The Human Touch Behind Digital Success: Microfinance institutions that go mobile need to support the people behind the technology

In digital solutions, technology is the enabler, but people are still the backbone of the service. This driver is important for microfinance institutions to remember when considering mobile financial services (MFS), since transitioning to these services will require all their departments to navigate change.

For example, the marketing team will have to hire extra temp staff to sell the product, and operations will have to boost its customer service center staff. Everyone must become acquainted with the service, first through training and promotions, before they can sell or explain it to others. And since digital services are generally launched over a mobile operator’s agency network, the collaboration will require a strong team of skilled and trained managers, who are prepared to deliver the new service and engage with the new customer segment.

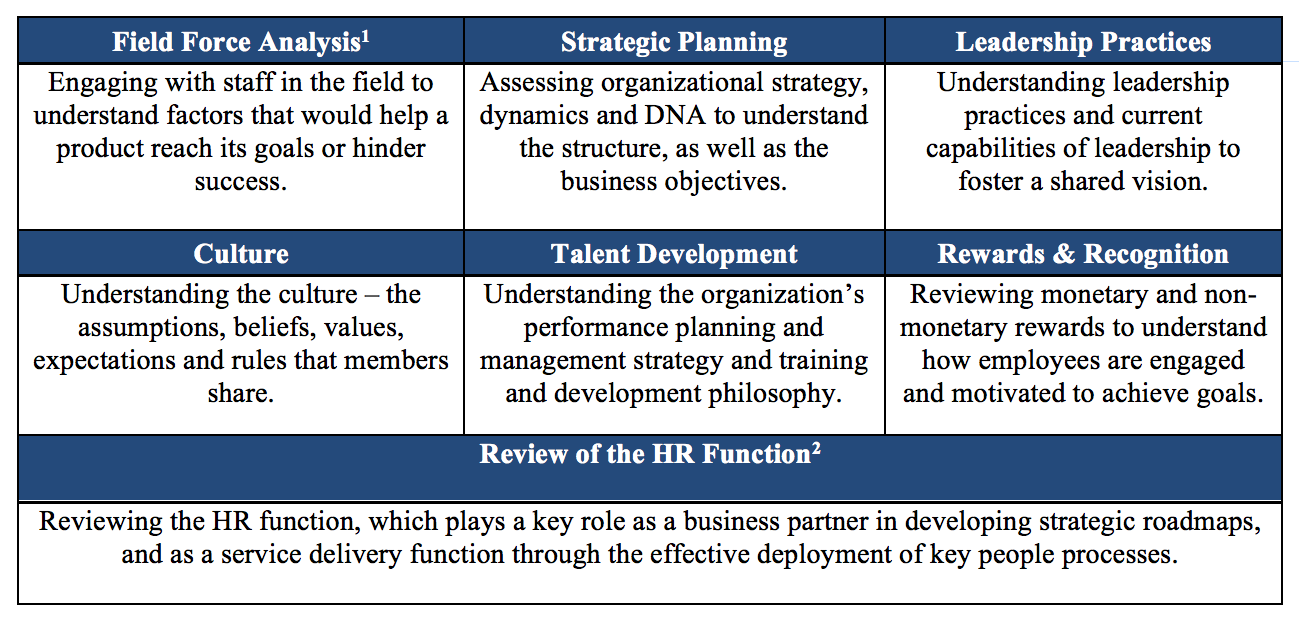

Strong human capital systems can help financial institutions manage this change. When Grameen Foundation began working with Pride MDI and Centenary Bank, we first conducted a human capital management assessment, spanning several areas, to understand existing practices (see chart below). Those findings helped identify areas of strength and weakness before launching the digital offer.

Several insights emerged from our engagement with these partners:

Active support from strong senior leaders is required: A digital channel is a strategic shift, not just a change in technology. Financial institutions adopting this model must have strong managing directors who champion the initiative, incorporate it into the strategy, and communicate the priority focus to the rest of the institution.

In our engagements, senior management led the process. The managing director of Centenary Bank sent a bank-wide communication introducing the new channel and kicking off the staff promotion. To encourage staff to familiarize themselves with the product, Centenary held contests during the pilot to identify the branch with the greatest number of average transactions and the individual staff who transacted the most. He also participated in the award ceremony for the winning branch and staff member. At Pride MDI, the head of corporate affairs issued this communication and also ran a campaign for staff usage to drive excitement across the organization.

Management buy-in was also needed to understand the demand on resources that this project required. The leaders assigned people to the project and made staff engagement a part of their key performance indictors as an incentive for their commitment.

Develop and train field managers: The strategy is driven from the top, but the day-to-day execution of the digital strategy is managed in the branches. Strong field managers, or strong approaches for providing training and support, are crucial to ensure that the field team is briefed, trained, and equipped to deliver. However, it cannot be assumed that there is strong management at all levels.

For example, it is common for financial institutions with large networks of staff to recruit managers from within the organization. They are promoted from the ranks of field-level specialists on the basis of their technical performance as field officers, and typically lack the soft skills, training, management knowledge and experience that make a strong leader. They learn as they perform their jobs. However, the lack of formal education and relevant experience often makes it difficult for these middle managers to handle the complexities of their new positions. To address this issue at Pride, Grameen Foundation conducted its Leaders of the Field (LFTF) training, which prepares middle managers for the responsibilities to come. LFTF was designed to bridge the leadership gap that exists in the middle management ranks of microfinance institutions and social enterprises to enable middle managers to build skills for new levels of responsibility in their careers.

Engage field staff when developing the offer: The staff at an institution’s branch offices have the most frequent contact with customers. Engaging them (and customers) early on regarding their expectations of a digital service can help a financial institution tailor the service, the marketing, and the internal training approach. With both partners, Grameen Foundation used the staff as part of our pilot of the service to obtain feedback on messaging or menu issues.

It is also important to engage staff early on to help them understand and embrace the service. A certain section of staff may feel threatened if “going digital” means fewer face-to-face interactions with customers, as some may think: “Won’t I lose my job?” For others, internal marketing of the service is key to show that it will not cannibalize other products, but rather, will enhance them. For example, showing credit officers who are usually focused on giving loans that digital services can help in both the dissemination of loans and also collections of funds can help them become champions of the product in the branches.

The recommendations adopted by both institutions to strengthen their systems prepared both Pride MDI and Centenary Bank to develop the human capital needed to manage this change. As Deo Kateizi, Head of Corporate Affairs at Pride MDI said, “The mobile banking fusion is new territory for banks and requires new skill sets. Programs like the Leaders for the Field training program were designed to plug this gap, and equipped the Pride MDI team with the required skills. This has paid enormous dividends for the institution during the MFS rollout.”

[1] Field Force Analysis was done only at Centenary Bank

[2] Review of the HR Function was done only at Pride MDI

Faisal Wahedi leads the Human Capital Center at Grameen Foundation India. Lisa Kienzle manages global operations and strategy for Grameen Foundation’s financial services initiatives.

- Categories

- Uncategorized