Business Models, Best Practices and Measures in Access to Medicine: Index to be released Monday ranks pharmaceutical companies’ efforts to improve availability in developing countries

The 2014 Access to Medicine Index will be released on Monday (Nov. 17). This powerful tool speaks to the performance evaluation of the 20 top research-based pharmaceutical companies across 95 indicators in providing access to medicines for 47 high-burden diseases in 106 low- and middle-income countries.

The Access to Medicine Index has dramatically impacted how the pharmaceutical industry approaches low-income markets and historically low-priority diseases by building awareness, speaking industry’s language, applying metrics and assembling evidence to inform strategic business practices. The index has undoubtedly supported a shift in mindset from predominantly philanthropic to a broader commercial orientation. This has garnered greater voice for emerging markets and neglected diseases within these pharmaceutical companies and informed long-term corporate strategies around issues such as disease opportunities and priorities, collaborative R&D, intellectual property, and investment in infrastructure and access.

Historically, the pharmaceutical business model has centered on research and development of new medicines for the developed markets of the United States, European Union and Japan. Over time, emerging markets attracted more interest due to demographic and epidemiology changes as well as increased competition and maturation of the developed markets. With this interest in emerging markets came considerable challenges to traditional pharmaceutical investment strategies, given internal competition for corporate resources, infectious disease portfolio requirements and the various unknowns and idiosyncrasies of emerging markets.

First published in 2008, this year’s Access to Medicine Index will be the fourth in a biennial series that originated from founder Wim Leereveld’s vision that pharmaceutical companies’ role in tackling the world’s challenge of access to medicines would be better directed through systematic and aggregated measurement. The index fills a critical role for global health stakeholders by providing an impartial, systematic evaluation and tracking tool through which these leading 20 pharmaceutical companies can view their access efforts in emerging markets over time. Support for this vision has grown since 2008, as the index has generated ongoing reflection and exchange in publications such as Forbes and The Lancet. The resulting dialogue has informed pharmaceutical manufacturers’ corporate strategies for emerging markets as well as continued refinement of the index’s research and analytic methodology.

The Access to Medicine Index Foundation is fully independent from the pharmaceutical industry, receiving funding from the Bill & Melinda Gates Foundation, the Dutch Ministry of Foreign Affairs, the UK Department for International Development, Cordaid, the Humanist Institute for Cooperation with Developing Countries, and the Interchurch Organization for Development Co-operation. This independence lends substantial credibility and autonomy as well as opportunity to engage with the multiple stakeholder groups in the global health community.

Through its work with the pharmaceutical companies as well as investors, academicians, civil societies, global health practitioners and multilateral organizations, the index foundation has generated information and insights that have been transformative to the drug manufacturers’ role in global public health. Just as physicians are taught to practice evidence-based medicine, the pharmaceutical sector and its investors are driven by analytics and evidence, which the index has galvanized for emerging markets. Deutsche Bank’s recent industry report on seven large-cap pharmaceutical companies is an excellent example. Analysts referenced the Access to Medicine Index and characterized pharma’s engagement as “both doing the right thing and strategic investment,” noting that 40 percent of the world’s population lives in the tropics, including most of the least developed countries.

Through its work with the pharmaceutical companies as well as investors, academicians, civil societies, global health practitioners and multilateral organizations, the index foundation has generated information and insights that have been transformative to the drug manufacturers’ role in global public health. Just as physicians are taught to practice evidence-based medicine, the pharmaceutical sector and its investors are driven by analytics and evidence, which the index has galvanized for emerging markets. Deutsche Bank’s recent industry report on seven large-cap pharmaceutical companies is an excellent example. Analysts referenced the Access to Medicine Index and characterized pharma’s engagement as “both doing the right thing and strategic investment,” noting that 40 percent of the world’s population lives in the tropics, including most of the least developed countries.

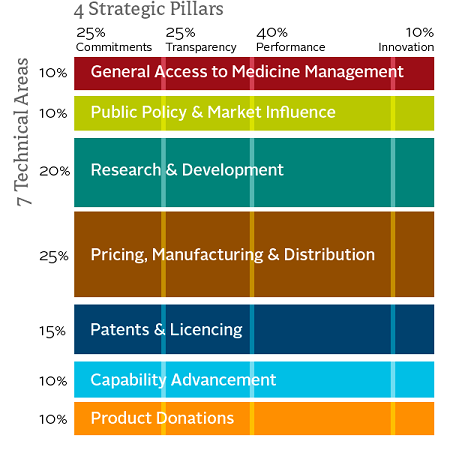

(Access to Medicine index methodology framework 2012, left.)

Since its inception, the index has refined its methodology and become increasingly robust. (Editor’s note: Prashant Yadav has served as a technical committee advisor to the Access to Medicines Index.) The 2014 index applies the same basic framework as prior years with minor enhancements, enabling both individual and aggregated progress tracking. The analysis is constructed along seven technical areas, with 95 indicators measured across four strategic pillars. The four strategic pillars include Commitments, Transparency, Performance and Innovation, with Performance the most heavily weighted at 40 percent. The technical areas are also weighted in the evaluation, with Pricing, Manufacturing & Distribution; Research & Development; and Patents & Licensing weighted the most heavily at 25 percent, 20 percent and 15 percent, respectively. The remaining technical areas of Public Policy & Market Influence; General Access to Medicine Management; Capability Advancement; and Product Donations are all weighted at 10 percent, respectively.

The 2014 methodology places greater emphasis on the need for access to medicines to become “business-as-usual” within the companies, i.e. maintaining profitability while fostering access. This is apparent in adjustments to the technical area indicators, such as measuring business model innovation that is economically viable and beneficial for access to medicine. Notably, the disease scope has expanded considerably from 33 to 47 disease states. The geographic scope has also expanded from 103 to 106 low- and middle-income countries. The disease scope expansion highlights the breadth of the index and reflects important epidemiological trends as reported by the World Health Organization, based on global burden of disability-adjusted life years and the relevance of pharmaceutical interventions. The 47 conditions fall into four categories – communicable, non-communicable and neglected tropical diseases, and maternal and neo-natal health care.

In a workshop leading up to the 2014 index, pharmaceutical company participants highlighted three key themes in best practices for access strategies: 1) external stakeholder expectations, 2) the importance of internal corporate support, and 3) opportunities for industry-wide collaboration. The Access to Medicine Index addresses these themes by building stakeholder expectations into metric development and assessment, producing high-caliber evidence worthy of corporate decision-making and identifying opportunities for increased collaboration. This serves a critical function by enabling emerging market business leaders to gain visibility within their pharmaceutical organizations and incorporate outside expertise and critique. Going forward, the global health world will be watching to see if strong longitudinal performance in the index corresponds to corporate and fiscal success in the emerging markets opportunity.

The overall ranked leaders in the 2012 index were GlaxoSmithKline in the top spot, followed closely by Johnson & Johnson and Sanofi. Let’s see what this year brings with the publication of the 2014 Access to Medicine Index on Monday.

Prashant Yadav is a senior research fellow at the William Davidson Institute (WDI) and director of the Health Care Research Initiative at WDI. Andrea Bare is senior advisor, Market Dynamics, at WDI.

- Categories

- Health Care