Three Ways Entrepreneurs Can Tackle Climate Change (Hint: It’s Not Just About Scale)

In Morocco, a startup called Farasha is working on smart diagnostic systems for solar plants. In Kenya, Global Supply Solutions is commercializing clean-burning oven briquettes made from pineapple waste. These and many more entrepreneurs tackling climate change are supported by local partners of infoDev’s Climate Technology Program. Unfortunately, low- and middle-income countries have limited resources to launch a climate technology revolution, so our local partners need to make bets on which entrepreneurs to support.

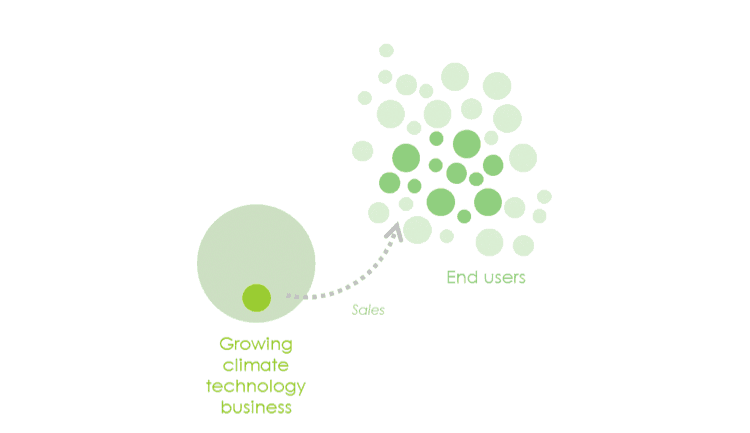

Option 1: Support Scalable Businesses

How to do that? Ask a Silicon Valley venture capitalist and the answer will be straightforward: Bet on teams that can bring their businesses to scale. Scaling up will translate into impact through high volumes of climate-change-do-gooder products sold, and through profits – which presumably are translated into local jobs. Venture capitalists will invest in businesses that have prospects for disproportionate returns, in order to make up for the risk of investing in unproven ideas. This theory of change fits well with disruptive inclusive innovations such as Grameen Bank with microfinance in Bangladesh and M-Pesa with mobile payments in Kenya.

You’re probably tired of hearing about these same two examples. The problem is that the disruptive inclusive innovations that have been scaled globally through high-growth ventures are few and far between. The closest examples in developing countries’ climate technology sectors are d.light and M-KOPA, two global market leaders in small off-grid solar lighting systems. But they come nowhere near the scale of Grameen Bank and M-Pesa.

The truth is that scaling climate technology business ventures requires significant time, capital and luck. Most investors shy away from considerable time and capital requirements – particularly in countries with challenging business environments and no venture financing markets – and luck requires that a large number of businesses try their hand at disruptive innovation for a few to succeed. So if high-growth inclusive businesses are so elusive, does that mean that tackling climate change through entrepreneurship is a bad idea?

Thankfully, there are at least two ways entrepreneurs can make sizeable impacts on climate change without Facebook-like growth curves. One is through demonstration effects, and another is by commercializing solutions that remove major market bottlenecks to climate impact.

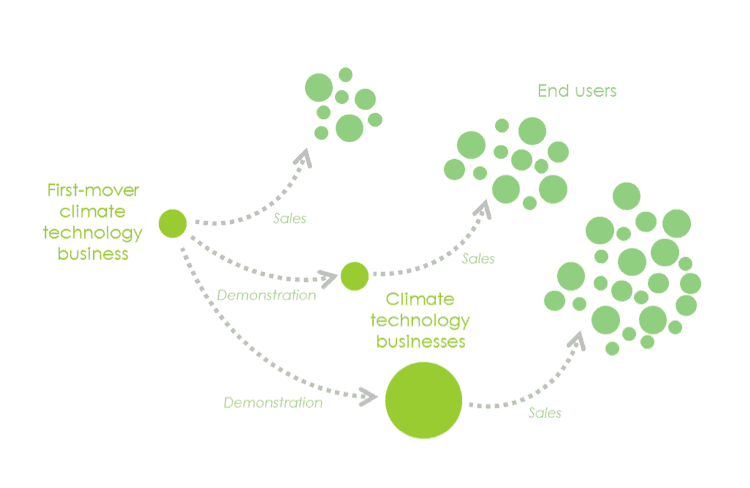

Option 2: Support First-Movers with Replicable Business Models

Demonstration effects are important in the world of pioneer entrepreneurs. Observing what first-mover entrepreneurs try, and where they succeed and fail, helps entrepreneurs de-risk and lower the costs of figuring out their business models. First-movers also pave the way for fast-followers by educating consumers on novel product or service categories, and building the ecosystem of talent, suppliers and other actors that they need to thrive.

A good example is the history of energy service companies (ESCOs) in the United States. ESCOs are businesses that develop energy efficiency retrofit projects through clever performance-based contracting mechanisms, and their clients include building or factory owners. At least 47 ESCOs are operating in the United States in a market that is projected at $7.6 billion this year. Few people remember any of the small upstarts who seeded the ESCO industry in the 1970s. Most of these companies don’t exist anymore or were acquired by larger players as the industry consolidated and grew. But even if they don’t ever grow to generate lots of revenue and jobs, the spillover effects from first-mover entrepreneurs make them a worthwhile investment in long-term climate impact.

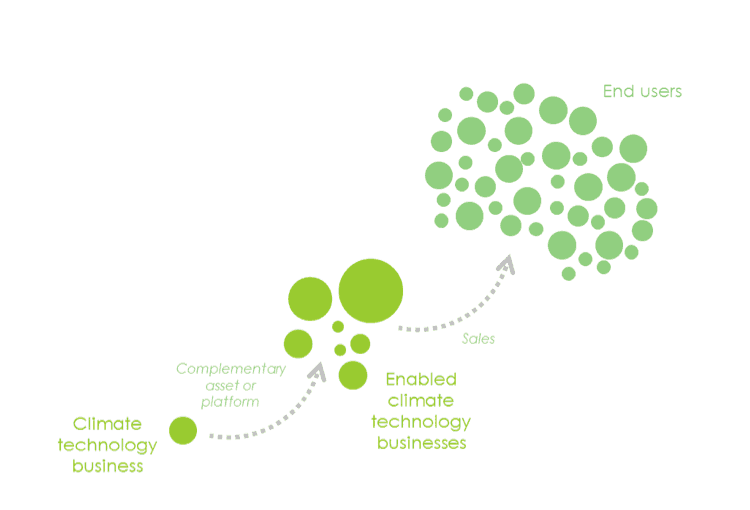

Option 3: Support Market Bottleneck Disruptors

The other way entrepreneurs can have an impact without scaling is by removing a major bottleneck from the market. For example, in the late 1950s, investors created a new business model called venture capital (VC), which made it possible for startups to gain access to the capital they need to grow. Without VC, I would be using a typewriter to write this blog. The VC sector has an oversized impact on global innovation. The secret of VC is that, more often than not, it is not a profitable business. The vast majority of VC profits are made by a small minority of top-tier VC firms. A 20-year study of VC by the Ewing Marion Kauffman Foundation found that the average VC fund fails to return investor capital after fees. So does that mean that the United States government should not have made massive investments to kick-start the modern VC sector through the Small Business Investment Act of 1958? To address climate change, we need solutions with oversized impact, and similar to VC, some of them may not always be profitable.

Critical bottlenecks removed by infoDev’s Climate Technology Program include the high costs and logistical complexity of distributing products like solar home systems, clean cookstoves and water filters in rural areas with little market infrastructure. These areas can benefit the most from these products, but the costs of reaching customers are often higher than the cost of manufacturing the products. Solving the rural distribution challenge would have a significant positive impact on the well-being of rural populations. What if an entrepreneur was able to find a business model that solved this challenge but didn’t yield high returns on investment? There would probably be a good case for investing in this low-profit entrepreneur.

In sum, entrepreneurs can make an impact on climate change in different ways. They can scale a climate change solution on a massive scale, they can pave the way for other entrepreneurs who will free-ride on their journey, or they can solve critical market bottlenecks that are hampering other entrepreneurs. While the first category of entrepreneurs promises generous returns for an investor, the others do not. The global community can support all three categories of entrepreneurs. Some have already risen to the task, including the governments of the United Kingdom, Netherlands, Italy, Denmark, Australia and Norway, all of which support infoDev’s Climate Technology Program and our partners across the world.

One implication of this three-pronged support strategy is that traditional firm-level metrics from private sector development programs such as goods sold, customers served, revenues generated or jobs created are no longer effective proxies for impact. The best way to catalyze a climate technology market may not involve any of these metrics.

Another implication of backing low-growth businesses is that we don’t have effective instruments for supporting low-growth pioneer entrepreneurs. Entrepreneurial support instruments usually fall into two categories: vocational training and microcredit for low-risk microentrepreneurs – mom-and-pop shops that operate laundry services or roadside restaurants – or accelerators and VC funds for high-risk innovative enterprises whose aim is market domination. The innovative, high-risk, low-growth firms fall through the cracks. What support instruments can help them? At infoDev, we are testing new models that might help us shed some light on this question.

Jean-Louis Racine leads the infoDev Climate Technology Program at the Innovation & Entrepreneurship unit in the World Bank Group’s Trade & Competitiveness Global Practice.

Photo by Karsten Würth courtesy of Unsplash.

- Categories

- Energy, Environment, Technology