Weathering a Perfect Storm – Part 2: Seven Ways Fintechs Can Survive the COVID-19 Pandemic

As we discussed in the first article in this two-part series, the COVID-19 pandemic has brought unprecedented challenges to the financial services industry – particularly in emerging markets. As the sector continues to grapple with health challenges, lockdowns and growing economic uncertainty, fintechs are redrawing their strategy to weather this storm and seize new opportunities.

Over three weeks starting from April 15, MSC interacted with a wide range of fintechs, investors, policymakers and industry associations across Bangladesh, Côte d’Ivoire, India, Indonesia, Senegal and Vietnam to understand how they are coping since the advent of the crisis. With no playbook to refer to or precedents to follow, fintechs are adapting to these difficult times on their own. Some have been building new tools and services, while others offer existing services with innovative tweaks. Based on MSC’s interactions and other analyses, fintechs are adopting several key measures to stay relevant, augment their recovery and build their resilience during the crisis. Below, we’ll look at seven approaches that fintechs have utilized to overcome the challenges brought forth by the pandemic.

1. Adaptability is the name of the game

Clearly, the need of the hour is to change and adapt to new situations. One fintech-and-logistics startup we encountered modified its business strategy and distribution infrastructure to keep up with the shift in the priorities and requirements of its rural customers from discretionary to essential goods. Today, though its margins on the delivery of essential goods are much lower, the startup has compensated with higher volumes coupled with faster turnaround times.

2. Improvisation is crucial to survival

Many fintechs rely on in-person verification of customers. But during the pandemic, some of them have switched to verification through video calls while maintaining their promised standards of quality assurance. This improvisation has helped them to keep their businesses running with substantial savings on logistics.

3. Ethical business practices never grow old

Containment measures, such as the lockdown, have resulted in panic buying and hoarding of essential and non-essential goods. A few opportunistic businesses have responded by raising their prices significantly. However, our respondent fintechs still believe in remaining ethical. One of them has kept its promise of helping farmers get a fair price for their produce. As licensees to deliver essential goods across lockdown areas in India, they continued to charge regular prices to their retail customers who were otherwise willing to pay more. This approach is paying off: In response, some of their big retailers are willing to give them the “first right of refusal” for large-quantity orders should they find it challenging to deliver.

4. Customer empathy is the secret sauce of success

The credit and lending fintechs that we spoke to have one thing in common: fear of borrowers defaulting on their repayments during the crisis. With imminent delinquencies due to loss of income, a few have taken an alternative approach. These fintechs now allow conversion of short-term loans (1-4 months) to longer-term loans (4-8 months) for a small processing fee. Not only are the delinquencies under control, but some customers are even willingly paying more than their installment amounts—which have now been reduced.

5. New incentives are needed for savings

The outbreak of the pandemic has led to the hoarding of groceries, essentials and cash. Central banks in our focus markets have reported a sharp jump in cash-in-circulation and cash withdrawals over the last four weeks. Despite lockdowns, the demand for cash as a “safe asset” continues to rise, particularly among low- and moderate-income communities as they prepare to weather the difficult days ahead. This is affecting fintechs that deal in savings. Some of them are brainstorming innovative solutions to counter their dwindling customer base, such as adding complementary products (like nano-insurance) to their offerings.

6. Stay relevant and you will flourish

The magnitude of the pandemic and the ensuing health and economic hardships have overwhelmed the financial services sector, especially the insurers. Nevertheless, some insurtechs and established fintechs have come up with meaningful and affordable products to help low- and moderate-income communities stay safe and protected. One such fintech startup in India quickly assessed the situation and built “a la carte” offerings from its insurance policy suppliers, allowing customers to pick and choose the specific coverage they need. Another fintech in Vietnam offers nano-insurance products for term and life that include hospitalization benefits against COVID-19, in partnership with a large insurance firm, at an annual premium of US $8-14.

7. The irony: the risk-takers are the most risk-averse

Venture capital (VC) and private equity (PE) firms are considered some of the most significant risk-takers, as they bet on the riskiest class of assets: startups. In the usual scenario of a market downturn, these investors seize the opportunity and stand ready to fund or acquire fintech startups. However, in the current situation of economic uncertainty, some of the VC and PE firms in our focus markets are contemplating which fintechs to continue funding and which to let loose as they seek safer investments. Anup Jain, a Managing Partner at Orios Venture Partners, aptly sums up the general investor sentiment today when he says, “Funds will now disproportionately preserve dry powder to finance their own portfolio companies.”

With investors less willing to continue funding riskier fintechs, we may witness subdued investment activity in the second quarter of this year and beyond. However, fintechs with validated business models with recurring revenue, long-term contracts and strong management teams will continue to attract investments. If fintech startups can’t prove their mettle on these more fundamental key performance indicators, they will find external investments hard to come by.

Looking toward the near future

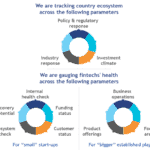

Clearly, these are uncertain times. An approach that is working today may not work tomorrow. However, newer and more innovative approaches are already emerging, as fintechs work to adapt to these rapidly changing circumstances. Through our multi-geography, holistic research on fintechs and their ecosystem partners, MSC will continue to track and assess policy, regulatory and industry responses, review the investment climate, and evaluate and support the coping strategies of fintechs.

Our objective is to design programmatic interventions to support fintechs, especially the ones focused on low- and moderate-income segments, to survive, rebuild, sustain and grow. We will continue to equip regulators, policymakers, ecosystem partners and investors with our findings, to empower fintechs to function effectively and play a positive role in the pandemic.

Stay tuned for more updates on www.microsave.net.

Akshat Pathak, Anshul Saxena, and Sunil Bhat are senior managers at MSC, a NextBillion partner.

Anil Kumar Gupta is a partner at MSC .

Photo courtesy of Quangpraha.

- Categories

- Coronavirus, Finance, Technology