, at a time. Moreover, cash counting and bookkeeping have become a tedious, time-consuming and labor-intensive exercise. Mistakes undermine group cohesion.

With the support and guidance of the Financial Sector Deepening Trust, AKF joined with Selcom and BFA to work on a digital savings group (DSG) product. AKF knows savings group participants, their behaviors and needs, and as such has become an innovator of digital and financial design for low-income populations in Tanzania.

The foundation has found that digitizing savings groups provides an opportunity for members to grow accustomed to using digital financial services within the “comfort of friends,” leading to a more confident use of mobile payments for other financial activities. It was clearly a great opportunity to link a known (savings groups) and an unknown (digital and formal financial services). This allowed AKF to create an offer with a true value proposition for the end user, a trusted and valuable service.

Designing for Emotions

The design process for AKF’s Boresha Maisha (Improve Life!) platform began in 2015, with the objective of eliminating cash and bookkeeping from savings groups without undermining their cohesiveness. The Boresha Maisha platform is cashless and paperless, but otherwise similar to the traditional community-based savings group approach. Group members continue to meet physically, retaining the socially supportive role that savings groups play. All members bring their mobile phones to the meetings and check that everyone has made their payments digitally to the shared pool of savings. Today, the platform is testing user experience with live groups in a pilot project to research behavioral change and further improve the offering. For example, the research is testing whether group members are more comfortable with a wider variety of mobile phone use cases – sending and receiving texts, for example – than they were prior to using the platform, or even more interested in using mobile money to pay for other things, like school fees. The research also tests for any “negative” impact on the savings group, such as a decrease in group cohesion, now that payments could be done digitally.

One of the keys to using savings groups to make women more comfortable with digital services is the high frequency of multiple use cases involved in using them: Savings groups pay in, share out, check balances, keep track of loans, and pay out each loan. The groups are therefore a natural entry point to familiarize new users with mobile payments, to acquire consistent transactions, and to increase people’s trust and comfort level with other financial services.

Savings groups provide members with an opportunity to get used to using digital financial services within a safe community. The more sophisticated members of the group are incentivized to help those who are less digitally literate to make their own transactions. This allows not only for financial inclusion, but also becomes key in easing people into the financial and digital world through a positive emotional association.

AKF is now piloting its Boresha Maisha DSG platform with 11 of its savings groups for a full 9-month savings group lifecycle. Throughout the pilot, groups are being trained and evaluated on their use of the platform. Insights will feed back into product development as a key component of the design process. At the same time, participating digital groups will be compared with cash-based savings groups, to provide evidence of how (and whether) digital groups really do encourage confidence amongst group members in their use of digital financial services and build a bridge to crossing the digital divide.

The Key to Digital Financial Solutions: Find the Emotional Gateway

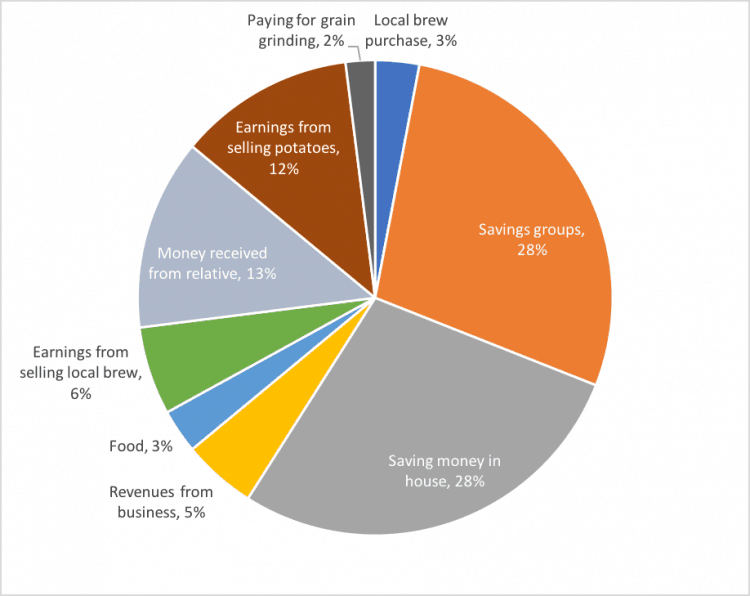

Chart 1 below provides a picture of the types of financial transactions that are most important in terms of volume and value for a typical smallholder household in a village outside of Mbeya, Tanzania. It details all individual transactions that take place in a month. The chart documents that savings groups constitute nearly one-fifth of all transactions this household undertakes in a single month and nearly one-third of the value of all transactions. Similar patterns exist in other household accounts.

Qualitative interviews among these households and through Financial Diaries research globally have shown that savings groups are emotionally important to households. This qualitative research provides clear evidence that households prioritize their contributions to savings groups over other payments. Emotional prioritization is in part what also led to the success of M-Pesa with its Send Money Home campaign, which connected remittances to filial duty.

Part of the emotional attachment to groups stems from the connection and responsibility that members experience in saving and contributing money in a broader community. Savings groups are central to people’s lives – as one South Africa Financial Diaries respondent said, “We would die without our umgalelo (savings groups).”

Chart 1: Destination shares of amount transacted in a Tanzanian smallholder household

Source: CGAP Smallholder Financial Diaries, run by BFA.

While companies and projects often prioritize person-to-person and agricultural payments as key payments to digitize, we see that households have greater volume and value in transactions with their savings groups. Given this, it makes the most sense for service providers to focus on acquiring savings groups’ transactions first, followed by other transaction types.

This then forms a big lesson for design: Find the emotional transactions in a household portfolio, the ones that are really important, and start creating digital financial solutions there.

The Emotional Tipping Point

The financial inclusion industry still struggles with an age-old challenge: low usage numbers. People register for mobile money and they open accounts in the millions. But use lags far behind – in many cases only 20 percent of accounts are regularly used. Many FSPs follow a cookie cutter approach. They see something that works in country X, so they build the same in country Y. “If you build it, they will come” seems to be their motto. Yet for over two decades that point has been continually disproven.

Based on AKF’s experience, the digitization of savings groups offers users something FSPs have not been able to offer: familiarity, trust, community and positive emotional associations. People are only rational actors in behavioral economics theories – in reality, they make decisions with their hearts and based on their friends’ recommendations.

The Financial Sector Deepening Trust’s aim in supporting the design of this product is that it will complement an ecosystem of digital payment opportunities for financial services – and very critically, for the micro-businesses that generate the majority of employment in Tanzania. Our hopes are that this product will cultivate a culture of female DFS users, given that savings groups’ membership is 66 percent women.

Crossing the right emotional threshold through digitized savings groups presents the opportunity for a win-win: It can allow people to continue to save money in their communities, to save time by connecting digitally, and to greatly simplify book-keeping. They learn to go digital together, and their money is safe in an institution that is regulated. Meanwhile, FSPs can continue to find innovative approaches to ensure everyone can be financially included. They just need to embrace a key ingredient in product design: emotions.

Innocent Ephraim is a head of Digital Finance at the Financial Sector Deepening Trust, an organization that drives financial inclusion in Tanzania.

Daryl Collins is managing director of Bankable Frontier Associates (BFA).

Top image: A savings group meeting in Bangladesh. Image credit: WorldFish/Flickr

- Categories

- Finance